Platinum and Palladium - Hitch a Ride on the Supply Crunch

Commodities / Metals & Mining Nov 25, 2013 - 06:50 PM GMTBy: Jeff_Clark

Can you name a commodity that's currently in a supply deficit—in other words, production and scrap material can't keep up with demand? How about two?

Can you name a commodity that's currently in a supply deficit—in other words, production and scrap material can't keep up with demand? How about two?

If you find that difficult to answer, it's because there aren't very many.

When you do find one, you might be on to a good investment—after all, if demand persists for that commodity, there's only one way for the price to go.

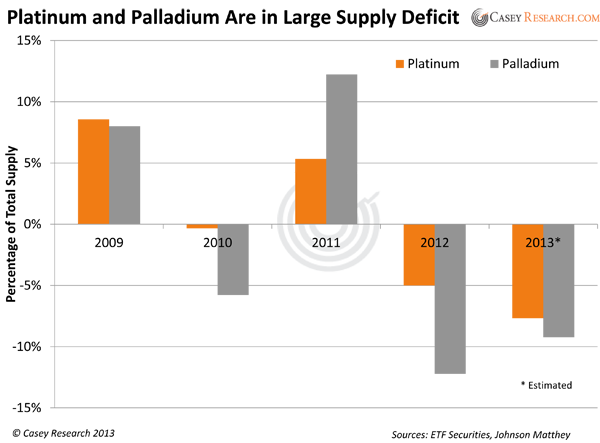

At the end of 2012, the platinum market was in a supply deficit of 375,000 ounces. Much of it was chalked up to the sharp decline in output from South Africa, where about 750,000 ounces didn't make it out of the ground due to legal and illegal strikes, safety stoppages, and mine closures.

The palladium sector was worse: It ended the year with a huge supply deficit of 1.07 million ounces—this, after 2011, when it boasted a surplus of 1.19 million ounces. The huge reversal was due to record demand for auto catalysts and a huge swing in investment demand—going from net selling to net buying in just 12 months.

What's important to recognize as a potential investor is that the deficit for both metals isn't letting up, especially for platinum.

Since platinum supply is dwindling, let's take a closer look…

Will the Supply Deficit Continue?

According to Johnson Matthey, the world's largest maker of catalysts to control car emissions, platinum supply will decline to 6.43 million ounces this year, largely due to lower Russian stockpile sales. But the company claims the decline will be made up by a 7.4% increase in recycling.

Ha. Projections on scrap supply are almost always wrong. Analysts said in early 2012 that supply from recycling would grow 10-12% that year—but it declined by 4%.

There are critical issues with scrap this year, too…

- Impala Platinum ("Implats") reported a 17% decline in output, not due to decrease in production but in scrap supply. Other companies have not reported this problem, but Implats is one of the biggest producers of the metal.

- Recycling of platinum jewelry in China and Japan is falling and is on pace to be 12.9% lower than last year.

- European auto sales are declining, so one would think demand would be the most impacted. However, this has major implications for supply, too: The average age of a car in Europe is eight years, with more than 30% over 10 years old. When a vehicle exceeds 10 years, the wear and tear on the catalyst is so significant that a substantial portion of the platinum has already been lost. So the jump in supply many are anticipating will be much less than expected.

Some of these declines are offset by scrap from auto catalysts in the US, but this obviously hasn't made up for all of it.

Demand Isn't Letting Up Either

Platinum demand is driven mostly by the automotive industry and jewelry, which account for 75% of world demand. What happens in these two sectors has a significant impact on the metal.

We'll let you draw your own conclusions from the data…

The Cars

- Auto industry analysts forecast total monthly sales in the US last month will reach about 1.23 million for passenger cars and light trucks, up 12% from 1.09 million in October 2012.

- China, the world's largest auto market, saw a 21% rise in passenger car and light-truck sales in September to 1.59 million units, an eight-month high.

- PricewaterhouseCoopers forecasts that sales of automobiles and light trucks in China will have nearly doubled by 2019. This trend largely applies to other Asian countries too, becoming a constant source of demand for both platinum and palladium.

The Politicians

Both platinum and palladium will benefit from new regulations that take effect in 2014 in Europe and China:

- Europe's new "Euro 6" emission regulation will force diesel vehicles to have new catalysts going forward.

- China has already accepted tighter emission standards that will substantially push platinum demand in the country. It's worth mentioning that car markets in China and other emerging countries are at the "Euro 4" level, so they have some catching up to do before reaching US and European levels.

The Investors

NewPlat, a platinum exchange-traded fund, launched in South Africa on April 26 and has already seen an inflow of 600,000 ounces through the end of September. This unprecedented surge is expected to lift platinum investment demand by 68% to a record 765,000 ounces.

The Jewelers

Jewelry is the second-largest use for platinum, representing 35% of overall demand.

China dominates this market, and demand has doubled in the past five years. According to ETF Securities, China is well on its way to make up around 80% of total platinum jewelry sales in 2013—their report calls Chinese platinum demand "a new engine of growth."

Johnson Matthey expects the interest for platinum jewelry to soften in China this year. However, a recent article in Forbes suggests the opposite may be happening:

A good proxy for Chinese platinum jewelry demand is the volume of platinum futures traded on the Shanghai Gold Exchange. Average daily platinum volume on the exchange in 2013 is running near 45% above 2012 levels, recently reaching a new record high this year.

Another indicator of Chinese platinum jewelry demand is China platinum imports. The latest data on China platinum imports for September showed the highest level since March 2011 at 10,522 kilograms (or approximately 338,300 ounces).

And this from International Business Times…

Net platinum inflows into China hit their highest levels in two and a half years … China's net imports of platinum rose by 11%, to hit almost 70 metric tons for the first three quarters in 2013, higher than the 62 metric tons from the same period last year.

Overall, platinum demand is expected to be greater than ever before, reaching a record 8.42 million ounces this year. And this while supply continues to decline.

This supply/demand imbalance will likely continue for at least several years, perhaps a decade. Prices haven't moved all that much yet, but that doesn't mean they won't. Prices of commodities with a supply/demand imbalance can only stay subdued for so long before reality catches up. Either prices must rise or demand must fall.

The other metal to take advantage of right now is gold. While there's no supply crunch, the gold price is so low right now that it practically screams to back up the truck. Learn in our free Special Report, the 2014 Gold Investor's Guide, when and where to buy gold bullion… the 3 best ways to invest in gold… and more. Get your free report now.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.