Gold Market Tremors and Warnings

Commodities / Gold and Silver 2013 Oct 22, 2013 - 04:39 PM GMTBy: Jesse

Here are three charts that capture the somewhat uniquely dangerous situation in the gold futures market on the Comex.

Here are three charts that capture the somewhat uniquely dangerous situation in the gold futures market on the Comex.

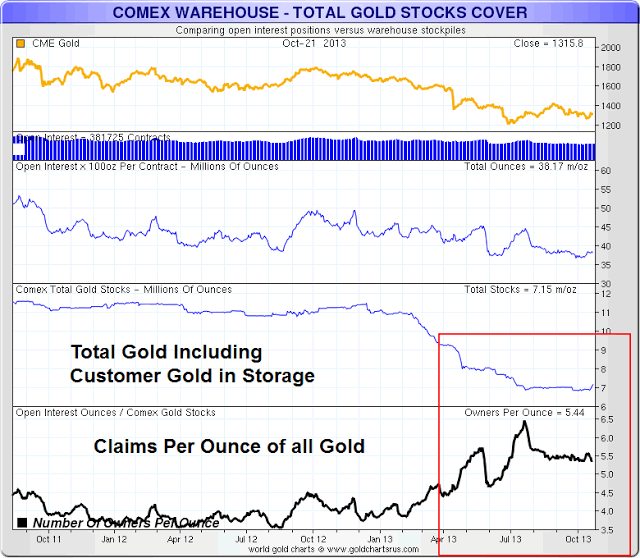

The first chart shows all gold in storage at Comex certified private warehouses. The major bullion banks control the vast majority of this storage. Among these are JPM, HSBC, Scotia Mocatta. Storage and delivery services are also provided by Brinks and Manfra, Tordella, and Brookes, a large NYC coin and bar dealer.

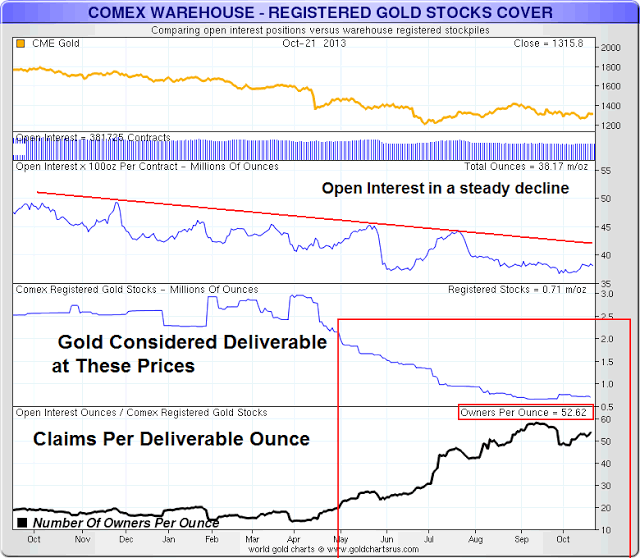

The year long decline in open interest on the Comex is a phenomenon worth noting. It is marked on the third chart. Even as gold bullion purchasing is soaring, gold futures interest in the US is in a secular decline. But even with this decline, the 'claims' of ownership as represented by futures contracts over ALL gold in the warehouses is a bit high.

Not to say that futures contract owners can have any claim on gold merely held in storage. But they can try. I include this because some people consider it to be important. If the price is allowed to rise high enough, that customer gold might be tempted into the deliverable category and offered for sale. The key question is 'how high.'

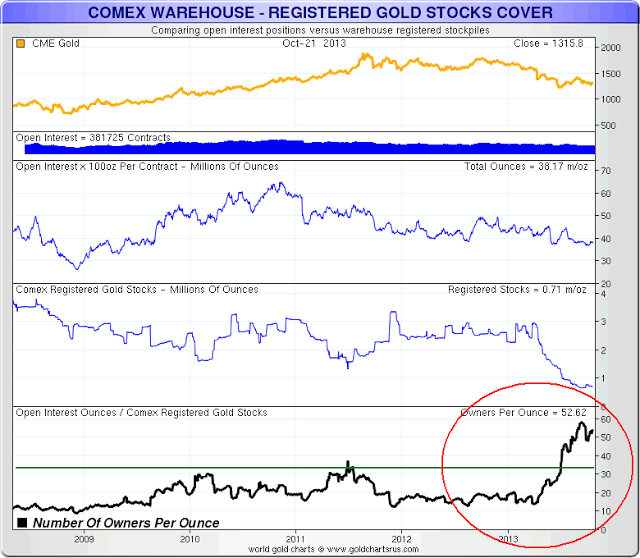

The better metric to watch is the number of claims per registered, or deliverable ounces of bullion on the Comex. This gives us a current 'temperature reading.' And that measure remains near all time highs on my data sources at 52.62 claims per ounce at these prices. My friend Nick Laird at Sharelynx, who does a wonderful job of charting and data gathering, prefers to call it 'owners per ounce.' But since a single ounce of gold cannot have 53 owners if the music stops, I prefer to call them 'claims' or virtual ownership.

Every prior deep decline in registered gold bullion during this bull market has marked an intermediate price trend change. I do not think this time will be different, all other things being equal.

What exacerbates this situation is the absolutely remarkable drawdown in gold bullion from the ETFs around the world, but most markedly in GLD. We have not seen anything like this in silver, platinum, or palladium.

As you know, I am persuaded that the request from the Bundesbank for the return of Germany's gold, and the deferral of this by the Fed for seven years, set off a chain of overreactions and market maneuvers that in retrospect will be viewed as foolhardy.

If the price of gold is allowed to rise to $1650 to $1750 by the end of January, preferably the end of December, I think the Comex might avert what for them could become a potentially disastrous situation. And they need to get started on this fairly quickly so that the rise is gradual and controllable.

If the bullion banks continue to game the system, and scalp profits with other peoples' money, my forecast is for a market break and dislocation in the gold market that will imperil quite a few smaller trading houses, and shake the global trade to its foundations. I would not be surprised to see a halt call to the gold trade, a forced cash settlement on futures and derivatives, and a price adjustment higher in multiples of triple digits.

And we could see a TBTF bullion bank or two shaken to their foundations. If the governments overreact in trying to get them out of their own mess without loss, then I think it is time to keep your heads down and hit the exits. I doubt they could be that clumsy, but most politicians know less about money than most economists, and that is pretty bad. And they are certainly as craven and pliable, so it is possible.

I think the die will be cast in December. If they try the annual price hit in early December, they might set off a series of unfortunate events.

So you might consider this a warning, just based on the market mechanics. It does not have to happen. But it is hard to overestimate the reckless stupidity of unbridled greed. So far that has been a good bet if one knows how to play it.

Again, most likely outcome is the infamous muddle through and the kick of the can down the road, with a rising price in gold as part of an intermediate trend change. But we are now in a period of high risk, and I don't yet see the right steps being taken to avert it. Some of that rests on the shoulders of the CFTC, and quite a bit on the exchange, the politicians, and the regulators of the banks.

I do not want to join the doomsayers, those who troll for clicks with ever more dire headlines of impending doom. All of our problems are soluble, and things are no worse now than they have been many times in the past. Our parents and grandparents faced worse, and I personally have seen harder times by far. But it is getting pretty bad on a secular level, mostly from self-inflicted wounds and corruption in my own opinion.

But I wanted to state this unequivocally because I can see another financial crisis, and a bunch of hand-wavers running around saying that no one saw it coming. Just like the last two or three financial crises. Maybe these time they will act with caution and good sense.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.