Gold In India: Did Gold Stop to Respond to the Rupee Price Moves?

Commodities / Gold and Silver 2013 Sep 14, 2013 - 10:03 AM GMTBy: Nadia_Simmons

Today, gold in the global market reversed early gains and fell to its lowest in more than a month as U.S. futures extended losses on fears the United States would curb its stimulus soon and as a U.S. strike on Syria looked less likely.

Today, gold in the global market reversed early gains and fell to its lowest in more than a month as U.S. futures extended losses on fears the United States would curb its stimulus soon and as a U.S. strike on Syria looked less likely.

According to Reuters, purchases from jewelers in Hong Kong and mainland China initially helped gold gain more than 0.5%, but heavy selling of New York COMEX and bullion futures on Tokyo Commodity Exchange pushed the price of gold below $1,330 per ounce.

Gold in India, the world's top consumer of the precious metal, fell to its lowest level in three weeks following losses in the world market.

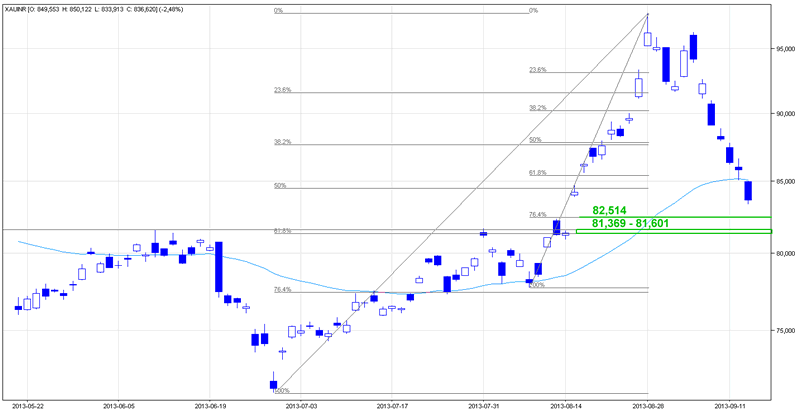

What impact did these circumstances have on the gold’s chart? Where are the nearest support zones and resistance levels? Let's take a closer look at the daily chart and find out what the current outlook for gold priced in rupees is.

Since my previous essay was published, that the situation has deteriorated once again.

Quoting my previous essay on gold in India from September 11:

(…) When we factor in the Fibonacci price projections, we see that the 1.618 ratio was broken today. If the gold bulls don’t manage to push the price higher from here, the next price target for the sellers will be around the 1.732 ratio at Rs 85,514. It’s worth mentioning that this ratio is slightly above the 61.8% Fibonacci retracement level based on the upward move from the August low to the August top (around Rs 85,449 per ounce). This area is also supported by the 45-day moving average (currently at Rs 85,090). If this strong support zone is broken, the next support level will be close to the 50% Fibonacci retracement level based on the entire June-August rally.

As you see on the above chart, gold priced in rupees broke below all these levels during today’s session. The buyers failed and gold bears did not give them any chance to improve the situation and initiate an upward move.

In this case, the next price target for sellers is around the 76.4% Fibonacci retracement level (based on the upward move from the August low to the August top). However, the strong support zone is between Rs 81,369 and Rs 81,601, where the 61.8% Fibonacci retracement level based on the entire June-August rally intersects with the June top.

Taking the above into account we see that there is still much room for further declines.

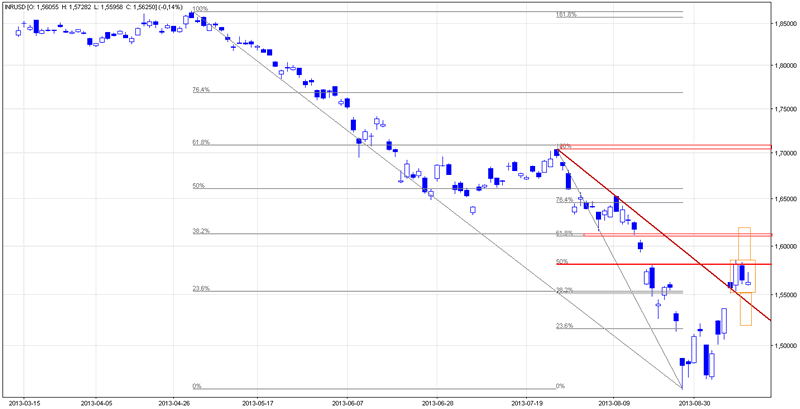

Once we know the current situation in gold priced in rupees, let’s take a look at the INR/USD chart and find out whether the relationship between gold and the INR/USD exchange rate still exists or not.

On the above chart we see that the situation hasn’t changed much in the decent days.

Quoting my previous essay on gold in India from September 11:

(…) the Indian rupee reached the 50% Fibonacci retracement level based on the entire July-August decline. Today we saw a small breakout above this resistance level (but only on an intraday basis), which is not yet confirmed.

Taking the above into account, in the following days we may see a corrective move to the previously-broken declining resistance line based on the July and August 12 tops.

On the daily chart we see that there hasn’t been a decline to this declining line so far. Instead of this a consolidation has formed in the recent days. That’s why we should consider two scenarios. If the buyers do not give up and push the price above the Wednesday’s high, the INR/USD exchange rate will likely climb to at least the 61.8% Fibonacci retracement level. Please note that this area is also supported by the 38.2% Fibonacci retracement level based on the entire May-August decline. However, if they fail and the rupee drops below the bottom of the consolidation, we will likely see a decline to about 159 level.

Summing up, taking all the above facts into account the we see that the Thursday’s decline didn’t trigger an upward move in gold. In other words, the recent negative correlation didn’t’ work this time. Additionally, it seems that today’s small bounce up in the INR/USD exchange rate pushed the yellow metal even lower. From today’s point of view it’s hard to estimate whether this tendency changed or it was just a one day phenomenon. That’s why it will be important to watch how gold will react to price moves in the rupee against the dollar which we are likely to see in the not-too-distant future.

If you'd like to stay up-to-date with our latest free commentaries regarding gold, silver and related markets, please sign up today.

Thank you.

Nadia Simmons

Sunshine Profits‘ Contributing Author

Gold Trading Tools and Analysis - SunshineProfits.com

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.