What's The Indian Government Doing to Gold?

Commodities / Gold and Silver 2013 Sep 19, 2013 - 04:57 PM GMT Difference between India & China

Difference between India & China

While both nations have been touted as the fasted growing nations in Asia, there are stark differences between the two nations that are coming to the fore now.

The first is that in China, the population has a fear of gov't and the dangers of disobeying it. After nearly 48 years of intense pressure and 're-modeling' of the thinking of the Chinese people, the Chinese are now a highly regimented people who appear to enjoy hard work, have a tacit obedience of gov't and appreciate the lift in their standard of living. They appear to be fully supportive of the extraordinary urbanization of the country and the present reality that nearly three quarters of the country have a much higher standard of living than they have ever experienced. The nation is headed towards becoming the economic powerhouse of the world before 2020.

India on the other hand has little to no trust of gov't or the official bodies and bureaucrats below it. They have seen little change in their world overall. The intelligent rising middle class either aims to find their full potential outside the country or working for a company that services the needs of the developed world, particularly on the IT front. They remain a rural thinking economy with a rejection of mass retailing and appear to accept change only when it suits them. Immersed in religion and tradition they are unlikely to continue on the path to anywhere near the development that China is experiencing.

The tradition with heavy religious overtones applies to the buying of gold. Not only is it a religious expression, but a family statement of supplying financial security to the next generation. In that they share a similar attitude to China.

In India there is a marked distance between the ordinary Indian and the wealthy upper classes. In China they share the same way forward as each other, at the moment. The Indian family in general does not share the same objectives as government and so the nation lacks the cohesion that China does.

In China, should the gov't deem it necessary to take its citizen's gold into their reserves - whether by confiscation or in exchange for dated bonds or simply require some form of access to it once it is held in the banking system -- we believe that the Chinese citizen would be happy to support their nation in such a strategic move. On the other hand the average gold-owning Indian would not trust his gov't or its intentions nor feel inclined to support government with his personal gold.

That is precisely why the developments in India regarding gold should be of such interest to the gold world.

Assault on Gold Imports

Since the beginning of the year, we've seen the Indian gov't launch an attack on gold importing by raising duties twice and by permitting imports of gold only if 20% of it were for re-export subsequently. In this way the government has blocked the imports of gold, for the time being. It appears that importers have allowed gold stocks to be run down pending a softening of the regulations. In the meantime, gold smuggling has never been more profitable and is on the meteoric rise; however, amounts coming in by this route are unquantifiable.

We look to the statistics coming out of the Middle East, Pakistan and other peripheral nations for evidence of this in the future.

The Indian gov't has felt that this set of measures would have the quickest impact on the CAD and it has had one, but it is not the solution to the problem. The internal growth of demand will continue until there are countrywide objections to these measures, which ahead of elections next year are unlikely to stand for too long. But short-term the damage has been significant to the supply of gold.

India's gold imports plunged in August to just 2.5 tonnes, more than a 90% drop from August 2012. The decline was a result of increased gov't tariffs and regulations governing gold imports. July saw 47.5 tonnes imported.

The Current Account Deficit touched an all-time high of 4.8% of Gross Domestic Product, or $88.2 billion in 2012-13. The Indian gov't proposes to bring down the CAD to 3.8% of GDP, or $70 billion, in the current financial year. But it is obvious that the attack on gold imports was a poor substitute for increasing exports. The Economic Affairs Secretary, Commerce Secretary S. R. Rao has asked for a relaxation of the new restrictions.

The fall in the Rupee that took it to nearly Rs.70: $1 has been halted by the use of a 'swap' line of $10 billion with which to intervene in the market place. But this can only be a short-term solution and one we suspect was secured by the promise of gold, should the Reserve Bank of India fail to unwind the swap.

Granted this is the quietest time of the year for Indian exports; however, this drop is exceptional. The 'gold-buying season' has now started in India and stockists are having to let stocks fall before they try to re-stock. When they do, expect the figures to jump sharply.

With the Rupee suffering so much the case for holding gold has been reinforced tremendously, putting the government in an even worse situation.

It appears that the lesson of the weaker Rupee is not lost on the government either. They have embarked on some clandestine moves to see if they can bring some of the between 20,000 and 30,000 tonnes of privately owned gold under their control in an attempt to shore up the int'l respect for the Rupee.

The first of these is a rerun of a scheme that failed in the past but is worth a renewed effort. With the loss of a good proportion of their business in sight, the nation's big jewelers have jumped on the bandwagon in the "Save Gold Campaign".

The "Save Gold" Campaign

The scheme involved gold owners bringing their gold to jewelers who will issue them with a "Gold Certificate" valid for three years after which the gold can be returned and on which interest would be paid. The accompanying statement of purpose was that this would negate the need to import gold, drawing on the 'idle' gold in the country.

We cannot see this working because at some point in time there would be a need to return the gold. If it has been sold back into the economy, then the only way this could happen was if gold was imported from overseas, thereby destroying the original purpose of the scheme.

Likely the gold would be held in the banks - who may well pay interest on it in a similar manner. But the banks remain under the control of the gov't so may well be pressed to 'loan' the gold to the gov't, who in turn could then use it to secure offshore loans.

The underlying purpose of the scheme would be to get the gold out of the private domain and into the government's. This would not be as brutal as a straightforward confiscation, but essentially is the same. It would place the gold under the control of the gov't (who could extend its use of the gold for as long as they wanted to and this would be tantamount to confiscation).

Indian Temple Gold to be bought/bonded or Confiscated?

It is now obvious that the attempts to get the public to deposit their gold through the "Save Gold" campaign, whereby they hand their gold to jewellers against the issue of a bond (where they will be paid Rupees as interest) for three or so years is part of a general search for an avenue to bring privately owned Indian gold within the control of government. If the government can harness gold for their international credit purposes - via the banks and jewellers -- they have access to unlimited credit. But the distance between the gold owning public and the gov't is a chasm as well for the following reasons...

-

The general population doesn't trust them.

-

They don't see the gold being returned, i.e. confiscation.

-

They don't want depreciating Rupees paid as interest to them, i.e. interest bearing confiscation.

-

They know that any period given before the gold is returned can be extended or extended until the national Balance of Payments crisis is over, i.e. confiscation for an indefinite period.

-

The gold is already held away from the government's eyes (even buried in gardens) and not easily located.

This is where the 80 - 20 rule kicks in. Eighty percent of the country's privately-held gold is held in 20% of the nation's hands. So it is easier to target these institutions first for the sake of effectiveness of the operation. So their first port of call, if this is the route the government wishes to follow, is to be found in the most visibly held, large stores of gold.

The most visible of these are selected temples, which in themselves have sufficient gold to ease the need for int'l loans. The Reserve Bank of India has confirmed that they are exploring this route by the letters they have already sent to the main temples asking for information about their gold ornaments and artifacts.

We would like to stress to you the reader that this is not some odd little event in the distant reaches of the globe. It is important for two reasons:

-

This is about using a nation's gold to support the nation's currency system, when it has lost credibility outside and inside of its borders.

-

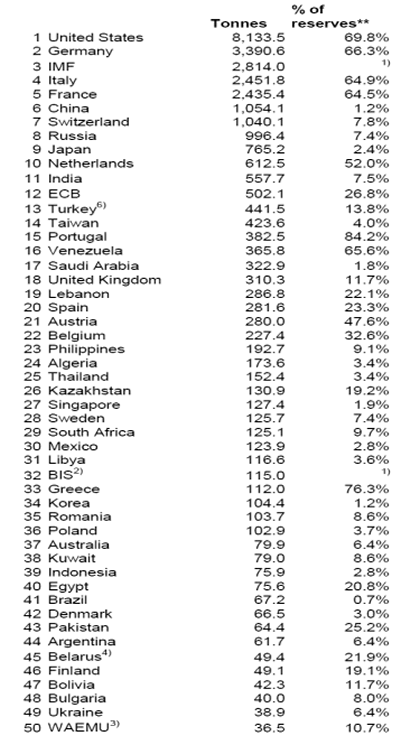

The quantity of gold within India is somewhere between 20,000 and 30,000 tonnes. To give this perspective the higher figure equals nearly the entire central bank reserve holding of gold globally. It is not far short of four times the gold holdings of the U.S.A. [which comprise around 75% of the U.S. reserves. Individual temples hold more gold than some nations.

To illustrate this point please see the list below of gold holdings of the top 50 nations and bear in mind gold is held as a last monetary resort.

Now take a look at the opulence of some of India's temples.

While the gods and idols in most of these temples are dressed in gold, several temple roofs are actually decked out in gold, including the Golden Temple in Amritsar, Punjab, the Tirupati temple in Andhra Pradesh, and the Nataraja temple in Chidambaram, Tamil Nadu. The Guruvayur temple, the two major temple boards that manage most temples in South Kerala, such as the Sabarimala temple, the Shree Krishna temple of Guruvayur in Kerala and the Vaishnodevi temple near Jammu and Kashmir, the Tirupati temple, which receives around 90 kilograms of gold and 100 to 120 kg of silver as offerings every month to add to the current stockpile of gold bars, coins and thick gold jewellery pieces. The temple sent 10 tonnes [338 kg] of gold to the Indian Overseas Bank, for converting into gold bars. In total Overall, the temple has deposited 42 tonnes [1,353 kg] of gold with IOB and 70.76 tonnes [2,275 kg] of gold with the State Bank of India.], the Sree Krishna temple in Kerala [it has over 18.66 tonnes [600 kg] of gold, of which more than 15.55 tonnes [500 kg] are deposited as bars with the State Bank in Mumbai] and the Padmanabhaswamy temple.

Just these amounts alone represent 132 tonnes or more than have the country's gold reserves at present. With much of this gold already held in banks, it is a small step to "harness it" for the nation's use.

In exploring this avenue, gov't has set itself up for a serious clash with religion. Some political/religious groups have told the boards of some temples to just ignore the letter. As is usual with such political moves, denial that there is any more than a curious gathering of data has already come from government.

The Reserve Bank of India's senior official, Salim Gangadharan, said the RBI had no plans to actually buy the temple gold, and that the exercise was a statistical one to estimate the gold. Gov't came into the story saying that they have no designs on temple gold to help fight the their current financial crisis. Minister of State for Finance, J D Seelam, said there was an inquiry, but "Gods' gold is the very last resort." So how far is the Indian government away from the last extreme resort? It depends on the decay of the Indian Balance of Payments. At the moment there appears to be little to combat that decay, so it may well be just a matter of time!

Watch this space!

Hold your gold in such a way that governments and banks can't seize it! Enquire @ admin@StockbridgeMgMt.com

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

![]()

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2012 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.