Five Years After Lehman - Gold Still Safe Haven As Financial System 'Insane'

Commodities / Gold and Silver 2013 Sep 13, 2013 - 03:50 PM GMTBy: GoldCore

Today’s AM fix was USD 1,308.25, EUR 984.46 and GBP 827.12 per ounce.

Today’s AM fix was USD 1,308.25, EUR 984.46 and GBP 827.12 per ounce.

Yesterday’s AM fix was USD 1,340.25, EUR 1,008.54 and GBP 847.46 per ounce.

Gold fell $41.60 or 3.05% yesterday, closing at $1,323/oz. Silver slid $1.31 or 5.66%, closing at $21.83. At 3:01 EDT, Platinum fell $28.60 or 2% to $1,437/oz, while palladium fell $2.03 or .3% to $688.47/oz.

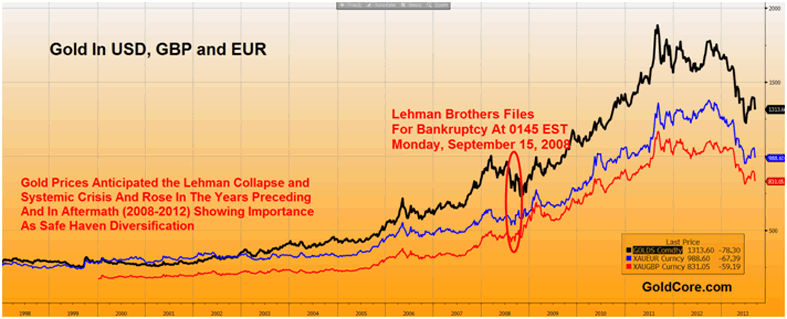

Gold in USD, GBP and EUR Before and After Lehman Brothers Crisis

Gold has fallen 5.4% this week and is headed to its lowest in five weeks (see chart below). A heavy burst of selling led to another sharp fall in gold from $1,323/oz to $1,312/oz, again in less liquid Asian markets overnight and gold broke through support at $1,320/oz and may now test support at the $1,275/oz level.

The losses appear to be primarily due to speculative paper selling of futures contracts leading to further technical selling as stop loss orders are triggered. There has been no marked decrease in global physical bullion demand or significant physical selling of any note in recent days.

Speculation that the U.S. Federal Reserve will decrease its stimulus next week and the lessening of the threat of U.S. military strikes on Syria may have contributed to the price falls as nervous speculators take profits or go short.

Lehman Brothers filed for bankruptcy at 0145 EST late Monday night, September 15, 2008, and the five year anniversary is this Sunday.

Little has changed in the financial world and on Wall Street since the collapse. Vital lessons have not been learned. The financial system remains vulnerable to excessive risk taking, unforeseen shocks and systemic risk.

It is important to note how the Lehman bankruptcy and subsequent systemic, financial and economic crises showed gold’s importance as a safe haven asset and as financial insurance in a portfolio.

Gold in dollar terms has risen 73% and silver by exactly 100% since the Lehman bankruptcy and collapse. Both have risen by similar amounts in other major currencies.

Gold rose in the years preceding the crisis when more prudent observers were warning about risks emanating from cheap money policies, overheating stock and property markets, an out of control derivatives market and the shadow banking system. A Lehman Brothers style crisis was obvious to many analysts who warned of systemic risk.

In the immediate aftermath of Lehman, gold prices fell for a few days leading to loud pronunciations that this proves gold is not a safe haven. However, by year end gold had risen again and it continued its gains as the crisis rumbled on into 2009 and morphed into a sovereign debt crisis subsequently.

MSCI World Stock Index Before and After Lehman Brothers Crisis

Commentators have suggested that risk assets such as equities have fared well since Lehman Brothers and this shows the importance of passive investing. This is true to an extent. However, equities had fallen substantially prior to the Lehman Crisis and there is a strong argument to be made that stocks were pricing in the coming crisis in the months prior to September 2008.

This crisis showed how equities are risk assets and far more risky than accepted by Wall Street and some hedge fund managers. It rightly called into question the ‘cult of the equity’ and the tendency for many investment and pension fund managers to be very overweight equities.

Many of these same fund managers completely ignore and or disparage gold. Yet a 5%, 10% or even a 20% allocation to gold would have greatly protected investors as gold’s long term inverse correlation with equities was seen once again.

This is an important lesson from the Lehman debacle. It is a lesson that if learned will protect investors from the coming financial, economic and likely currency crises.

Gold in US Dollars, Year to Date - Boomberg

The respected Gillian Tett has written an important op-ed piece in the Financial Times where she argues that the financial system is arguably more insane now than it was prior to the Lehman Crisis.

Tett is an award-winning journalist and author, and is a markets and finance columnist and an assistant editor at the Financial Times.

Her 2009 book ‘Fool's Gold: How Unrestrained Greed Corrupted a Dream, Shattered Global Markets and Unleashed a Catastrophe’ was widely reviewed throughout the English-speaking world and won the Spear's Book Award for the financial book of 2009.

Gillian Tett

She has been positive regarding gold as an asset and diversification for some time due to the degree of financial and economic uncertainty in the world.

In the Financial Times today, she writes:

-

The big banks are bigger – not smaller.

-

The shadow banking world is taking over more activity, not less.

-

The system depends more than ever on investor faith in central banks.

-

The rich have become richer.

-

Financiers have been prosecuted – but not for the credit bubble.

-

Fannie and Freddie are alive and well.

" ... these issues are ... a powerful reminder of the vast amount of work still to be done before we have a financial world that looks both sane and safe."

GoldCore Conclusion

The collapse of Lehman Brothers, the risk of other large important banks failing in the coming months and the still significant systemic, macroeconomic, monetary and geopolitical risk of today shows the vital importance of real diversification and an allocation to physical gold.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.