Attention Gold Bears - Fed to fall Short on Tapering QE-3

Commodities / Gold and Silver 2013 Jul 25, 2013 - 06:31 PM GMTBy: Gary_Dorsch

The value of Gold has fluctuated wildly over the past few years. After rallying for 12-straight years, the yellow metal has tumbled as much as -38% from its all-time high of $1,923 /ounce reached in August ‘11. Gold officially fell into the quagmire of a Bear market on April 12th, and even central bankers were caught off guard. They were net buyers of 535-tons last year, - the most they’ve ever accumulated in any single year. Today, the central banks are among the biggest losers - holding 31,700-tons, or roughly 19% of all the gold mined.

The value of Gold has fluctuated wildly over the past few years. After rallying for 12-straight years, the yellow metal has tumbled as much as -38% from its all-time high of $1,923 /ounce reached in August ‘11. Gold officially fell into the quagmire of a Bear market on April 12th, and even central bankers were caught off guard. They were net buyers of 535-tons last year, - the most they’ve ever accumulated in any single year. Today, the central banks are among the biggest losers - holding 31,700-tons, or roughly 19% of all the gold mined.

No one has more to lose from Gold’s slump than miners in South Africa, where the break-even costs are the highest in the world. Anything below $1,400 /oz is a red flag for South African gold miners. Costs are steeper than competitors abroad because of the extra labor that’s needed to dig deeper into its aging mines. Globally, gold-mining companies are moving to include capital expenditure in their per-ounce cost figures. Sibanye, South Africa’s second-largest gold miner by output, has total costs including production and capex of $1,334 /oz. Costs at Harmony, the country’s third-largest producer, are $1,487 /oz. AngloGold, the country’s largest gold miner, was the only South African bullion producer whose costs in the nation of $1,204 an ounce were below the current spot gold price.

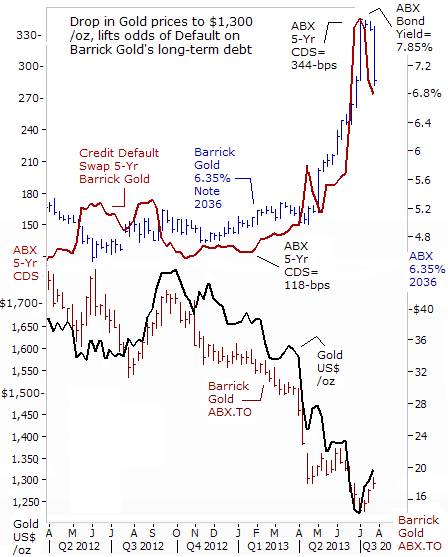

Even the world’s biggest Gold miner – Barrick Gold (ABX.TO) is at risk of defaulting on its longer-term debt obligations, if the price of the yellow metal falls significantly lower. Shares of Barrick Gold (ABX.TO) have lost about $40-billion in market value since April ‘11. After the price of Gold fell below $1,400 /oz in April ’13, the yield to maturity on Barrick’s 6.35% note due in Oct 2036, soared to as high as 7.85%. The cost to insure $10-million of ABX’s debt in the credit default swap market jumped to as high as $344,000 on July 5th. Moody’s and S&P rate Barrick’s debt at Baa2 and BBB respectively, but its long-term debt trades at yields that’s more in-line with junk bonds.

The problem plaguing ABX is that three acquisitions in the last five years for a total cost of $8.4-billion increased Barrick’s debt load to $16-billion today, the most among gold miners worldwide. In April, ABX said it expects “all-in sustaining costs” including output and capex costs to be between $950 and $1,050 /oz. But after ABX burned through $1.2-billion of cash in the 12-months through March, ABX could be forced to slash its $800-million annual dividend in order to preserve cash on hand, if Gold falls much further.

Gold knows what No one knows, Yet it is difficult to pin down the exact logic behind investors’ appetite for the yellow metal. Nathan Mayer Rothschild, - once the richest man in Britain and probably in the world, was appointed as the chief bullion broker to the Bank of England in 1840, and went on to operate the Royal Mint Refinery in 1852. NM Rothschild & Sons became a powerhouse in investment banking, lending, underwriting government bonds, discounting commercial bills, direct trading in commodities, foreign exchange trading and arbitrage, and dealing in Gold bullion. When asked what the value of the barbaric metal was worth, Nathan used to say, “I only know of two men who really understand the true value of Gold – an obscure clerk in the basement vault of the Banque de Paris and one of the directors of the Bank of England. Unfortunately, they disagree.”

Asked about the price of Gold, which is down about -23% this year, the chief of the Federal Reserve, Ben Bernanke also admitted on July 17th that he doesn’t understand the yellow metal. “No one really understands Gold prices,” Bernanke told the Senate Banking Committee, adding he doesn’t get it either. Calling it “an unusual asset,” the Fed chief said that investors hold Gold for “disaster insurance” and as an inflation hedge. He expressed surprise about the latter, noting “movements in Gold don’t predict inflation very well.” Bernanke took some solace in the recent sharp decline in Gold prices, though, suggesting they could reflect diminishing concerns over really bad outcomes.

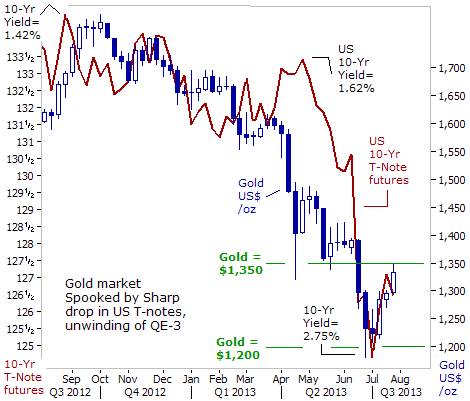

Gold has a multi-faceted personality, but nowadays, its behavior is mostly influenced by the direction of 10-year US Treasury notes. Spooked by the increasing likelihood that the Bernanke Fed will begin to “taper” down its $85-billion per month of liquidity injections into the money markets, the price of Gold has nosedived, alongside what appears to be the early stages of a bursting of the US T-Note Bubble. Lower T-Note prices, - and higher interest rates, are sending a clear signal to the marketplace, that the Fed is seriously entertaining the idea of winding down in radical “quantitative easing,’ QE, money printing scheme.

Fed informs G-20 about downsizing QE-3, The top central bankers and finance chiefs from the Group-of-20 nations, huddled in Moscow on July 19th, where they heard behind closed doors that the Fed intends to down-size its purchases of bonds, - probably starting in September. “Unconventional monetary policies that were decided by the Federal Reserve, the Bank of England, the European Central Bank, and the Bank of Japan have consequences on capital flows. The unwinding of these policies needs to be phased out carefully,” said IMF Managing Director Christine Lagarde.

“The current turbulence in global financial markets could continue and deepen,” the IMF warned at the July 20th meeting in Moscow. “Growth could be lower than projected due to a protracted period of stagnation in the Euro area, and risks of a longer slowdown in Emerging markets have increased. The eventual exit from low rates and unconventional monetary policy in advanced economies could pose challenges for emerging economies, especially if it proceeds too fast or is not well communicated,” the IMF warned. However, it was Bank of Japan chief Haruhiko Kuroda who let the cat out of the bag, with the most explicit signal yet of the Fed’s next move on QE, “An eventual tapering of monetary stimulus by the Federal Reserve would be natural and appropriate” he said on July 19th.

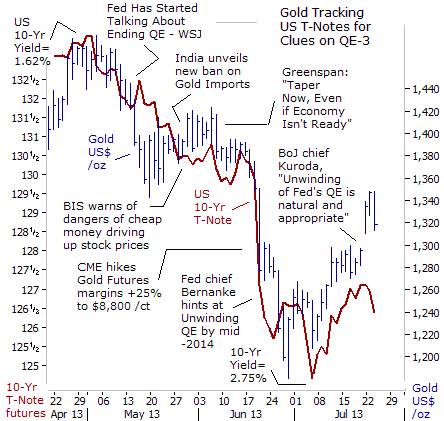

The partial unwinding of the Fed’s radical QE-scheme has been telegraphed to the marketplace during the past two months, - through a series of leaks and hints to the media. The most influential and powerful voice comes from the Bank for International Settlements (BIS). On June 23rd, the BIS said that G-7 central banks should not allow fears of disrupting markets to delay the timely withdrawal of cheap money. The BIS anticipated that signaling an exit might cause market disruptions but warned that the risks from delaying was likely to rise over time. “Central banks will need to strike the right balance between the risks of exiting prematurely and the risks associated with delaying exit further. The longer the current accommodative conditions persist, the bigger the exit challenges become,” the BIS warned.

Former Fed chief Alan Greenspan used to be famous for keeping his listeners in the dark about the central bank’s future plans. “I guess I should warn you. If I turn out to be particularly clear, you’ve probably misunderstood what I’ve said,” he used to say. So it was shocking to hear Mr Greenspan tell the viewers of CNBC on June 7th, in crystal clear terms, that the Fed must begin to taper its QE-scheme, even if the US- economy is not ready for it.

“The sooner we come to grips with this excessive level of assets on the balance sheet of the Federal Reserve, - that everybody agrees is excessive, - the better,” he said in a “Squawk Box” interview. “There is a general presumption that we can wait indefinitely and make judgments on when we’re going to move. I’m not sure the market will allow us to do that. But if the Fed moves too quickly in reining in its accommodative policies, it could shock the market, which is already dealing with a very large element of uncertainty. I’m not sure the markets will allow an easy exit. Gradual is adequate, but we’ve got to get moving.”

As for the Fed’s Zero Interest Rate Policy, (ZIRP), Greenspan said it’s buoying stock prices, but the markets need to be prepared for a faster-than-expected rise in long-term interest rates. “Bond prices have got to fall. Long-term rates have got to rise. The problem, which is going to confront us, is we haven’t a clue as to how rapidly that’s going to happen. And we must be prepared for a much more rapid rise than is now contemplated in the general economic outlook. We’re still well below the interest rate level we normally ought to be at this stage. The consequence of that is that when the bond market begins to move we may not be able to control it as well as we'd like to. And that has a lot of ramifications with respect to all sorts of markets,” Greenspan warned on June 7th. Greenspan’s comments knocked the Gold market $30 /oz lower on June 7th, to $1,383 /oz, but bigger carnage began 2-weeks later, on June 20th, when Fed chief Bernanke hinted at a timetable for unwinding QE-3.

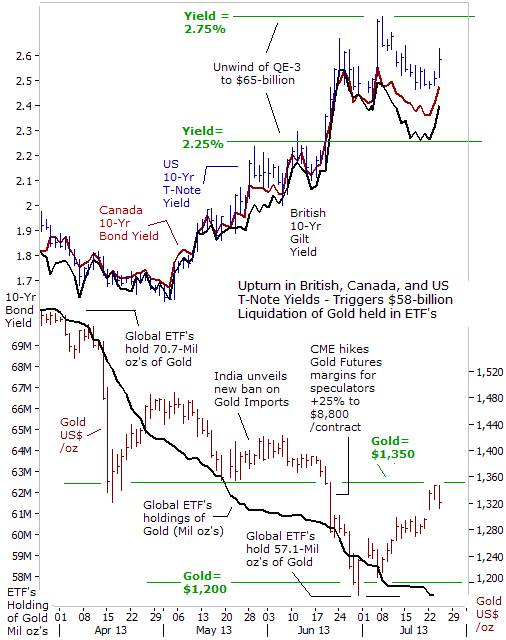

The upward surge in US Treasury yields isn’t the only factor that’s undermining the Gold market. Long-term interest rates in Britain, Canada, and Hong Kong have increased by +1% or more in lockstep. Corporate and sovereign bond yields in the Emerging nations of Brazil, Russia, India, and South Africa have surged +124-basis points (bps) to +250-bps higher in recent weeks. The synchronized increase in bond yields across the globe has caused many investors to lose faith in Gold as a store of value. As investors dumped ETF’s that are backed by Gold, fund managers were forced to sell 13.6-million ounces since April 1st. That represents about $58-billion in market value. Some investors switched tactics, by plowing the proceeds into stock market indexes, with the best performers in Britain, Germany, Japan, and the US.

According to the Wall Street Journal, “Fed officials say they plan to reduce the amount of bonds they buy in careful and potentially halting steps, varying their purchases as their confidence about the job market and inflation evolves,” the WSJ’s Jon Hilsenrath wrote on May 10th. “I don’t want to go from wild turkey to cold turkey,” Dallas Fed chief Richard Fisher, told the WSJ. Withdrawing the QE-3 stimulus, would be combined with promises by the Fed to keep the fed funds rate locked at near zero percent into 2015. “Jawboning” techniques would also be utilized to influence trader psychology at key price levels on the T-bond charts.

Still, US T-note yields have already built-in expectations of a $20-billion cutback in the Fed’s QE-3 scheme at the upcoming Sept 18th meeting. Until then, US-T-note yields could gyrate within a tight range between 2.45% and 2.75%. Likewise, British Gilt and Canadian government bond yields are expected to continue to track the US T-note yield, although their rates are priced about -25-bps less. If the recent past is any guide to the near term future, the Gold market would still be hounded by fear of yet another jolt in US T-note yields into a higher plane of equilibrium, to between 3% and 3.50%. In order to knock the Gold market towards $1,250 /oz, it might require a second round of tapering of QE-3 to $45-billion /month.

China’s Short Lived Liquidity Crunch, When standing on the battlefield of the global financial markets, - the bullets can come flying from any direction, and sometimes, the wounds can be quite painful. For example, on June 4th, investors in the Gold market were suddenly ambushed by a surprise attack by India's central bank. New Delhi introduced a new round of restrictions on Gold imports, ramping up its efforts to slash its trade deficit and shore-up the value of the rupee. India is the world’s largest gold market, accounting for about 28% of world demand. India hiked the import tax on Gold to 8-percent.

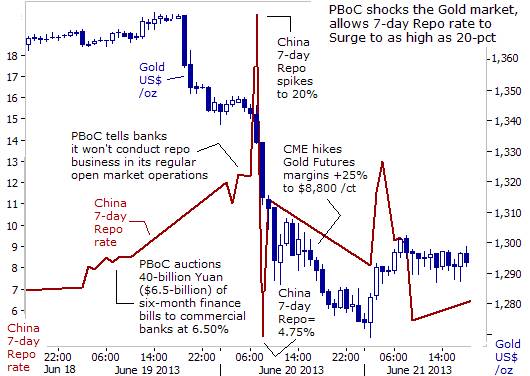

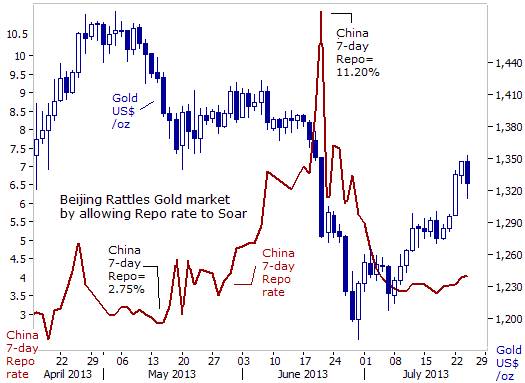

In the early morning of June 20th, - the People’s Bank of China (PBoC) played a surprising role in knocking the price of Gold sharply lower. In the weeks building up to June 20th, the 7-day repo rate in the Chinese inter-bank market was creeping higher, climbing from around 2.75% on May 15th, to as high as 7% by June 19th. Then on June 20th, the PBoC auctioned 40-billion yuan ($6.5-billion) of six-month finance bills to commercial banks at a rate of 6.50%. That compared to a rate of 4.80% in late May and was interpreted as hard evidence that the PBoC was attempting to engineer a severe liquidity squeeze in Shanghai money markets.

Shortly afterwards, the benchmark 7-day bond repurchase rate jumped 144-basis points to close at 8.24%, its highest since October 2007. The overnight repo rate jumped +200-bps higher to 7.70%, while the 14-day rate added +150-bps to 7.68-percent. Yet the People's Bank of China (PBoC) refused to inject cash on a large scale as it appeared to be an effort to put a severe squeeze on sub-prime lenders in China’s $6-trillion “shadow banking” network. Many sub-prime lenders failed to obtain enough short-term money for business at the normal closing time of 4:30 pm, amid the acute squeeze.

The Chinese central bank’s determination to punish sub-prime lenders and rein in rapid credit growth, created a whirlwind of panic in Shanghai has sent inter-bank interest rates soaring to record highs, as some banks scramble to secure short-term funds. China’s 7-day repo rate climbed to as high as 20%, - to levels reminiscent of the global credit market freeze that preceded the collapse of Lehman Brothers in September 2008. But the People's Bank of China stood firm, refusing to bow to pressure to flood the interbank market with more cash.

Whether by design or a strange act of coincidence, in hindsight, the volatile surge in Chinese money market rates was a key catalyst that triggered a sharp meltdown in the Gold market. The yellow metal was already sliding on June 19th, tumbling $35 /oz to the $1,345 level, as China’s 7-day repo rate steadily climbed higher from 7% at the market open to as high as 12% late in the session. However, when China’s 7-day repo rate suddenly spiked upward to an all-time high of 25% it triggered a crash in the Gold market. The yellow metal plunged by as much as -$60 /oz, to below the $1,300 /oz level. As if to add insult to injury, the Chicago Mercantile Exchange’s decision on June 20th, to hike the initial margins +25% for Comex 100-oz Gold futures +25% to $8,800 /contract, also put a knife in Gold’s back.

Four days later, on June 24th, the Shanghai Red-chip Index fell -5.3%, notching its largest single day drop since August 2009, amid fears that the PBoC was trying to engineer a liquidity crunch. The Shenzhen Index plunged -6.7% with the selloff rippling across Asia - Japan’s Nikkei fell -1.3% and Hong Kong’s Hang Seng fell -2.2%. In Shanghai, midsized banks, such as China Minsheng Bank and Industrial Bank both lost nearly -10%. More than 100-companies dropped -10%, the daily limit, before trading was halted. Having witnessed the carnage in the stock markets, on June 25th, the PBoC switched gears, saying it would use all tools to safeguard stability in money markets and ease tight conditions, giving the first official signs of relief for a cash squeeze in the world’s second-largest economy.

In turn, the 7-day repo rate quickly began to calm down - it’s been holding steady at around 4% in the month of July. Likewise, the sharp drop in Chinese money market rates might have played a role in supporting Gold’s latest recovery rally to the $1,350 /oz level. It’s unlikely the PBoC will pull another stunt in the repo market anytime soon. Yet the fickle Gold market could decide to switch its focus again, to the benchmark US T-note market, where sentiment about the Fed’s next move on QE-3 is expressed each day. As goes the perception about the future of QE-3, so goes the value of the US$ index, and its knock on effects on Gold and Silver.

Given the shrinkage in the US-budget deficit, expected at $660-billion this fiscal year, the Fed has the leeway to reduce the size of its monthly purchases of T-bonds. If correct, the Global Money Trends newsletter suspects that Fed chief Bernanke would move to taper down the QE injections to $65 /month in September, and to $45-billion at the next meeting in December. At the behest of the BIS, the Fed might downsize QE-3 to $45-billion, even if it becomes increasingly apparent that the US-economy is sliding into a mild recession.

Still, the next Fed chief would be appointed in January by liberal Democrats, who want to continue with QE. Therefore, the next Fed chief is expected to placate his /her political masters by stonewalling any attempt to taper QE-3 to less than $45-billion in 2014. As for the Gold market, the key question is; did the recent slide to $1,200 /oz, - fully price-in the scenario of a complete tapering of QE-3 to zero by mid-2014? If yes, then such bearish ideas were overblown. In that case, Gold has found its Bear market bottom at $1,200 /oz, where it could start to build a base of support, and begin a recovery rally in the months ahead.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Global Money Trends filters important news and information into (1) bullet-point, easy to understand reports, (2) featuring “Inter-Market Technical Analysis,” with lots of charts displaying the dynamic inter-relationships between foreign currencies, commodities, interest rates, and the stock markets from a dozen key countries around the world, (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, posted Monday and Wednesday evenings, with the latest news and analysis on global markets. To order a subscription to Global Money Trends, click on the hyperlink below,

http://www.sirchartsalot.com/newsletters.php

or call 561-391- 8008, to order, Sunday thru Thursday, 9-am to 9-pm EST, and on Friday 9-am to 5-pm.

This article may be re-printed on other internet sites for public viewing, with links to:

http://www.sirchartsalot.com/newsletters.php

Copyright © 2005-2013 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.