Will British Pound GBPUSD Sustain The Upward Momentum?

Currencies / British Pound Jul 26, 2013 - 11:59 AM GMTBy: Forex_Abode

After some struggle against the 55-day EMA, GBP/USD ultimately broke that resistance and closed above it. The high of this upward move was 1.5282.

After some struggle against the 55-day EMA, GBP/USD ultimately broke that resistance and closed above it. The high of this upward move was 1.5282.

GBP/USD retracements and 55-day EMA

Isn't it interesting that this high where some resistance was seen was also the 50% Fibonacci retracement of the downward move from 1.5751 to 1.4813? Not only this level brings in the resistance of the 50% retracement but is also slightly below 1.5304 which had proved to be a strong resistance earlier.

But what if both these resistances are broken?

GBP/USD retracements and 200-day EMA

If both these resistances are broken then the next level will have the combined forces of the resistance of 61.8% retracement and the 200-day moving average. The current 200-day SMA is at 1.5404 i.e. just 22 pips above the 61.8% retracement level.

Longer view of the price action w.r.t. the 200-day moving average

Lets also have a peek into the important economic releases from the U.K. and The U.S. during the last week.

Recent Economic Releases

U.K.

GBP: Consumer Price Index: Year on year CPI 2.9% was slightly less than the expected 3.0% but was better than the previous 2.7%. The core CPI was same as the consensus of 2.3% and slightly better than the previous 2.2%.

GBP: Producer price Index: Year on year PPI for Input was 2.2% and positive as compared to the consensus (1.9%) as well as the previous 1.2%. PPI Core (output) was 1.0% and though slightly less than the consensus of 1.1% but was better than the previous 0.8%. The year on year PPI for Input was same as the consensus of 4.2% and quite better than the previous 1.8%.

GBP: Claimant Count: The change in June was -21.2K and was better as compared to the consensus (-8.0K) as well as the previous -16.2K. The claimant count rate came down to 4.4% from the previous 4.5%.

GBP: Average Earnings Including Bonus (3 months/year): 1.7%, positive as compared to the consensus (1.4%) as well as the previous 1.3%.

GBP: ILP Unemployment Rate: no change from the previous 7.8%.

GBP: Retail Sales (YoY): 2.2%, positive as compared to the consensus (1.7%) as well as the previous 2.1%. Year on year retail sales ex-fuel was 2.1% and though better than the expected 1.6% but was less than the previous 2.3%.

GBP: Public Sector Net Borrowing: GBP 10.234 billion and though more than the consensus of GBP 9.450 billion but was better than the previous 12.770 billion British pounds.

U.S.A.

USD: Retail Sales: Month on month change was 0.4% and negative as compared to the consensus (0.8%) as well as the previous 0.5%. Same was the case with retail sales ex-autos which was 0.0% against the consensus of 0.4% and previous 0.3%.

USD: Consumer Price Index: Year on year CPI 1.8% and positive as compared to the consensus a(1.5%) s well as the previous 1.4%. Year on year CPI ex food and energy was same as the consensus of 1.6% and slightly less than the previous 1.7%.

USD: Net Long-Term TIC flows: USD -27.2 billion, negative as compared to the consensus (US$ 14.3 billion) as well as the previous -21.8 billion US dollars.

USD: Industrial production (MoM): 0.3%, positive as compared to the consensus (0.2%) as well as the previous 0.0%.

USD: Housing: Housing starts were 0.836 million and hence negative as compared to the consensus (0.960 million) as well as the previous 0.928 million. Same with the building permits of 0.911 million against the consensus of 1.000 million and previous 0.985 million.

USD: Initial Jobless Claims: 334K, positive as compared to the consensus (345K) as well as the previous 358K.

USD: CB Leading Indicator: 0.0%, negative as compared to the consensus (0.3%) as well as the previous 0.2%.

USD: Philadelphia Fed Manufacturing Survey: 19.8, quite positive as compared to the consensus (7.8) as well as the previous 12.5.

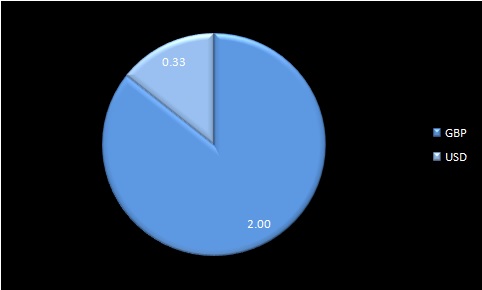

Comparative weight on the basis of last week's economic releases:

What can we Expect

By touching a.5282 the currency pair has completed the 50% retracement of its fall from 1.5751 to 1.4813. Though the strong jump has strengthened the short-term bullish outlook but please note that the resistance came exactly at 50% retracement level. Not only that but this level is just below 1.5304 which had proved to be a strong resistance on July 3rd 2013. Because of these facts we will remain neutral till any decisive break over 1.5304 does not take place.

On the upside if there is a decisive break of 1.5304 then we will expect further gains towards 1.5392/1.5404. As indicated in the above mentioned alert, this zone is expected to be a very strong resistance because of the combined powers of the 61.8% retracement, 200-day moving average and also the approaching psychological zone of 1.5500 level. Even if the pair manages to break this resistance zone a stronger resistance will be expected near 1.5477

On the downside support should come neat 1.5171 where the 38.2% retracement of the above mentioned fall should now act as support level. Any decisive break of this support will be the first sign of topping but even in that case we would expect a strong support near/above 1.5027. In case the support near 1.5027 does not hold then the focus will turn back towards downside for a move to retest the 1.4813 or possibly below that.

GBP/USD outlook is also available at ForexAbode.com

Connect with the author at Google: +Himanshu Jain.

ForexAbode.com Provides free Forex trading analysis, forecast & strategies, free trading tools, education, Forex Blogs and Forex Forum. The best Forex trading website for online trading.

© 2013 Copyright ForexAbode.com - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.