Reasons to be Bullish on Gold

Commodities / Gold and Silver 2013 Nov 15, 2013 - 12:26 PM GMTBy: DailyGainsLetter

Mohammad Zulfiqar writes: Gold has gained a significant amount of negative attention lately, being called a “slam-dunk sell” not too long ago. While the bears have their reasons, I continue to be bullish on the shiny yellow metal for a few reasons of my own.

First of all, central banks around the world are continuously printing or using easy monetary policies to spur growth in their respective countries—these policies are rigorous and extraordinary, to say the least. For example, the central bank of Australia has lowered its benchmark interest rates by more than 40% since the beginning of 2012. The cash rate in the country stood at 4.25% in early 2012, and now it sits at 2.5%. (Source: “Cash Rate Target: Interest Rate Changes,” Reserve Bank of Australia web site, last accessed November 12, 2013.)

Similarly, not too long ago, we heard a surprising announcement from the European Central Bank: it cut interest rates to their lowest level after the eurozone’s economic health didn’t show signs of improvement.

On the printing front, the Federal Reserve continues to be at the forefront. The central bank is still printing $85.0 billion a month and buying U.S. bonds and mortgage-backed securities. Note that we hear gold bullion is going down in value these days because the Federal Reserve will be tapering quantitative easing. Sadly, they forget that tapering still means more printing, just at a slower pace.

Secondly, the demand for gold bullion continues to increase. We have seen mints across the global economy sell a record amount of gold bullion coins, consumers rush to buy the precious metal, and nations that are thought to be the biggest consumers of gold bullion experience robust growth. In India, the demand remains robust in spite of the combined efforts of the government and the central bank to curb the demand. Over the country’s festival season, the premiums to buy gold bullion reached a record high.

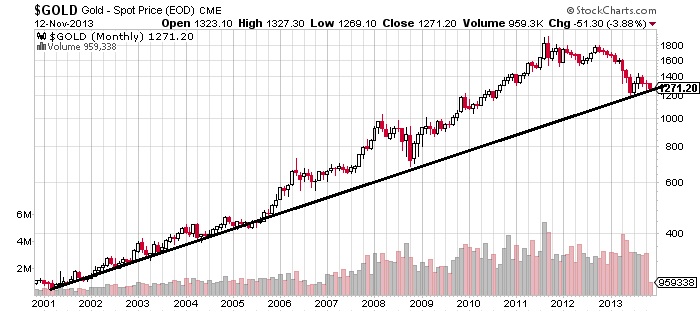

Last but not least, no matter how you look at it, gold bullion is still in an uptrend. Please look at the chart below of monthly gold bullion prices, in which the trend is very evident.

Chart courtesy of www.StockCharts.com

When it comes to gold bullion prices, I am looking at it from a long-term perspective; short-term fluctuations don’t really matter.

As it stands, there are opportunities in the gold bullion market, specifically with those who are looking for or producing the metal. That said, investors have to keep in mind that they provide leverage return to gold bullion prices; therefore, investors have to use stops and proper risk management techniques.

This article Three Bullish Reasons to Renew Your Trust in Gold was originally published Daily Gains Letter

© 2013 Copyright Daily Gains Letter - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.