U.S. Government Shutdown Gold Fuel

Commodities / Gold and Silver 2013 Oct 07, 2013 - 04:54 PM GMTBy: Ned_W_Schmidt

The shutdown, albeit it temporary, of much of the U.S. government has drawn both fierce and mixed emotions. On one hand are those that believe a day without government is day with greater liberty. The other group is upset that government is prevented from repressing the spirits of a free economy. Regardless of which group you find yourself, as an investor one should recognize that the shutdown will increase the availability of the fuel necessary to push the price of Gold higher.

The shutdown, albeit it temporary, of much of the U.S. government has drawn both fierce and mixed emotions. On one hand are those that believe a day without government is day with greater liberty. The other group is upset that government is prevented from repressing the spirits of a free economy. Regardless of which group you find yourself, as an investor one should recognize that the shutdown will increase the availability of the fuel necessary to push the price of Gold higher.

Remember that both reality and perceptions, right or wrong, influence the setting of the monetary policy of the Federal Reserve. So, one of the important questions is how the shutdown and subsequent events will be perceived from the viewpoint of Keynesian economists. To answer that question we must remember that Keynesian economists are rigid ideologues. Their thinking is constrained by a near religious training experience. They treat a book written almost 80 years ago as some might any of the great religious texts, containing undeniable truths. They ignore that it was written in the depth of and solely for the Great Depression. Hayek correctly pointed out the error in their approach, but was and is ignored.

The partial shutdown in the U.S. government is another battle in the war to rein in the spending of that government. The sequester process was also just one battle of the war on U.S. government deficit spending. While all know that U.S. government spending will continue to grow, an effort is being made by some to avoid the cataclysm that lies ahead for a nation that relies on debt to finance unconstrained spending.

In the view of Keynesian economists, this effort to reduce the level of U.S. government spending should reduce the growth rate of the U.S. economy. Other factors also contribute to such thinking. Little doubt exists that Obamacare will do major damage to the U.S. economy. At the same time the depressionary impact of both the Obama tax increase and regulatory onslaught continue to thwart economic expansion. Those on and around the Federal Reserve Open Market Committee are likely to view all this in sum as depressing economic activity.

All the above discussion leads to two important questions:

How is the FOMC likely to respond?

What does that response imply for the value of the dollar and the price of Gold?

Some may wonder why no discussion of a U.S. default on debt is included in the above discussion. Our view is that the politicians will find some way to temporarily avoid that event. Their actions will defer, not prevent, the inevitable "default" on U.S. debt. Since all of us know that such as event is probable and know that Gold is the only wealth insurance for it, why discuss what we already know?

Given the ideological backgrounds of those on the FOMC, a continuation of the policy of quantitative easing is a near certainty. Once a committee creates a giraffe in its effort make a horse, it is not likely to change course and suddenly create a horse. Tapering, the latest fantasy of the Street's economists, went off the agenda the day the U.S. partial shutdown began.

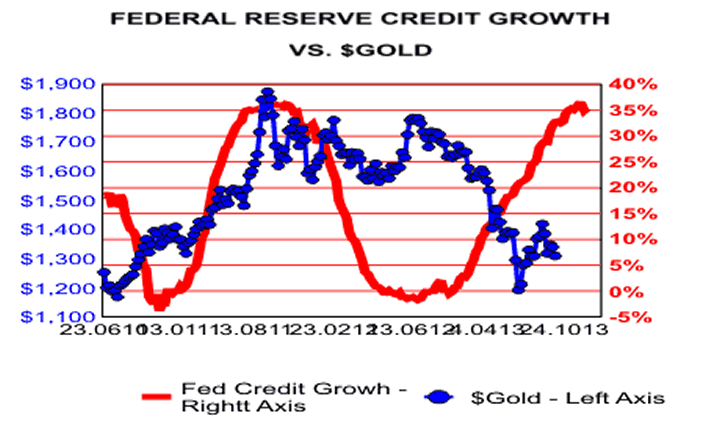

Above chart, which we have discussed previously, portrays the year-to-year rate of change for Federal Reserve Credit using the red line and the right axis. In blue, using the left axis, is the Friday PM setting for $Gold. Until this year the relation was reasonable, and as expected. When the growth rate of Federal Reserve Credit expanded to an extreme, the price of Gold rose. When that growth rate declined, the price of Gold declined. With the shutdown ending the prospects for taper, Federal Reserve Credit will expand. That is the ongoing fuel for the price of Gold to rise.

That all leads to our third question. Why has the price of Gold not responded as it should have? Answer is that an often powerful force, mentioned often in the literature, took control. Animal spirits have the power to interfere with the natural movement of prices in asset markets. With overly abundant liquidity available, speculative funds returned to chasing the dreams available in paper equity markets. Why invest in Gold when one has such wonderful fantasies as internet social networking sites? Never mind that they are no more than today's version of the pachinko machine companies of times long past. Why invest in Gold when one has Twitter coming public?

Ultimately reality overcomes animal spirits, and it will again with Gold. With an ongoing flow of fuel, the price of Gold will rise to reflect that reality. By the way, using an extremely simplistic methodology and the growth rate for Federal Reserve Credit suggests an appropriate price for $Gold of around US$2,000.

By Ned W Schmidt CFA, CEBS

Copyright © 2013 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.