The Smell of Financial Collapse is in the Air

Stock-Markets / Financial Crash Sep 19, 2013 - 02:41 PM GMTBy: DeviantInvestor

The U.S. stock market is near all-time highs, while politicians and economists are blathering about recovery, low inflation, and good times, but instability and danger are clearly visible in our debt based monetary system. To the extent we rely upon the fantasies of ever-increasing debt, money printing, and credit bubbles, we are vulnerable to financial collapses. Perhaps a collapse is not imminent, but it would be foolish to ignore the possibility. Consider what these insightful writers have to say:

The U.S. stock market is near all-time highs, while politicians and economists are blathering about recovery, low inflation, and good times, but instability and danger are clearly visible in our debt based monetary system. To the extent we rely upon the fantasies of ever-increasing debt, money printing, and credit bubbles, we are vulnerable to financial collapses. Perhaps a collapse is not imminent, but it would be foolish to ignore the possibility. Consider what these insightful writers have to say:

The Fantasy of Printing "Money" To Solve Problems:

"Money-printing cannot solve problems. It doesn't really give us much gross domestic product growth, as we have seen. It hasn't really helped on the employment front either, as job growth is meager (of course, it is also hampered by other government policies). What money-printing has accomplished is to push the stock market high enough to cause people to once again become delusional in their expectations."

"Debt worldwide is now expanding exponentially. With absolutely no possibility of stopping this debt explosion, we will soon enter a period of unlimited money printing leading to a total destruction of paper currencies. The consequence will be a hyperinflationary depression in most major economies."

"No, Larry Summers won't be able to save the day... The damage is already done; and thus, NOTHING can turn the tide of 42 years of unfettered, global MONEY PRINTING - which as I write, has entered its final, terminal phase."

"So the ending is already clear. The U.S.S. Titanic is about to be intentionally sunk (again), and B.S. Bernanke's 'fingerprints' will be planted all over the crime scene."

Credit Bubble in the Global Economy Will Eventually Collapse:

"... nothing was fixed after 2008, just as nothing was fixed after the housing, tech stock, and junk bond bubbles burst. The response has been the same each time, only progressively more aggressive and experimental. That the financial, economic and political mainstream think that the system has been reset to 'normal' because asset prices are back where they were just before the 2008 crash is, well, crazy. With financial imbalances bigger than ever before - and continuing to expand - the only possible outcome is an even bigger crash."

"THIS is where THE REAL BUBBLE is! The biggest bubble in all of history, (larger than the Tulip mania, South Sea, the Mississippi Bubble, 1929, current global real estate and global stock bubble combined then cubed) is the current and total global financial system. EVERYTHING EVERYWHERE is based on credit. In fact, over 60% of this credit is dollar based and 'guaranteed' by the U.S. government. The minor little problem now is that we have reached 'debt saturation' levels everywhere. There are no more asset classes left able to take on more credit (air) to inflate the balloon. The other minor detail is that the 'asset' that underlies the value of everything (the dollar and thus Treasury securities) is issued by a bankrupt entity. What could possibly go wrong?"

Discussion:

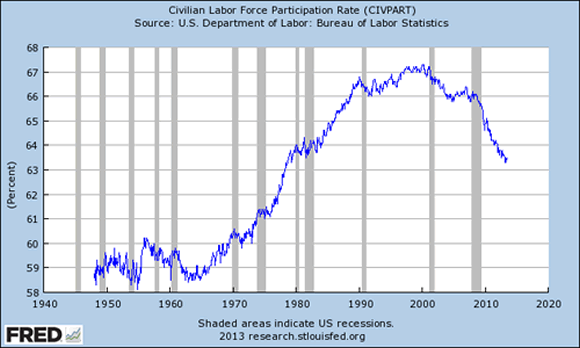

Growing and healthy economies mean more people are productively employed. It appears that much of the "growth" in the U.S. economy over the last five years has been in disability income, food stamps (SNAP), unemployment, student loans, welfare, debt, and government jobs - none of which are productive. Examine the following graph of Labor Force Participation Rate - the actual percentage of the populace that is employed. Does this look like a healthy economy experiencing a recovery or a collapse in productive employment?

The damaging effects of 100 years of Fed meddling in the U.S. economy, many expensive wars, 42 years of unbacked debt based currency, and unsustainable growth in credit and debt have left the Western monetary system in a precarious position.

Using common sense, ask yourself:

-

Can total debt grow much more rapidly than the underlying economy which must support and service that debt? FOREVER?

-

Can government expenditures grow much more rapidly than government revenues? FOREVER?

-

Will interest rates remain at multi-generational lows? FOREVER?

-

Will a fiscally irresponsible congress rein-in an out of control spending system that our fiscally irresponsible congress created?

-

Is another and larger (than 2008) financial collapse likely and inevitable?

-

Do you still believe in the fantasies of ever-increasing debt, printing "money" and credit bubbles? Are you personally and financially prepared for a potential financial collapse?

-

Have you converted some of your digital currencies into real money - physical gold and silver? Is it safely stored outside the banking system and perhaps in a country different from where you live?

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2013 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.