Can Silver Hold $23 ? $26 Should

Commodities / Gold and Silver 2013 Sep 08, 2013 - 07:00 AM GMTBy: Michael_Noonan

The silver situation continues to grow more positively, based on developing market activity. Almost everyone has an opinion, but they are all subservient to whatever the market dictates with its most current and most reliable information. It is then a matter of reading the message. Sometimes it is very clear, sometimes not.

The silver situation continues to grow more positively, based on developing market activity. Almost everyone has an opinion, but they are all subservient to whatever the market dictates with its most current and most reliable information. It is then a matter of reading the message. Sometimes it is very clear, sometimes not.

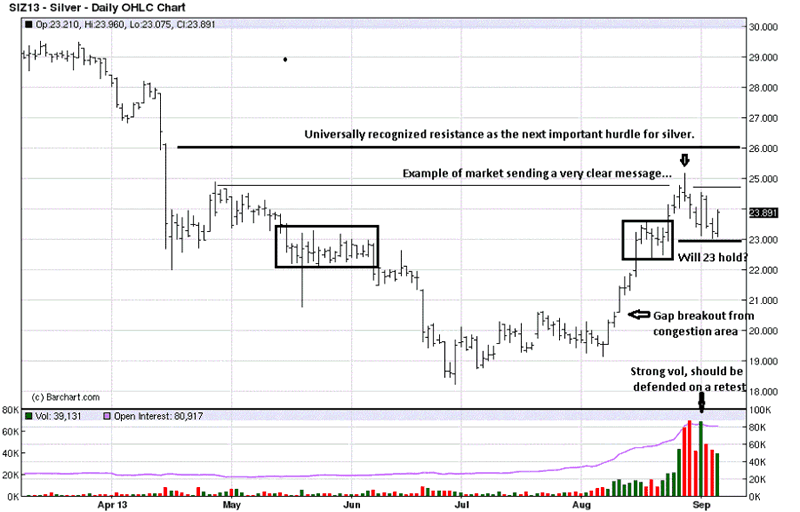

The resistance for silver at $26 is uppermost on the mind of everyone with any degree of awareness for this market. A lesser market message, but one still quite clear was the lesser resistance from a demonstrated failed swing high retest back in April.

The new swing high in August closed poorly, the market advertising the likelihood of a correction to follow, as one did. We took no defensive action on this, at the time, with the "belief" that $26 would be the more important area from which to respond, and the activity for silver was developing positively. The point is, even though the market gives out important information, it is not always heeded, for a variety of reasons. For the most part, many do not even "see" the "message."

The TR box on the left shows how price failed to overcome $23 at the end of May and early June. There was an indication of how $23 could be important when price held that level, earlier in April. Broken support becomes resistance. The second, smaller TR box at the right shows that $23 was traded above/below for six TDs before rallying strong above the TR, making it support, once again.

The upside breakout gap is shown as a measure of potential strength underlying presently developing market activity. The sharp volume increase on the first TD in September is likely to be further defended by buyers, and it was. The question posed, will $23 hold?

A look at the intra day for a possible answer.

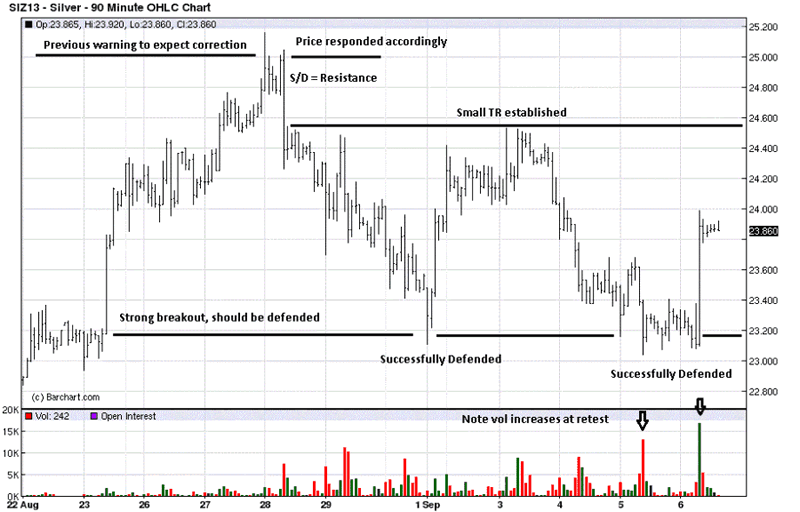

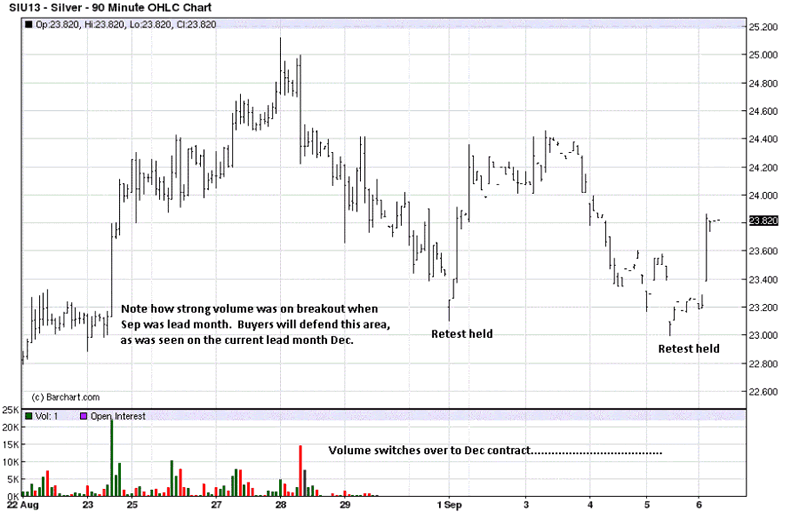

The starting point for this scenario was 23 August, when silver had a breakout from a wedge formation on exceptionally strong volume, [shown on the 3rd chart]. Whenever there is high volume behind a breakout, it will be defended on any retest, as those who bought, at the time, want to protect their purchases.

The first retest came on 1 September. There was an effort for price to go lower, but it failed, evidenced by the market's ability to respond with a strong rally. This is an example of the HOW a market responds to a known support/resistance area, and it gives us added information from newly developing market activity that $23 is holding very well.

The failure rally of the 28th, in between, had a secondary retest right after the S/D wide range bar lower, and that little retest effort failed at just under $24.60. Its importance became evident when price contained another attempt at that level, early in September. This created a small TR between 24.55 and 23.

There were two more attempts to break support at $23 on Thursday and Friday, and both failed when, for a period of time, $23 looked like it would not hold. The increased volume sell off on the 5th became pivotal on the 6th when another retest was failing to confirm the attempted break. You can see the high volume rally that created a collective sigh of relief for silver longs, at that point.

What makes that strong rally bar even more significant was the bar just before it. It had all the appearances of a potentially failed rally, followed by a poor close that looked like new lows were eminent. That would be a legitimate opinion, at the time, but the market does not care what we think. It will do what it will do, regardless of anyone's opinion.

For now, silver is in a small trading range, and $23 has held. This can change on Monday, if silver were to sell off under $23. We do not know, nor do we have to know. All anyone can do is deal with the available information in the present tense. If new, future market activity alters that view, we get to deal with it then, and respond accordingly.

If that little bar just prior to Friday's strong rally tells us anything, it is to wait for confirmation before acting. Had we determined silver was about to break under $23, by the looks of that bar, and acted on it, we would have missed out on the rally, just a few minutes later. This is why we always say to follow the market, not lead it.

This chart of the then lead month, Sep, is included to show how the breakout on the 23rd occurred on very strong volume. It was a pivotal piece of information, and still is.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2013 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.