Oversold Gold Does The Trick, Bulls Get The Treat

Commodities / Gold and Silver 2013 Oct 24, 2013 - 09:56 AM GMTBy: Clif_Droke

In what started as a depressing month for gold investors has turned positive with metals and mining stocks posting their best performances since August.

In what started as a depressing month for gold investors has turned positive with metals and mining stocks posting their best performances since August.

Investors may have dreaded October heading into the month for various reasons - not the least of which was the U.S. government shutdown and debt ceiling showdown. But the "scariest month" is turning out to be nothing more than a phantasm heading down the final stretch. In this commentary we'll examine where gold is likely headed thanks to a historic technical condition mentioned in previous commentaries.

The latest precious metals sector rally was telegraphed last week when the gold stock advance-decline (A-D) line broke out from a multi-week downtrend. By breaking the downtrend, the A-D line sent a "heads up" signal not only for the gold mining stocks but also for the metal itself. We continue to view the A-D line as the most important leading indicator for the mining shares since it has proven its merit time and again this year.

The price of gold was given an additional boost on Tuesday from a disappointing jobs report, which suggested to traders that the Federal Reserve would leave intact its $85 billion/month bond purchasing program in the foreseeable future. Gold hit a 3-week high for the day. Also helping gold was a notable decline in the U.S. dollar index, which is at its lowest level since February 4.

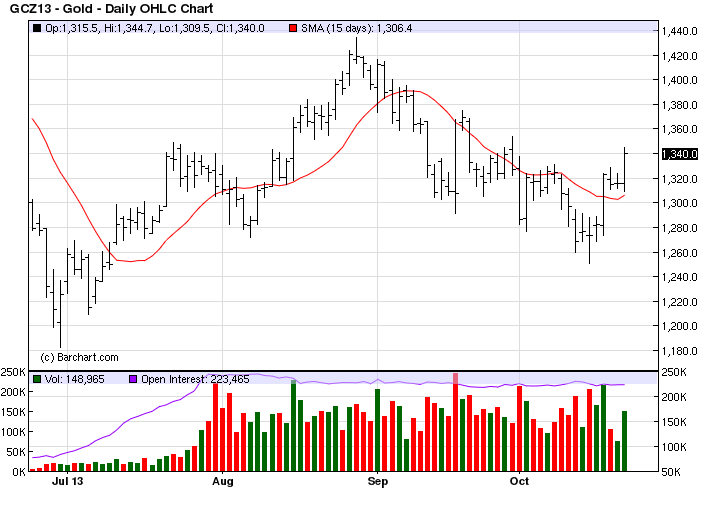

The gold price has finally emerged back above its 15-day moving average and managed a 2-day higher close above the dominant immediate-term trend line as of Tuesday, Oct. 22. This is the first confirmed immediate-term bottom signal gold has given since August, which is amazing in and of itself.

Now that gold and the mining shares are once again showing signs of life, the first of what will probably a growing list of investment banks are beginning to upgrade the outlook for the PM sector. According to Ben Levisohn, writing in Barron's, HSBC upgraded several gold stocks on Oct. 21 as the bank expects gold prices to rebound. HSBC analyst Patrick Chidley wrote:

"Despite the rush to the door by speculators in the [SPDR Gold Trust ETF (GLD)], we continue to believe the fundamentals are supportive of higher prices. China continues to report gold imports at very high levels (over 130 tons in the month of August from Hong Kong alone). Based on our belief that the pressure on gold price is temporary, due to continued strength in Chinese demand, continued strong Indian demand (despite recently ramped up government tariffs on gold imports), growing demand in other emerging markets countries, continued central bank purchases, a strong physical supply response coupled with a lack of new projects coming into production in the next few years, we believe the gold price will rebound in the next few months.

"Hence, given the rebasing of gold equity prices to reflect the current gold price below USD1,300/oz, and HSBC's view that gold can climb back above USD1,400/oz within a few months, we are upgrading a group of stocks and hold a generally bullish view on the gold sector, looking forward, while recognizing the current situation is tough unless gold rebounds."

Chidley and his HSBC team upgraded Agnico-Eagle Mines (AEM) and Yamana Gold (AUY) from underweight to neutral. Barrick Gold (ABX), Goldcorp (GG) and Iamgold (IAG) were upgraded from neutral to overweight.

HSBC also believes that inflation in Asia will drive gold demand. Demand for jewelry, bars and coins in India, Greater China, Indonesia and Vietnam increased to about 60 per cent of the global total compared to 35 per cent in 2004, economists including Frederic Neumann wrote in a note to investors on Oct. 18. Citing data from the World Gold Council, Neumann wrote that bullion is mostly used in the region as a store of value.

"With inflation still elevated in many markets and interest rates not offering adequate compensation, expect Asia's voracious appetite for gold to persist," Neumann wrote. "Asia is going for gold. Over recent years, demand has soared." He foresees continued strong demand in the coming years as inflationary pressures increase in China, India and other regions of Asia.

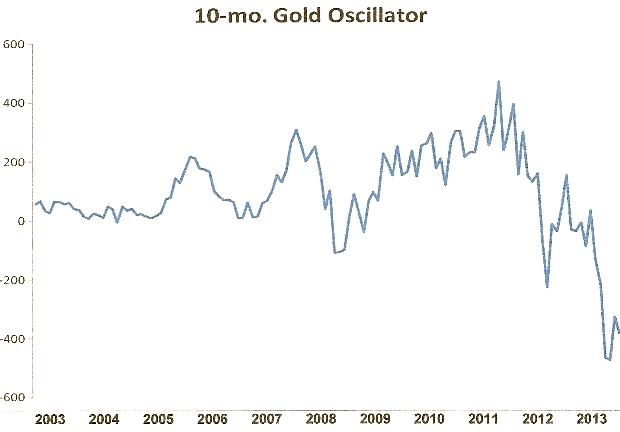

Also helping buoy the metals and mining stocks is the fact that gold is coming off its most oversold technical extreme in years. As we talked about in a previous commentary, the 10-month oscillator for gold fell to its lowest level in over 10 years recently. Historically the price of gold tends to rally vigorously when coming off such oversold levels.

Gold has earned for itself a much needed respite and should be able to enjoy one thanks to this historic oversold condition. Sentiment on the metals and mining stocks has been bearish to the extreme in recent weeks as one investment bank on top of another has piled onto the "sell everything" bandwagon. Capitulation has been evident, which from a contrarian standpoint supports a short-term recovery for the sector.

Stock Market Cycles

Take a journey with me as we uncover the yearly Kress cycles - the keys to unlocking long-term stock price movement and economic performance. The book The Stock Market Cycles covers each one of the yearly cycles in the Kress Cycle series, starting with the 2-year cycle and ending with the 120-year Grand Super Cycle.

The book also covers the K Wave and the effects of long-term inflation/deflation that these cycles exert over stock prices and the economy. Each chapter contains illustrations that show exactly how the yearly cycles influenced stock market performance and explains where the peaks and troughs of each cycle are located and how the cycles can predict future market and economic performance. Also described in this original book is how the Kress Cycles influence popular culture and political trends, as well as why wars are started and when they can be expected based on the Kress Cycle time line.

Order today and receive an autographed copy along with a copy of the booklet, "The Best Long-Term Moving Averages." Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://clifdroke.com/books/Stock_Market.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.