Why Gold and Silver are Having a Tough Time

Commodities / Gold and Silver 2013 Nov 23, 2013 - 03:07 AM GMTBy: Clif_Droke

Ben Bernanke provided some clarity to the recent confusion surrounding the Fed’s QE stimulus program. He indicated on Tuesday that the near-zero Fed Funds rate will likely remain at that level long after ending asset purchases under quantitative easing (QE). This satisfied Wall Street and provided much relief, allowing a mini-rally to transpire in equities but providing additional selling pressure for gold and silver.

Ben Bernanke provided some clarity to the recent confusion surrounding the Fed’s QE stimulus program. He indicated on Tuesday that the near-zero Fed Funds rate will likely remain at that level long after ending asset purchases under quantitative easing (QE). This satisfied Wall Street and provided much relief, allowing a mini-rally to transpire in equities but providing additional selling pressure for gold and silver.

Thus the inverse relationship between gold and the stock market continues to hinge on the assurance of easy money courtesy of the central bank. While many precious metals analysts continue to insist that gold will benefit from QE, the evidence is quite clear that the opposite is in fact the case. Stocks are the clear beneficiaries of loose money and investors have exited the safe havens of recent years, namely gold and Treasuries, in favor of equities this year. Until the massive liquidity provided by the Fed is in any way reduced, gold and silver will likely continue to have a tough go of it.

On the supply/demand front, the latest report from the World Gold Council revealed that consumer demand for gold in jewelry, bar and coin form increased 26% in the first three quarters of 2013 compared to last year. Consumer demand, however, was more than offset by ETF divestment along with clampdown on gold by India’s government. Barclays meanwhile pointed out that the market surplus for gold is at its widest since 2005 due to decreased demand.

According to Numismatic News, a new record was reached Nov. 12 for sales of silver American Eagles. The U.S. Mint said total purchases had reached 40,175,000. This surpassed the previous record high set in calendar year 2011 when 39,868,500 were sold.

“Silver Eagle demand is now snapping up four times the number of coins that were sold by the Mint in 2007, before the economic crisis upended the financial world,” according to Numismatic News. “Sales in 2007 were 9,887,000 pieces, which was still below the 1987 production record of 11,442,335 pieces.”

By comparison, in 2008, sales doubled to 19,583,500 as panic fueled demand for hard assets. In 2009, when the stock market was bottoming out, silver Eagle buyers stocked up on 28,766,500 coins, roughly 50 percent higher than the prior year, according to Numismatic News.

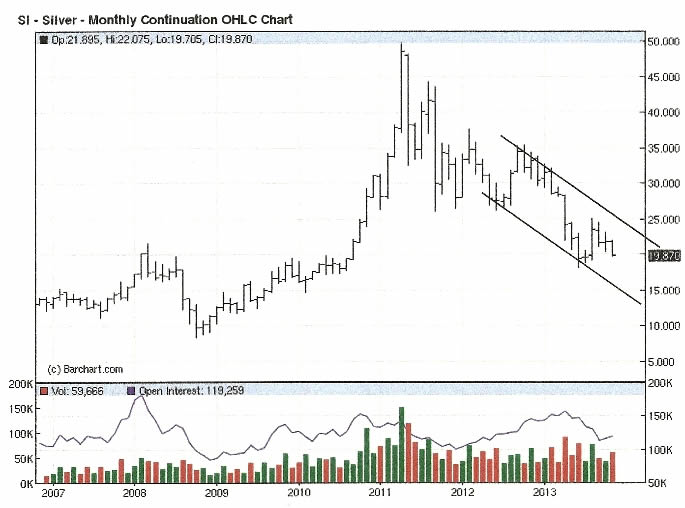

Let’s try and put the latest silver coin numbers in perspective. Investors were correct to snap up silver bullion coins during the bottoming phase of the credit crash between October 2008 and March 2009. From a monthly closing low of $8.40 in October 2008, the silver futures price rose to a high of almost $50 in April 2011 before peaking. From there the price of silver has been in a downward trend for the last two-and-a-half years. Essentially, the buyers were right during the first two-and-a-half-year rally but have been wrong to keep buying silver coins in the last two-and-a-half-year decline.

With the silver market in a confirmed downtrend, the path of least resistance is down and the market is more sensitized to bad news than to good news. That means that any negative news developments for silver – which also includes bullish news for the stock market – will likely be used by sellers as a catalyst to keep the silver downtrend intact. In other words, lower silver prices are a higher probability for now. Until the pattern of declining tops and bottoms is decisively broken, we have to assume the silver bear market remains intact. Until the bear market in silver has a confirmed ending, why purchase large amounts of physical silver when the price could end up going lower? Trying to time the bottom is a tempting preoccupation with individual investors, but in most cases it ends up being a costly mistake.

If silver is poised to begin a new bull market in 2014 the market will surely give us ample time to make new long commitments without leaving us behind. There is, after all, a lot of ground to cover before a new upward trend can be established and there’s also a lot of overhead supply to be dealt with before a new bull market commences.

Another factor to consider is that if silver does end up making a lower low in the coming weeks, there’s always a chance that many of these silver Eagle purchases will be dumped onto the market in the form of panic selling, thereby resulting in even more selling/supply pressure. Bottom line: let’s wait for the market to signal its intent before jumping on the silver bullion bandwagon.

High Probability Relative Strength Trading

Traders often ask what is the single best strategy to use for selecting stocks in bull and bear markets. Hands down, the best all-around strategy is a relative strength approach. With relative strength you can be assured that you're buying (or selling, depending on the market climate) the stocks that insiders are trading in. The powerful tool of relative strength allows you to see which stocks and ETFs the "smart money" pros are buying and selling before they make their next major move.

Find out how to incorporate a relative strength strategy in your trading system in my latest book, High Probability Relative Strength Analysis. In it you'll discover the best way to identify relative strength and profit from it while avoiding the volatility that comes with other systems of stock picking. Relative strength is probably the single most important, yet widely overlooked, strategies on Wall Street. This book explains to you in easy-to-understand terms all you need to know about it. The book is now available for sale at:

http://www.clifdroke.com/books/hprstrading.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.