Why Silver Prices Could Easily Double from Here

Commodities / Gold and Silver 2013 Nov 05, 2013 - 02:38 PM GMTMichael Lombardi writes: In the first 10 months of this year, the U.S. Mint sold 39.2 million ounces of silver in coins. In the same period last year, the Mint only sold 28.94 million ounces of silver in coins. A general negativity by investors surrounding silver this year has not stopped people from buying silver coins. In fact, demand is up 35% so far in 2013. (Source: U.S. Mint web site, last accessed November 1, 2013.)

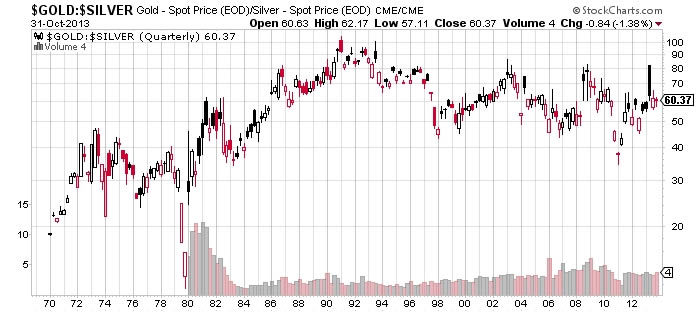

Meanwhile, if I look at the chart of the gold-to-silver ratio—which shows how much silver is needed to buy one ounce of gold bullion—silver prices look undervalued. (I’ve posted the chart for my readers below.)

Chart courtesy of www.StockCharts.com

At present, it would take 60 ounces of silver to buy one ounce of gold bullion. The 200-year historical average is 37 ounces of silver to buy one ounce of gold bullion. (Source: Market Watch, July 19, 2013.) If we go back to the historical average, and we eventually will, silver prices would have to rise to $35.00 an ounce given the current price of gold bullion.

And if we look at the “natural gold-to-silver ratio,” that’s the amount of silver in the earth’s crust compared to gold, then the ratio is 17 to one. Yes, in that case silver would have to increase in price to $77.00 an ounce!

The more realistic picture, dear reader, is for silver to go back to its record high reached in April 2011 of $48.70 an once—that’s more than twice the current price of silver.

Since silver prices fell this spring, silver producers don’t have much incentive to explore for more silver—they have started to cut back on their production. So supply is soft for silver, demand is rising, and investor sentiment is very negative—the perfect scenario for silver prices to start rising again.

It’s also very interesting to note that for gold bullion prices to get back to their peak of $1,900 an ounce, they would have to increase 44% from today’s gold bullion price. But for silver prices to get back to their peak of $48.70 an ounce, they would have to rise 132% from today’s prices. Silver prices have been much harder hit than gold prices—and that tells me silver has more upside potential.

Michael’s Personal Notes:

There have been many instances when the adage “buy when there’s blood on the street” has turned out to be the best investment strategy. March of 2009 was one great example of this—there were not a lot of stock advisors saying buy stock back then as panic had set in. In the midst of this panic, the greatest buying opportunity was born.

These days, I hear stock advisors saying companies operating in the eurozone are a good buy. The words I hear thrown around are “good value” and “cheap.” My opinion on the eurozone stocks is very different. I feel the worst is yet to come for many companies operating in the weaker eurozone countries, especially the Italian banks.

I’m sticking to my original belief that the euro region is still in outright trouble and that the economic slowdown the region is experiencing could continue for a long time.

Yes, there is speculation the euro region is slowly getting out of its economic slowdown, but that opinion is not backed by the statistics—the numbers are telling a different story.

The unemployment picture in the area is not improving! In September, there were 19.47 million people unemployed in the eurozone. The unemployment rate remained at 12.2% in September, unchanged from August. (Source: Eurostat, October 31, 2013.)

What’s worrisome is the fact that the biggest economic hubs in the eurozone are seeing their unemployment rate increase. In France, the second-biggest economy in the region, the unemployment rate has risen seven percent from the same period a year ago. In September, the jobless rate in France stood at 11.1% compared to 10.4% in September of 2012. The unemployment rate in Italy, the third-biggest hub in the euro region, has increased from 10.9% in September 2012 to 12.5% in September of this year!

The root problem that created the economic slowdown in the eurozone remains—bad debt. According to Pricewaterhousecooper (PwC), the amount of bad loans has increased to 30% of all loans in Greece. At the end of 2012, this number stood at 25%, and it was 18% at the end of 2011. (Source: Kathimerini, October 31, 2013.)

To this day, there appears to be no light at the end of the tunnel for the eurozone. Buying companies operating in the region right now is risky, because we have yet to hit bottom in the eurozone. In 2009, in America, there was “blood in the street” and we hit bottom. I don’t think the eurozone has quite hit bottom yet.

This article Why Silver Prices Could Easily Double from Here is originally published at Profitconfidential

Michael Lombardi, MBA for Profit Confidential

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.