COMEX Deliverable Gold Bullion Plunges By 78% in 2013

Commodities / Gold and Silver 2013 Sep 14, 2013 - 06:25 PM GMTBy: Jesse

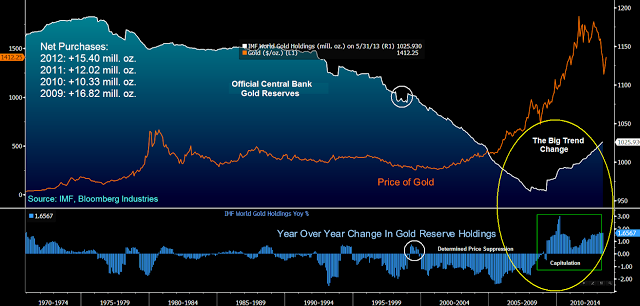

The last time that the claims per ounce were nearly this high was in the late 1990's. At that time the central banks had to intervene to keep one or more bullion banks from faltering. It occurred during a period of coordinated bullion selling from the central banks into the market under the Washington Agreement, culminating in the notorious gold dumping known as Brown's Bottom. At least the Germans still have a receipt. That selling failed to hold the line, and shortly thereafter gold began its great bull market run.

The last time that the claims per ounce were nearly this high was in the late 1990's. At that time the central banks had to intervene to keep one or more bullion banks from faltering. It occurred during a period of coordinated bullion selling from the central banks into the market under the Washington Agreement, culminating in the notorious gold dumping known as Brown's Bottom. At least the Germans still have a receipt. That selling failed to hold the line, and shortly thereafter gold began its great bull market run.

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it."

Sir Eddie George, Bank of England, reportedly in private conversation, September 1999

The first chart below shows that rather nicely. Nick Laird, the maestro of charts from Sharelynx.com, was kind enough to go back and pull all the available data. It helps to complete the picture don't you think?

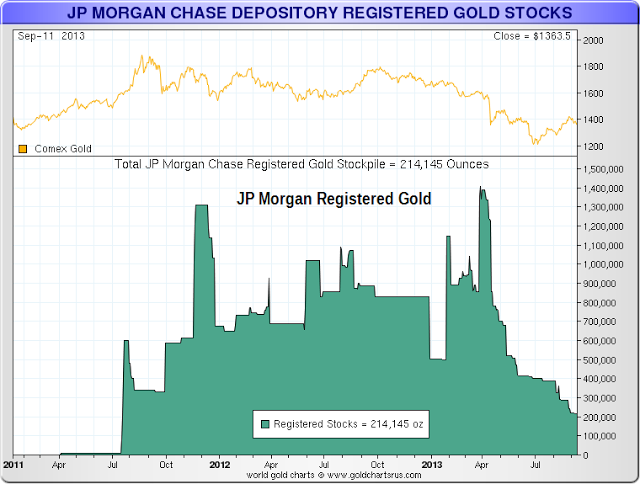

One difference this time is that the fellows who examine the more detailed reports tell us that the big boy of the bullion banks, JP Morgan, is said to have already liquidated their large short position and gone net long gold. Perhaps they are well advised.

If this is true they would benefit greatly from another bull run. And since gold has been reaffirmed as a Tier 1 asset along with cash and government securities, it is literally 'as good as gold' for the Banks' balance sheet, n'est-ce pas? How fortunate for America's favorite financier.

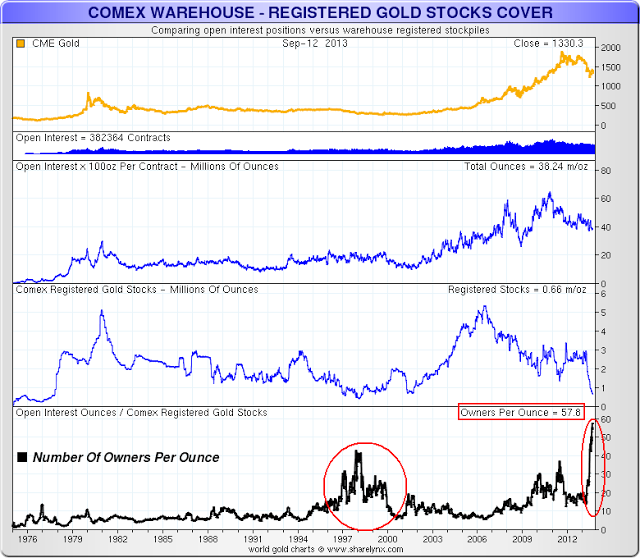

Deliverable 'dealer' gold, known as registered gold at the COMEX, has plunged a remarkable 78% during the vicious price smashing of gold in 2013.

This decline in gold available for delivery has not been matched by a similar decline in contracts bidding for that gold, known as the open interest.

Therefore the number of contracts for each ounce of deliverable gold has now reached a new all time high of about 57.8 claims per ounce, a level that has not ever been seen since Nixon closed the gold window.

There was another big buildup in the claims per ounce that occurred just before gold began its big bull market run in 2000. Some contend that this drain in dealer gold was the result of a last ditch effort to the hold the price of gold lower before the market broke and the price began its remarkable run.

But given that the banks became net buyers of gold around 2008, as shown in the third chart below, it does not seem likely that the Bank of England or the western central banks will sell bullion into the market to save the overleveraged speculators again.

Recently the Federal Reserve was unable to comply with a request from the Deutsche Bundesbank to return the German national gold which had been held in custody in New York. The vault seems to be a bit on the thin side in general. I am sure all the gold is there, it is just that we live in an age in which multiples of rehypothecation for our financial assets held in trust are de rigeur. All the finest financiers are doing it without fear or regret, even when it occasionally decimates their customer accounts or shakes the global economy to its foundations.

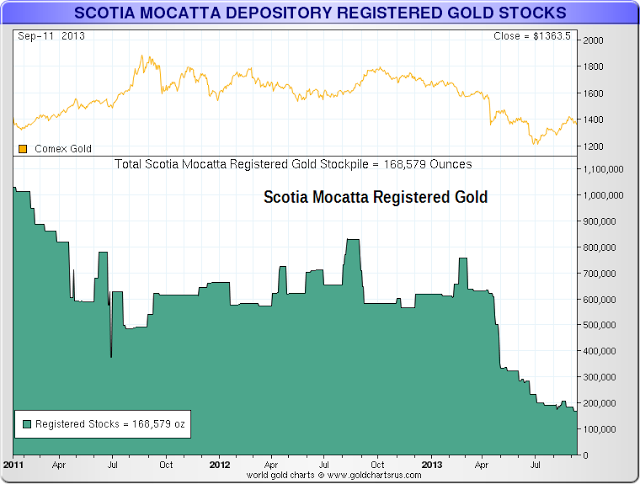

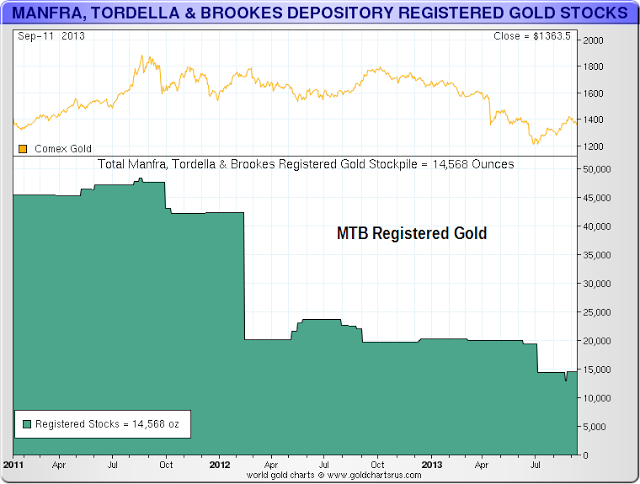

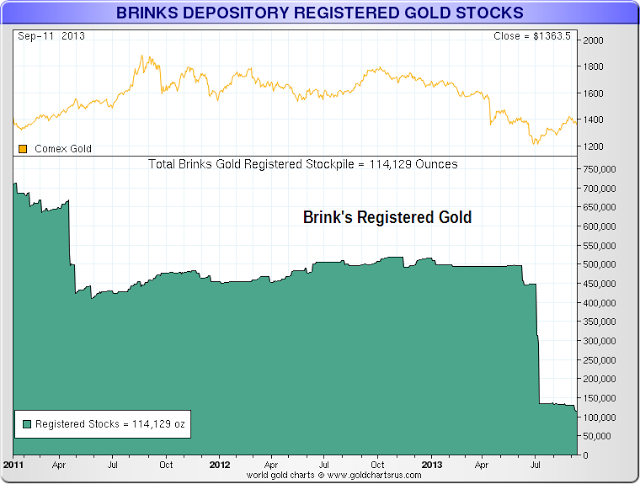

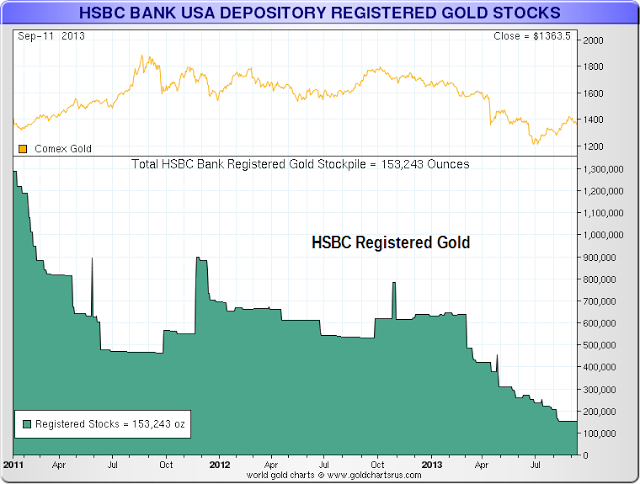

Also included below is a peek at the registered inventories of all the COMEX warehouses. Some of the declines are impressive. What a remarkable coincidence.

There has rarely been a dull moment since they knocked down Glass-Steagall. It will be interesting to see what happens next. This has been so much fun that it hard to know whether to crack open a bottle of champagne, or to make a run for the border.

We'll probably have to wait until after Goldman brings out the Twitter IPO. Priorities.

Have a pleasant weekend. See you Sunday evening.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.