USD Index and US Treasury Notes Suggest More EUR Weakness

Currencies / Euro Nov 04, 2013 - 12:39 PM GMTBy: Gregor_Horvat

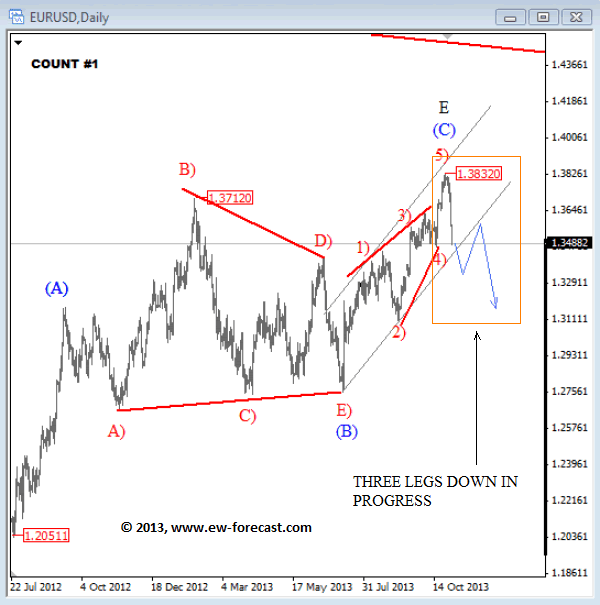

A sharp reversal from the highs could be an early sign for a bearish trend on EURUSD which sooner or later will occur if we consider that rally from 1.2050 low is corrective. A decline from 1.3832 made last week looks impulsive so based on minimum expectations EURUSD will now move down in three legs, but ideally this is a start of a significant EUR weakness in impulsive fashion.

A sharp reversal from the highs could be an early sign for a bearish trend on EURUSD which sooner or later will occur if we consider that rally from 1.2050 low is corrective. A decline from 1.3832 made last week looks impulsive so based on minimum expectations EURUSD will now move down in three legs, but ideally this is a start of a significant EUR weakness in impulsive fashion.

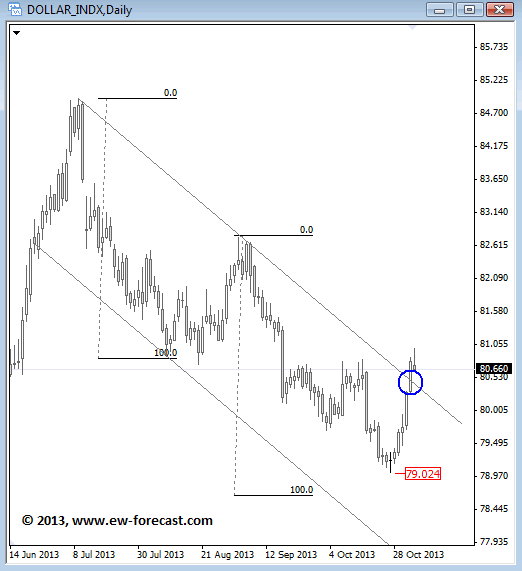

The reason why we are bearish on EURUSD is also USD Index where prices reversed strongly to the upside last week, out of a downward channel which should be an important sign for a change in trend, even if just temporary.

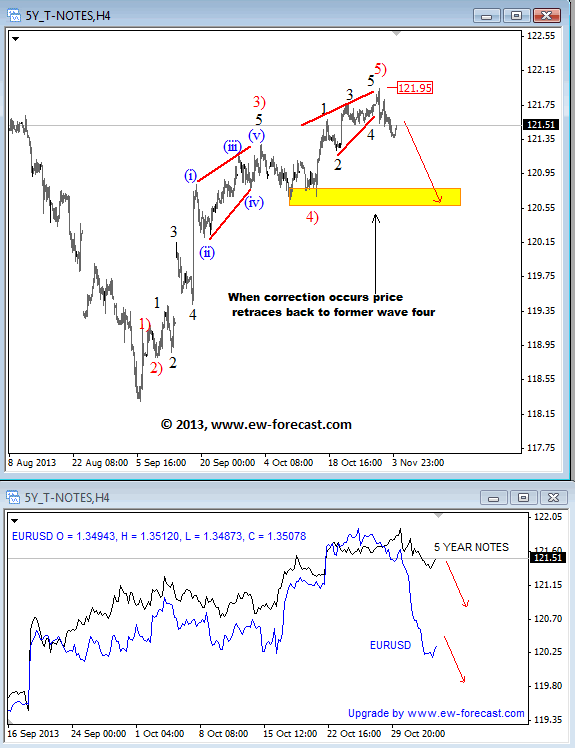

Another reason for further decline on EURUSD are US Treasury Notes where prices turned bearish last week following the FOMC statement which was just a trigger for a reversal that has been technically expected already earlier, based on Elliott Wave approach. Notice that from September low, rally on 5 Year notes can be counted in five waves with broken wedge at the top of the current rally which is a reversal sign. Traders with Elliott Wave approach will also know that after every five waves correction follows back to the area of the former wave 4). If we are correct then US notes will move lower in the next days maybe even weeks back to the former wave 4).

An how US notes help us?! Well, we see a positive correlation between the EUR and US notes so if the US notes will fall then the EURUSD will probably follow.

Written by www.ew-forecast.com | Try our 7 Days Free Trial Here

Ew-forecast.com is providing advanced technical analysis for the financial markets (Forex, Gold, Oil & S&P) with method called Elliott Wave Principle. We help traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our view and bias as simple as possible with educational goal, because knowledge itself is power.

Gregor is based in Slovenia and has been in Forex market since 2003. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets; from candlestick patterns, MA, technical indicators etc. His specialty however is Elliott Wave Theory which could be very helpful to traders.

He was working for Capital Forex Group and TheLFB.com. His featured articles have been published in: Thestreet.com, Action forex, Forex TV, Istockanalyst, ForexFactory, Fxtraders.eu. He mostly focuses on currencies, gold, oil, and some major US indices.

© 2013 Copyright Gregor Horvat - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.