What Did Congress Do to Gold Prices?

Commodities / Gold and Silver 2013 Oct 06, 2013 - 09:56 PM GMTBy: Investment_U

Sean Brodrick writes: The U.S. government is in crisis. After all, the government failed to pass a continuing resolution to fund government operations on Monday. The U.S. dollar fell.

Sean Brodrick writes: The U.S. government is in crisis. After all, the government failed to pass a continuing resolution to fund government operations on Monday. The U.S. dollar fell.

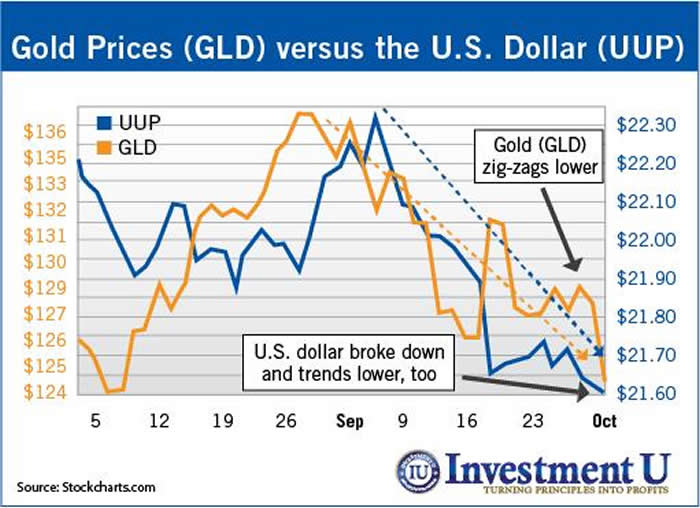

But many traders are left wondering, “If it’s such a crisis, why isn’t gold doing better?” The last time we had this scenario, in December 1995, gold moved higher. But this time, gold tanked. Seems weird, right?

Since gold is priced in dollars, they usually move in opposite directions. Now, they’re trending the same way. Money is rushing out of “safety” assets (gold and the dollar) and into “risk” assets.

What’s going on?

It’s a case of “The Congress That Cried Wolf” one too many times.

People have seen this movie before. Washington comes up against a budget deadline or debt limit. We’re told it will be the end of the world if the two sides in Washington don’t come to an agreement. They don’t come to an agreement.

Somehow the world muddles along anyway.

Then, after much shouting, the two sides Scotch-tape together some kind of agreement long after the “deadline” passes.

In other words, this “crisis” has become part of the usual noise out of Washington. America shrugs its broad shoulders and gets on with life.

My readers know that I’ve been predicting a short-term move lower in gold. But the long-term forces for a big move higher are still there.

So, this is leading to a better buying opportunity, if you believe those long-term forces are still in place. And I think gold’s big move higher is coming, because:

•China’s Appetite Is Growing for Gold. Consumer gold demand in China, last year’s second-biggest user after India, should rise by at least the same pace as the country’s economic growth, according to the World Gold Council. China’s consumption is expected to hit 1,000 metric tons this year. Chinese New Year is only a few months away, and that’s usually a very bullish time for gold.

•Inflation-Fueled Protests Are Spreading. Turn on your TV and watch international news. You’ll see protests and, in some cases, widespread civil unrest in Egypt, Turkey, Brazil, India, Indonesia – even China. Why are these people braving police beatings to voice their anger? Because inflation is heating up in those countries, and many of the world’s poor are seeing the cost of maintaining their standard of living slip out of their grasp. Inflation may be tame in the U.S. That’s not the case overseas. How long do you think before inflation spreads to our shores? And inflation and widespread unrest have historically both been supportive of gold.

The fact is, the recent dip in gold prices is a gift. When the hard times come, most people will decide they don’t own enough of it.

The Oxford Club recommends you have 5% of your money in gold. If you don’t own any yet, you might want to buy the pullback.

In any case, you’re in charge of your own investing decisions and destiny. And it sure looks like no one is in charge in Washington, D.C.

Good investing,

Sean

Source: http://www.investmentu.com/2013/October/what-did-congress-do-to-gold-prices.html

Copyright © 1999 - 2013 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.