Diabolical Stock Market Pattern, Hard Down on Monday!

Stock-Markets / Stock Markets 2013 Oct 11, 2013 - 06:34 PM GMT SPX has just crossed above mid-Cycle resistance at 1692.30 after a struggle. The next resistance is at the lower trendline of the Broadening Wedge (and round number resistance) at 1700.00. I suspect that this will be the final resistance of the rally, if it doesn’t run out of steam (or greater fools) before then.

SPX has just crossed above mid-Cycle resistance at 1692.30 after a struggle. The next resistance is at the lower trendline of the Broadening Wedge (and round number resistance) at 1700.00. I suspect that this will be the final resistance of the rally, if it doesn’t run out of steam (or greater fools) before then.

What may be surprising to many is what comes next. The next pivot occurs on Sunday, which suggests that Monday opens down…possibly hard down. Based on that information, I don’t expect to see a big reversal today, but possibly a lingering top into the close.

We should have our bearish positions lined up by the end of the day, however. The Cycles are occurring a bit later than usual, but on the track that I had expected.

VIX appears to have finished its corrective Intermediate Wave (B) near mid-Cycle and Intermediate-term support. The next move may be what I would call the “towering inferno”. VIX also has formed a series of zigzags that suggest this wave is corrective, so many Elliott Wave practitioners view this formation as corrective rather than impulsive. The market really does want to fool as many people as it possibly can and this formation is truly diabolical.

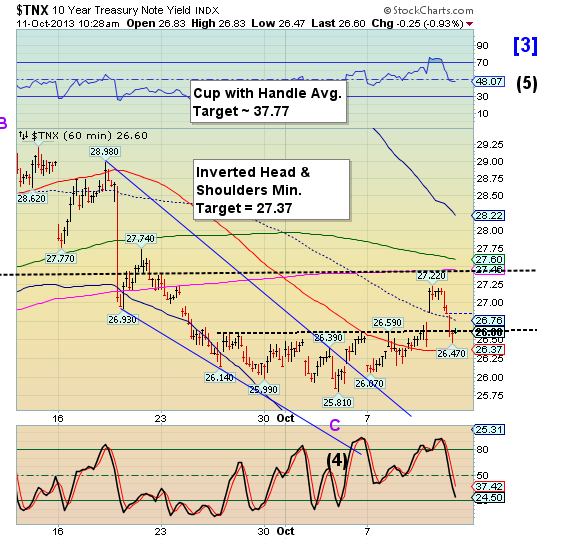

TNX briefly overshot its small Head & Shoulders neckline, but is attempting to move back above it. Again, the moves appear corrective. It may be that it formed an extended Minute Wave [b] to 27.22 and it appears to have finished Minute Wave [c].

I will label the waves as more clarity emerges.

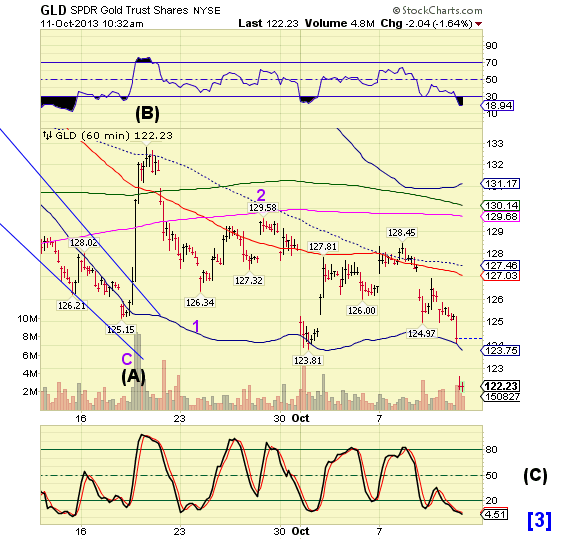

GLD has made a very deep decline that may take it to or below the previous (April) low and Head & Shoulders neckline at 114.68. Once beneath that, it has a potential target of 43.51. That’s right. I have checked and re-checked that target and it appears to be confirmed by alternate analysis as well.

I will be leaving around 2:00 pm to travel with friends to a place called Whisky Point in northern Michigan, where we will be…well, I will leave it to your imagination.

I won’t be back until late Sunday, so there will be no Weekend Update. I will be back at the desk early Monday morning. I hope your weekend is enjoyable as well.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.