If You're Worried About Rising Interest Rates, Look at This Chart

Interest-Rates / US Interest Rates Aug 04, 2013 - 12:34 PM GMTBy: DailyWealth

David Eifrig writes: "Don't fight the Fed."

David Eifrig writes: "Don't fight the Fed."

You can hear that phrase on bond-trading desks throughout Wall Street. It's a warning to investors and traders. Don't try to outthink the central bank or anticipate its next moves...

Federal Reserve policies and their effects on the economy are like the movement of a giant aircraft carrier. It takes a long time for the direction and momentum to shift. The ships don't swerve suddenly.

The Fed is the same way. The influence of its monetary policies is pervasive and relentless. If the central bank is cutting rates and trying to juice the markets to keep the economy moving along... you'd better not bet against fixed-income and stock markets.

In my experience, working on the desks of a few Wall Street firms, trying to go against the Fed is a bad trade... You'll lose almost every time.

But... you may ask... what happens when the Fed does begin to shift? We don't want to be caught on the wrong side of any new policy, right?

It turns out, you don't need to lose sleep about that, either. Let me explain...

As readers of my Retirement Millionaire service know, I always base my decisions on the facts. I don't risk my money on speculations or hypotheses. I look deep into what the data tell me is really happening in the market. We make our decisions based on evidence.

So today, we're going to look at the facts surrounding how markets react to Federal Reserve market policy. I assure you the data tell a different story from the one you're likely to hear about "taper risk" and the imminent demise of the "bond bubble."

Let's look at the facts. What would likely happen if the Fed comes out tomorrow and announces, "Great news, the economy is booming and we're raising rates and ending all of our stimulus!" Would that be our signal to run to cash?

Not at all. And here's why...

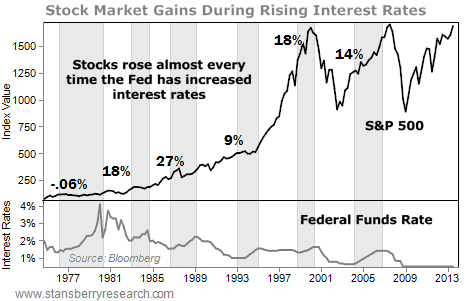

When an announcement is made that rates are rising – whether it's ahead of the Fed's actual actions or an advance warning – stock indexes like the Dow Jones Industrial Average will take a tumble for a few days, maybe a week. But believe me... they'll come roaring back.

This chart shows stocks for 40 years, essentially my investing lifetime. The shaded areas are the time when the Fed was raising its federal-funds rates. That's the rate it sets for banks to lend each other money. The average gain when the Fed was raising rates was 14%.

That's not a trade I'd want to miss.

But be thankful that most people don't know that. It makes it easier to benefit from misguided or overblown fears in the stock market. This is why I recommend people stay invested in stocks in their portfolio's asset allocations.

In fact, the U.S. economy continues to grind higher. I don't see evidence that the Fed will declare victory and cut off its bond-buying as soon as some people think. And even if it did, you'd have time to adjust your portfolio before the true effects filtered through the economy... Again, the Federal Reserve's ship does not turn on a dime.

That means a portfolio of well-chosen stocks will continue to perform well. And it means investors should not unload their unleveraged fixed-income positions, either. With a slow-growing economy and minimal price inflation, real returns on almost all securities still look attractive.

My core holdings always include businesses that are shareholder-friendly and that will make money in almost any economic environment. If I can buy sales and cash flow at cheap levels, I want to do that trade over and over...

No matter what the Fed is doing.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.