Why Gold Prices Are Rising Now

Commodities / Gold and Silver 2013 Jul 25, 2013 - 02:24 PM GMTBy: Money_Morning

Tony Daltorio writes: After watching some drastic one-day plunges this year for the yellow metal, investors are wondering why gold prices are rising now– could this be the start of a healthy, prolonged rebound?

Tony Daltorio writes: After watching some drastic one-day plunges this year for the yellow metal, investors are wondering why gold prices are rising now– could this be the start of a healthy, prolonged rebound?

On Monday, gold enjoyed its biggest one-day jump in more than a year. It hit a four-week high as gold finally broke through the $1,300 an ounce technical resistance level and finished above $1,335 an ounce.

Short-covering by technically-oriented traders and the perception that the Fed will continue QE for the foreseeable future are the short-term answers as to why gold had such a strong day, and why prices are rising now.

But there are solid fundamental reasons as to why gold should and will keep recovering in price in the months ahead.

One key reason was pointed out several times by Money Morning Global Resources Specialist Peter Krauth.

I’m talking about the growing divergence between the paper (futures, etc.) gold market and the actual market for physical gold – “market dislocation.”

Market Dislocation and Gold Prices

You see, since gold is a quasi-currency, it is rarely in backwardation. That is, the near-term contract for gold rarely trades at a price above the longer term contracts.

But in recent days that has occurred for the first time since the 2008 financial crisis.

This means the physical demand for gold is far outweighing the physical supply of gold.

Economist Guillermo Barba explained to Reuters, “More and more people want their gold today, at a higher price, no matter that they can buy a future much cheaper.”

Just ask JPMorgan Chase (NYSE: JPM) about that.

ZeroHedgereported last week that 90,311 ounces of the bank's eligible gold was withdrawn in one day. This translates to 66% of the bank's non-registered gold, leaving it with only 46,000 ounces of such gold in its vaults.

That’s quite a drop from the more than three million ounces held in JPMorgan's vault just two years ago.

The 5 Secret Gold Price Drivers No One Talks About

The Fed and physical demand for gold are just part of why the long-term outlook for the yellow metal is bullish.

What mainstream media fails to report are these hidden price catalysts that will propel gold to record highs.

You can find them out here.

Another indication of dislocation in the gold market is the rising lease rate for gold.

The lease rate is the amount it costs to borrow actual physical gold. The higher the rate, the tighter the market is – that is, the less physical gold supply there is in the marketplace.

Recently the one-month gold lease rate jumped to 0.3%, the highest level since January 2009. The lease rate is up from just 0.1% a few weeks ago and a negative 0.2% last September.

This rapid climb in the lease rate (still at 0.27%) is another reflection of dwindling gold supplies in the face of resilient demand for physical gold.

China’s Bullish Moves for Gold Prices

Add to the growing dislocations in the paper gold market the massive gold buying by investors in Asia – particularly in China – and you have a recipe for higher gold prices.

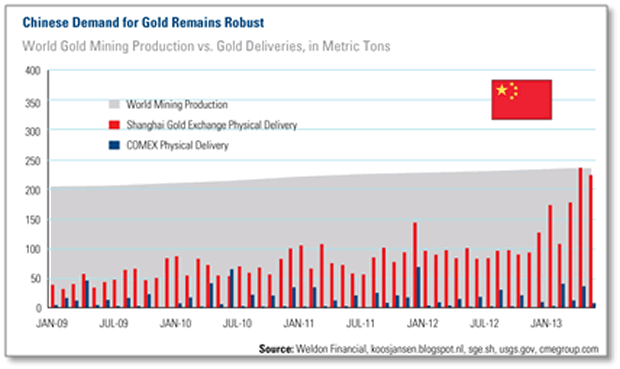

Money Morning Chief Investment Strategist Keith Fitz-Gerald, in a recent gold prices article, showed how Chinese demand for the precious metal is by itself nearly equal to total worldwide gold mine production.

Share on facebook Share on twitter Share on email Share on print More Sharing Services 5

And so far this year, physical deliveries of gold (1,098 metric tons) on the Shanghai Gold Exchange account for 50% of global gold production.

In addition, China's net imports of gold from Hong Kong continue to surge. In May – the last month reported – net imports surged 40% from the month earlier to 106 metric tons.

Let's not forget either that China approved the first two gold-backed exchange-traded products last month. The two products just had their subscription period close on July 12.

This should add even more to the country's already red-hot demand for gold, and drive gold prices higher.

The Great Gold Crash of 2013 was triggered by two very conspicuous trades – and the aftermath has led to a historical shift in gold pricing. Just read this fascinating analysis of the major implications those trades had on the future of gold prices.

Source :http://moneymorning.com/2013/07/24/why-gold-prices-are-rising-now/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.