Silver, Butter and TANSTAAFL

Commodities / Gold and Silver 2013 Sep 11, 2013 - 08:38 PM GMTBy: DeviantInvestor

TANSTAAFL is the acronym for “There ain’t no such thing as a free lunch.” The saying has been used for years, even prior to Robert Heinlein’s use of it in “The Moon Is A Harsh Mistress.” It is another way of saying there is always a price that must be paid.

TANSTAAFL is the acronym for “There ain’t no such thing as a free lunch.” The saying has been used for years, even prior to Robert Heinlein’s use of it in “The Moon Is A Harsh Mistress.” It is another way of saying there is always a price that must be paid.

Regarding butter: “If you subsidize butter, you get more butter.” Substitute whatever you wish in the place of “butter,” such as, welfare, stupidity, food stamps, drugs, student loans, mortgages, political contributions, bad policy, lazy thinking, too-big-to-fail banks, deficit spending, and so forth.

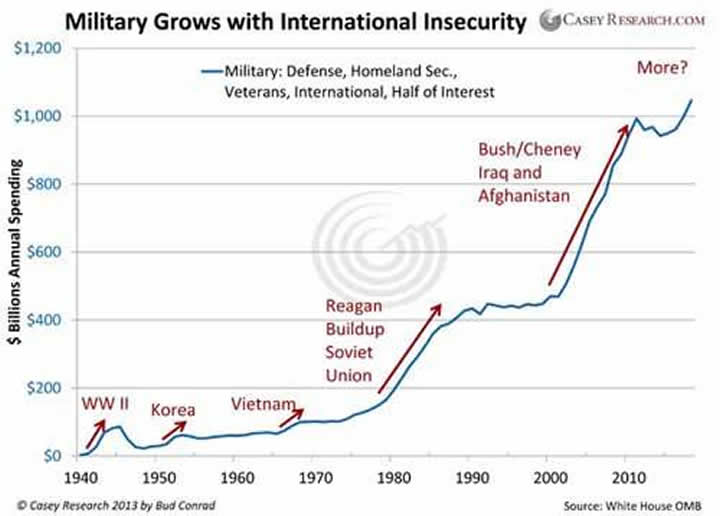

Military spending seems relevant as Congress prepares to vote on an attack on Syria. Casey Research published the following chart of military spending over the past 70 years. Their analysis, based on White House OMB data, is consistent with more detailed data I found from Data360 which lists spending by year. This is “big picture” analysis:

| Year | Military Spending (in $Billions) | Price of Silver (annual average from Kitco.com) |

| 1948 | $21 | $0.70 |

| 1971 | $100 | $1.39 |

| 2010 | $1,000 | $20.19 |

The exponential rate of increase for military spending from 1948 to 2010 (62 years) was about 6.4% per year. The rate of increase from 1971 – 2010 (39 years) was about 6.1%. For silver, the annual rate of increase from 1971 to 2010 was about 7.1%.

Military spending increased erratically and exponentially (1948 – 2010) at about 6.4 % per year. Silver prices increased similarly at about 7.1% per year since 1971, the year that Nixon “temporarily closed the gold window.” Both silver and military spending increased very rapidly following 9/11/2001. An analysis of increases in the total money in circulation, as measured by M2, and for the prices of gold and cigarettes produces similar results over long periods. Increases in the money supply, deficit spending, and debt clearly drive increasing consumer prices and increases in gold and silver prices.

If we subsidize butter, we get more butter. Our current system subsidizes many programs, from food stamps (SNAP), welfare programs, congressional importance, military contractors, mortgages, lobbyist compensation, student loans, medical costs, and on and on to eventual insolvency. Congress will soon raise the debt ceiling in another circus of political “horse-trading” that will enrich those who made the largest donations to congress. Military spending is destined to rise along with debt, denials, and prices.

Do you expect any of these massive expenditures or subsidies to stop, or even slow their rate of increase? Of course not!

Unfortunately, there is no free lunch, there are consequences to bad decisions, and the costs of subsidized programs must be paid. These consequences will be life-changing and quite drastic. Consider some thoughtful preparation.

You can buy 30 year bonds (a very LONG commitment) and earn a bit less than 4% per year in a currency virtually guaranteed to decline in value, or you can put your savings into a Certificate of Deposit and earn 1% per year. You could be “Cyprused” with a “bail-in” that converts your deposit in the bank, which is legally a liability of the bank and no longer your money, into equity in a failing bank. We hope such “bail-ins” do not occur but the laws are in place and the precedents have been set.

Alternatively, you can purchase “insurance” in the form of gold and silver and watch it increase erratically in price, along with military spending, the national debt, many other programs, and the money supply.

I strongly discourage an investment in gold and silver if you believe that Congress will balance the budget and reduce the national debt to near zero before the next presidential election.

However, in the real world, “insurance,” in the form of gold and silver, makes good financial sense.

Consider storing your gold and silver outside the banking system and in a country other than where you live.

Read: Back to Basics – Gold, Silver and the Economy Read: Gold, Silver, and the Sins of the Past

GE Christenson aka Deviant Investor

If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail© 2013 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.