Egypt’s Vanishing Currency Black Markets

Currencies / Fiat Currency Jul 26, 2013 - 10:31 AM GMTBy: Steve_H_Hanke

Despite escalating tensions between Egypt’s new military-backed government and supporters of ousted president Mohammed Morsi, there is at least one positive development coming out of the Land of the Nile. Yes, at long last, some semblance of stability appears to be returning to Egypt’s economy.

Despite escalating tensions between Egypt’s new military-backed government and supporters of ousted president Mohammed Morsi, there is at least one positive development coming out of the Land of the Nile. Yes, at long last, some semblance of stability appears to be returning to Egypt’s economy.

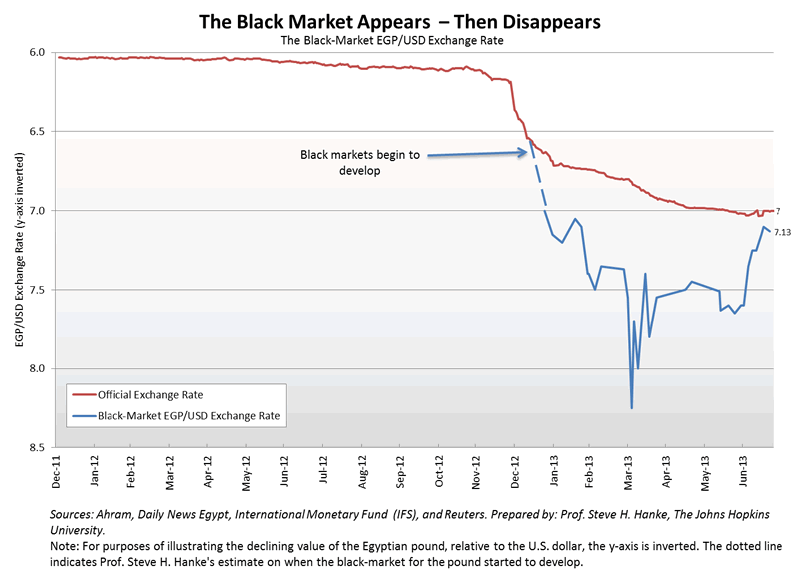

After the ouster of President Hosni Mubarak in 2011, the Egyptian economy took a turn for the worse. In particular, the Egyptian pound began to slide shortly after Morsi and his Muslim Brotherhood-backed government took power, sparking the development of a black market for foreign currency. The accompanying chart tells the tale: the official and black-market EGP/USD exchange rates began to diverge sharply in late 2012. In recent weeks, however, they have converged.

Recent currency auctions by the central bank, coupled with improved expectations about the country’s economic prospects, have begun to buoy the struggling pound. Indeed, the black-market exchange rate is now 7.13 EGP/USD, very close to the official rate of 7.00 EGP/USD. So, with Morsi, the black market appeared, and with the military’s re-entry, the black market has all but vanished.

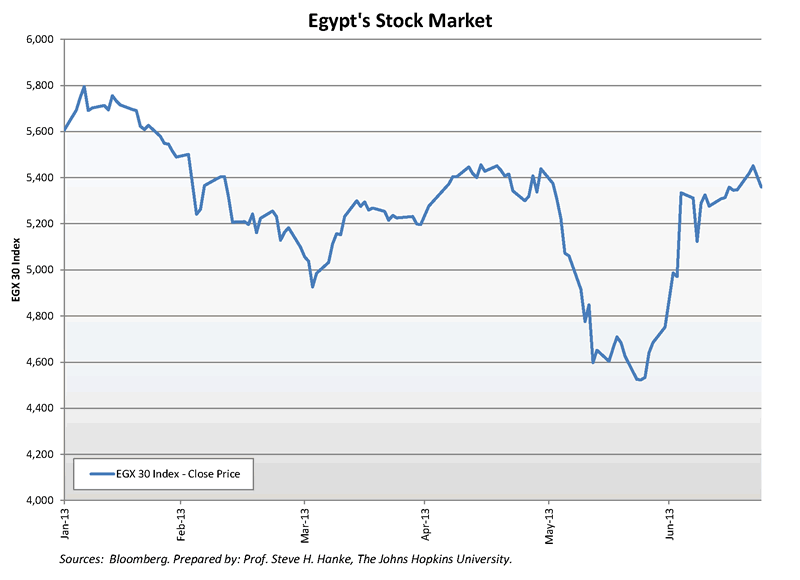

The Egyptian stock market is echoing the confident sentiments displayed by the foreign exchange markets (see the accompanying chart). But, it remains to be seen if this newfound confidence in the Egyptian economy will be sustained.

That said, there is still trouble in “paradise.” Egypt’s fiscal priorities are severely misplaced. Subsidies and interest payments eat up 58 percent of government expenditures. Salaries for Egypt’s bloated bureaucracy account for another 25 percent of government expenditures. The central bank, too, is in need of substantial reforms. The ideal solution would be to institute a currency board system, which would tightly link the Egyptian pound to a stable foreign currency, such as the U.S. dollar. This would establish the kind of monetary stability enjoyed by Hong Kong and Bulgaria, for example. A currency board system would also inject much-needed discipline into Egypt’s fiscal affairs.

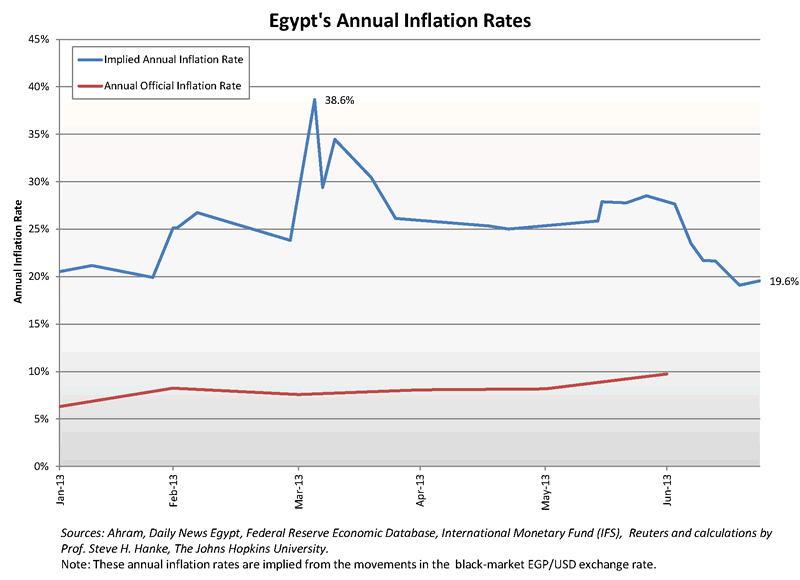

Alas, hope for such reforms seems dim at the moment. Indeed, the tidal wave of foreign aid that is headed for Cairo will weaken the government’s incentives to pursue a bold plan for Egypt’s economy – and in turn, will keep Egypt from reaching its full potential. For the time being, elevated inflation levels will remain the order of the day (see the accompanying chart).

Some much-needed stability has returned to the Egyptian economy since the military removed Morsi from power. But, it is doubtful that the military possesses the know-how or political will to make a bold move in the economic policy sphere. Morsi and the Muslim Brotherhood did not have a plan for the Egyptian economy. The military now appears to have a plan – a bad one. It centers on an old Egyptian political mantra: let’s pass the begging bowl.

By Steve H. Hanke

www.cato.org/people/hanke.html

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2013 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.