Gold Analysts Bullish Due To Money Creation On Scale Never Seen In History

Commodities / Gold and Silver 2013 Sep 27, 2013 - 02:22 PM GMTBy: GoldCore

Today’s AM fix was USD 1,321.50, EUR 978.45 and GBP 822.03 per ounce.

Today’s AM fix was USD 1,321.50, EUR 978.45 and GBP 822.03 per ounce.

Yesterday’s AM fix was USD 1,332.50, EUR 987.92 and GBP 830.22 per ounce

Gold slid $9.40 or 0.7% yesterday, closing at $1,323.70/oz. Silver fell $0.06 or 0.28%, closing at $21.70. Platinum dropped $21.70 or 1.5% to $1,404.50/oz, while palladium slipped $1.75 or 0.2% to $718.75/oz.

After initial gains, gold sold off soon after U.S. markets opened, falling from $1,336.40/oz to $1,322.53/oz in concentrated selling over a few minutes. Gold traded sideways in Asia prior to eking out marginal gains in early European trading prior to giving up those initial gains.

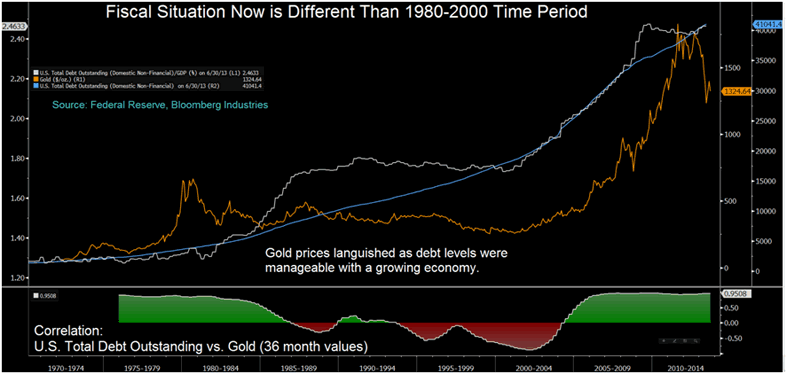

U.S. Total Debt Versus Gold (1970-2013)

While data has been mixed lately, some important data points have been negative including purchases of second hand homes which fell for the third straight month in August.

The misguided speculation regarding Fed tapering has begun again. A Bloomberg survey of 41 economists last week showed 24 expect the Fed will pare ‘stimulus’ in December. None of these same economists predicted that the Fed would not taper last week and their views on tapering should be taken with a pinch of salt.

As we have long contended, QE is set to continue for the foreseeable future as a discontinuation of QE would lead to market declines or worse and a serious recession or depression.

It remains prudent to ignore the noise from the Fed and the constant speculation from many analysts and economists - most of whom have a dismal track record in predicting events before or since the global financial and economic crisis.

Gold in USD, 5 Days - (Bloomberg)

Gold analysts are bullish for a second week due to the view that ultra loose monetary policies and budget talks risk a U.S. government shutdown which will spur demand for gold bullion as a haven.

According to Bloomberg as featured in The Washington Post:

Seventeen analysts surveyed by Bloomberg expect prices to rise next week, seven are bearish and three neutral. Gold, which fell into a bear market in April, rose 7.3% since the start of July, poised for the first quarterly advance in a year.

Bullion is still heading for its first annual drop in 13 years after some investors lost faith in the metal as a store of value. The Federal Reserve unexpectedly left its bond-purchase program unchanged last week, saying that restrictive fiscal policies pose risks for the economy. President Barack Obama and congressional Republicans are debating the federal budget in a confrontation that risks a government shutdown within days.

“The outlook is positive due to the twin risks of continued ultra-loose monetary policies as seen in the lack of tapering and also due to forthcoming risks regarding the U.S. debt ceiling. They may resolve the debt ceiling, but how they resolve it is most likely to kick the can down the road. People may buy gold as a safe haven.”

Gold prices languished from 1980 to 2000 and had declining correlations with debt levels because GDP growth was sufficient to mute concerns about budget and deficit issues. Debt levels in GDP terms actually fell in the 1990’s. Also the 1990’s was an era of great economic and geopolitical optimism with the end of the Cold War, a more stable world and the emergence of China, India and other emerging markets into the global economy.

This was during the Clinton presidency and prior to the Bush and Obama presidencies which have seen the U.S. spend money like a drunken sailor. That profligacy began soon after September 11th and the U.S. military response to the terrible events of that day.

It continues today despite a very precarious fiscal position. Since September 11th the world is a far more uncertain place and geopolitically the world is now reverting to the instability of the Cold War years.

The punch and judy show that is the U.S. Congress is making creditor nations around the world very nervous and astute investors and savers are diversifying into gold to protect from the real risk of a dollar crisis and global currency crisis.

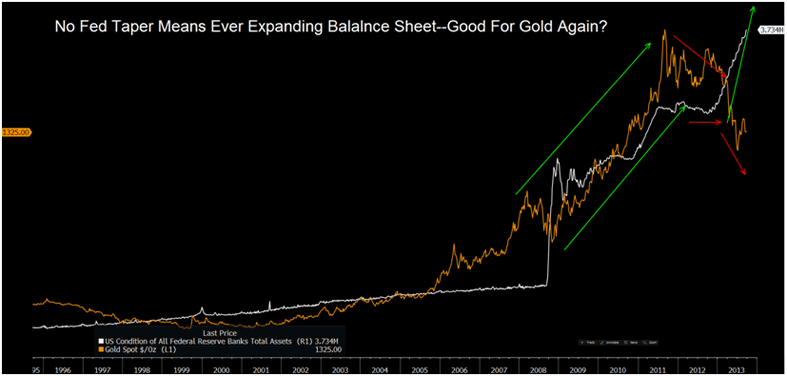

Gold In USD and All Federal Reserve Banks Total Assets - 1996 to Today (Bloomberg)

The Federal Reserve decision to refrain from a QE taper is very bullish for gold.

‘Tapering’ may be put off indefinitely due to the very fragile state of the massively indebted U.S. economy. This means that interest rates must be kept low for as long as possible, leading to money printing and electronic money creation on a scale never before seen in history.

This will inevitably lead to higher gold prices - the question is when rather than if.

QE1 and QE2, in addition to the start of the current QE3, sent gold to record nominal highs. Misleading guidance from the Fed and misguided speculation regarding tapering and the possible end of QE decreased interest in gold from more speculative buyers, contributing to its weakness in recent months. That will change in the coming weeks and months when there is a realisation that ultra loose monetary policies are set to continue.

Concerns about systemic risk and currency debasement is leading to continuing robust central bank demand for gold.

The IMF data released Wednesday showed that eight central banks increased their gold reserves in August, some very significantly.

Russia, which has the world's seventh largest reserves of gold, increased its holdings last month by the biggest amount since December. Russia increased reserves by 12.722 tonnes to 1,015.521 tonnes, according to the IMF's website. Russia's gold holdings crossed the 1,000 tonne mark in July.

Turkey raised its gold reserves by the most in five months in August. Turkey added 23.344 tonnes to lift its gold holdings to 487.351 tonnes. Turkey's increases have been bigger this year as its central bank allowed commercial lenders to hold a portion of their lira reserves in gold.

Turkey has bought gold in 13 of the past 14 months and Russia has added to its reserves for 11 consecutive months.

Ukraine, Azerbaijan and Kazakhstan were the other countries that added to their gold reserves by more than 2 tonnes each last month. Canada, Mexico and Czech Republic were among those that reduced their holdings very marginally.

Other very large buyers of gold, include sovereign wealth funds, some of which are also continuing to diversify into gold. Azernews reports that:

The State Oil Fund of the Republic of Azerbaijan (SOFAZ) has said that SOFAZ's gold reserves will reach 40 tons in 2014. The total amount of gold purchased by SOFAZ will reach 30 tons until the end of 2013, and 20 tons of the volume will be delivered to the country.

"So far, 26 tons of gold have been purchased, most of which has already been delivered to the country," Movsumov said.

He said the process of a phased purchase of gold over three years is effective, which allows to provide the average cost of purchased gold considering the volatility of prices for this precious metal.

According to the plans, SOFAZ buys gold in batches. The fund began buying gold in the first quarter of 2012. The first batch of gold in the amount of 32,150 troy ounces was delivered to the country on January 11, while the second batch was brought on February 1 and the third one on March 1.

The continuation of ultra loose monetary policies by the U.S. Federal Reserve and the other major central banks will lead to continuing diversification into gold by prudent money internationally.

This will lead to gold reaching a real (inflation adjusted) high above $2,400/oz in the coming years.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.