Can Crude Oil Play Super-Commodity Like 2008?

Commodities / Crude Oil Aug 02, 2013 - 04:22 PM GMTBy: Andrew_McKillop

TIME WAS

TIME WAS

Due to the recession, global oil demand in 2008 went down as global supply rose. Prices rose, also. Using US EIA data, global oil consumption decreased from 86.66 million barrels per day (Mbd) in the fourth quarter of 2007 to 86.34 Mbd in the first quarter of 2008. Between Q1 2008 and Q2 2008 global demand fell again, to 85.73 Mbd.

Between Q1 2008 and Q2 2008 prices for WTI grade oil on the US Nymex market increased sharply from $89.91 per barrel at the start of Q1 to $110.21 per barrel at the end of Q2, a growth of 22.6%. Overall therefore, demand fell and supply rose – and prices rose. A lot.

For the US EIA a major part of this sharp increase was attributed to what it called “volatility” in Venezuela and Nigeria, but it also noted an influx of investment money into commodities markets. At the time, investors were stampeding out of the falling real estate and stock markets, and among the commodities they bought gold and especially oil.

This equities market exit-bubble soon spread to other commodities. Investor funds swamped wheat, soy, vegetable oils, other food commodities and precious metals other than gold. One major impact was a world food price bubble starting in Q1 2008, driving up food prices dramatically in countries heavily dependent on imported foods. Food riots were commonplace in many less-developed countries.

Until Q1 2008, Daniel Yergin of the CERA consulting company did not believe there was any supply problem for oil, and claimed its price would soon retreat to “normal”, but in May 2008 he amended that position to predict that oil would reach $150 during 2008, “due to tightness of supply”. This reversal of opinion was significant because CERA provides price forecasts for many official bodies.

TIME IS

On August 1, 2013 Nymex prices for WTI hit $107.90 a barrel in early trading. The most-cited catalyst was continuing concern on the removal from office of Egypt's democratically elected President, Mohamed Moursi. Commodities traders worried that the Suez Canal could be closed if unrest spread.

(see my July 14 article/ http://www.marketoracle.co.uk/Article41390.html

Other supporting rationales included the unlikelihood of the US Fed starting to taper down, due to a “worrying absence of inflation pressure” in the US economy. Another was the Libyan situation. Bloomberg reported that: "Libya, holder of Africa's biggest crude reserves, has closed all oil terminals except Zawiya amid labor protests, according to Oil Minister Abdulbari Al-Arusi. Zawiya, capable of handling 300,000 barrels a day is operating, while the largest port, Es Sider, and others including Ras Lanuf, Marsa Brega and Hrega are shut, the minister said”. Probable loss of export supply will be around 0.325 Mbd, he said. Iraq's surging production may come under downward pressure if Sunni insurgents target its northern pipeline, and technical problems are curbing output in the south.

Among other frequently-cited upbeat items aiding oil's rise we have China news, where despite the signs of further slowdown reported by HSBC, the country's official purchasing manager's index came in higher than expected on Thursday August 1. This upbeat news was bolstered in Europe where a survey showed eurozone manufacturing returned to growth in July. Lending further support, US oil inventories at the Cushing, Oklahoma, delivery basing point for the Nymex crude contract fell for a fifth straight week, TWIP data showed on Wednesday, although overall stocks increased.

Since May 2008, the U.S. Commodity Futures Trading Commission has increased its surveillance of oil and other commodities' trading most recently in June 2013 concerning complaints of bogus bids and offers in the West Texas Intermediate crude-oil market, a practice known as “spoofing”. This is an illegal practice involving bids or offers that are entered with the intent of canceling them before the trade is executed, to either drive up or drive down oil prices on Nymex energy-futures contracts.

FUNDAMENTALS WIN, FINALLY

Remy Wagman, president of RJM Energy and at the time a 14-year Nymex veteran noted in a September 2010 interview with 'Alberta Oil' that the Nymex oil market attracts 'gambling junkies'. He added: “But if you’re completely a gambling junkie, it’s not an industry to work in for you. You have to know when to stop”. In 2008 the stop was $147 a barrel on July 11. Despite the highly-listened to oil forecaster Yergin claiming in May 2008 that he had had a change of outlook, and that henceforth (in early 2008) there would be oil shortage – in the face of US EIA oil demand data showing a continuing fall as the recession intensified – the stark evidence of declining oil demand finally took its toll.

From the day-averages of around US$140 to $145 attained in July 2008, oil prices collapsed to reach $30.28 a barrel on December 23, 2008, a fall of over 79% from the peak. This was the lowest day-traded price for WTI oil since the financial crisis started in late 2007.

To be sure, this peak-trough range of $147 - $30 shows such fantastic volatility that obviously both ends are extreme and unreal. To use an often cited term in the recent trial in New York of the former Goldman Sachs employee and financial algorithm expert Fabrice Tourre, this was “surreal” finance and trading, with intend to defraud. The US Securities and Exchange Commission accused Tourre of intentionally misleading participants in a complex mortgage-linked security named Abacus that earned in excess of one billion dollars for the Paulson & Co. hedge fund. Tourre was found guilty by a jury in Manhattan on six of seven counts.

Goldman Sachs, this year not 2008, has a studiedly neutral-to-negative outlook for oil prices, recently abandoning its “arb trade”, or arbitrage trading advisory and customer services for the Brent-WTI arbitrage or premium. On February 8, 2013 this premium had reached $22.70 a barrel in favour of Brent, but is now close to $1 to $3 a barrel and has traded close to zero in recent weeks. Goldman abandoned this trade when the premium fell to $5 a barrel.

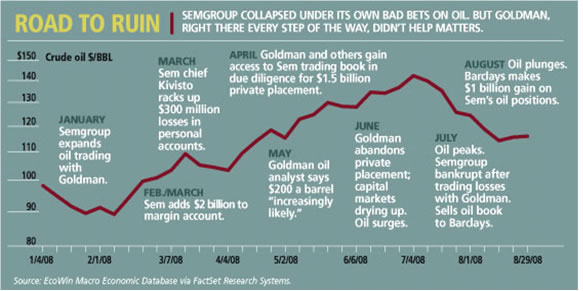

In 2008, Goldman Sachs had a dramatically oil-positive corporate stance. When oil prices spiked to $147 a barrel, the biggest corporate casualty was oil pipeline giant Semgroup Holdings, a firm with $14 billion in sales based in Oklahoma. It had racked up $2.4 billion in trading losses betting that oil prices would go down, on advice from Goldman Sachs which Goldman contests to this day, including $290 million of losses from personal accounts managed by its then CEO Thomas Kivisto. With the credit crunch eliminating any hope of meeting a $500 million margin call, Semgroup Holdings filed for bankruptcy on July 22, 2008.

Forbes magazine on March 26, 2009 noted that “Nmerous people familiar with the events insist that Citibank, Merrill Lynch and especially Goldman Sachs had knowledge about Semgroup’s trading positions from their vetting of an ill-fated $1.5 billion private placement deal last spring”. It went on to say: “What’s known for sure is that Goldman Sachs, through J. Aron & Co., its commodities trading arm, was in prime position to use such data – and profited handsomely from Semgroup’s fall. The J. Aron group was Semgroup’s biggest counterparty, trading both physical oil flowing through pipelines and paper oil, in the form of options and futures”.

Semgroup had been advised by Goldman that oil prices would fall, it claimed, but through late Spring and early Summer 2008 all they did was rise, sometimes by extremes of $5-a-day.

Source 'Forbes' magazine 26 March 2009

CAN IT HAPPEN AGAIN?

The chances of “another 2008” certainly exist – theoretically – for example due to financial industry hubris or “exuberance”, as well the industry's proven tendency to mislead and defraud. Since oil, like any other commodity including gold is a physical commodity, there are however final limits set by supply and demand.

Also, major 2008-versus-2013 differences abound. To date in 2013 there is no sign of an accompanying and comforting price-gouging process operating in agrocommodities, in fact the reverse. Several major food commodities are at remarkably low prices, today. As we know, gold has suffered a “severe correction”. Gold price manipulation – downwards – is a daily reality on the paper gold market, while physical gold demand is very strong.

The oil market of today is however very similar to 2008 in that paper oil, that is futures and options contract trading is completely dominated by a Select Few major bankers, brokers and traders. For this “community” supply and demand are only details. Physical oil supply is ample, or more than sufficient for current global demand, but this can be ignored during the “window of opportunity” for price gouging that the Select Few create and exploit. As in 2008 therefore, the oil price ramp of 2013 is a paper oil phenomenon and can run to heights that common mortals will find preposterous.

The main difference is that this time the “oil price bubble” is nearly alone among the commodities. The so-called Supercycle has been mauled, broken apart and compartmented, leaving only oil as the easiest picking for manipulation.

By Andrew McKillop

Contact: xtran9@gmail.com

Former chief policy analyst, Division A Policy, DG XVII Energy, European Commission. Andrew McKillop Biographic Highlights

Co-author 'The Doomsday Machine', Palgrave Macmillan USA, 2012

Andrew McKillop has more than 30 years experience in the energy, economic and finance domains. Trained at London UK’s University College, he has had specially long experience of energy policy, project administration and the development and financing of alternate energy. This included his role of in-house Expert on Policy and Programming at the DG XVII-Energy of the European Commission, Director of Information of the OAPEC technology transfer subsidiary, AREC and researcher for UN agencies including the ILO.

© 2013 Copyright Andrew McKillop - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

Andrew McKillop Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.