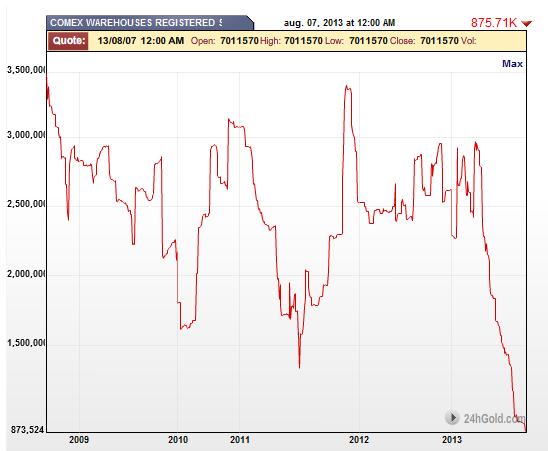

COMEX Deliverable (Registered) Gold Declines By Almost 60,000 Ounces

Commodities / Gold and Silver 2013 Aug 08, 2013 - 12:29 PM GMTBy: Jesse

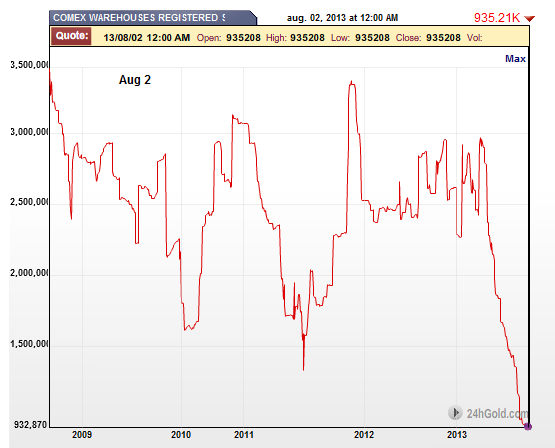

Since last Friday the registered gold in the COMEX warehouse has declined by almost 60,000 ounces to a new recent low of 875,710 ounces.

Since last Friday the registered gold in the COMEX warehouse has declined by almost 60,000 ounces to a new recent low of 875,710 ounces.

Total gold including eligible gold stored by customers in COMEX warehouses but not offered for sale holds steady at around 7 million ounces.

There was a transfer of about 6,445 ounces of customer gold from HSBC to JPM. But this was not deliverable gold as indicated on a popular website, but merely a transfer of eligible ounces from one warehouse to another.

I noted today that about 8,300 ounces of gold bullion in 400 oz. bars was redeemed from the Sprott Physical Gold Trust. Gold in this form is ready for delivery to Asia. I cannot imagine why else someone would go through the redemption process unless there was an immediate need for physical gold.

Given the amount of bullion actually being offered for sale at the COMEX, higher prices seem to be indicated in this delivery cycle with a little over 200,000 ounces worth of contracts standing for delivery, at least for now.

GLD lost about 4.5 tonnes of bullion due to paper induced selling. At some point when the price of gold turns and GLD must start adding bullion back the pressure on physical supply could be interesting.

But why debate or belabor this any further? Hit the paper price again if you dare, with the government of India doing all that it can already to stop the flow of gold into that country, and the gold forward rates negative over twenty days as the search for deliverable gold at these prices is becoming increasingly desperate.

People wish to protect at least some portion of their wealth from opaque counterparty risks.

Weighed, and found wanting.

Stand and deliver.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.