The Uranium Race Is Set to Resume – Price Surge Could Begin in Days

Commodities / Uranium Nov 26, 2013 - 11:45 AM GMTBy: Money_Morning

Peter Krauth writes: One in every 10 lightbulbs in the United States gets its power from Russian fuel. It's been that way ever since 1993, when the Megatons to Megawatts program began.

Peter Krauth writes: One in every 10 lightbulbs in the United States gets its power from Russian fuel. It's been that way ever since 1993, when the Megatons to Megawatts program began.

Under this agreement, the highly enriched uranium (HEU) contained in ex-Soviet nuclear weapons was downblended and converted into nuclear fuel.

It was a win-win arrangement. Americans got the nuclear fuel they needed; the Russians got the hard currency they needed. And the world got a cleaner, less dangerous environment, as around 20,000 warheads were stood down.

But this era is rapidly coming to a close. The very last shipment of the program's uranium recently left St. Petersburg, Russia, for Baltimore, Maryland.

By the end of December, the deal that helped provide about half of all commercial nuclear power in the United States... will simply end.

And that's going to open up a fantastic opportunity for us...

Drastic Changes Seen for the Global Uranium Supply

Drastic Changes Seen for the Global Uranium Supply

These events mean that, starting in 2014, 13% of global uranium supply will simply dry up.

And not just uranium, but high-grade uranium. That's a serious challenge to replace.

America's nuclear plants, all 104 of them, consume a whopping 43 million pounds of uranium every year.

There are 435 nuclear reactors in the world, with another 66 under construction. That's 15% more than are currently operating. By some estimates, 408 more will be added in the next couple of decades.

China already has 26 projects under construction, and 30 more are planned. That nation's expected to account for as many as 90 of the more than 400 future reactors.

The United States, India, South Korea, Russia, and a host of others will be adding new facilities and increasing capacity at existing plants in the coming years.

Despite Japan's tragic Fukushima disaster, the huge cost of importing liquefied natural gas (LNG) has caused that nation to do its best to restart some of its own nuclear reactors.

The outlook is simple. We're going to need to produce more uranium. A lot more...

The question is: Can this uranium be produced cost-effectively?

What You Need to Know About Uranium Prices

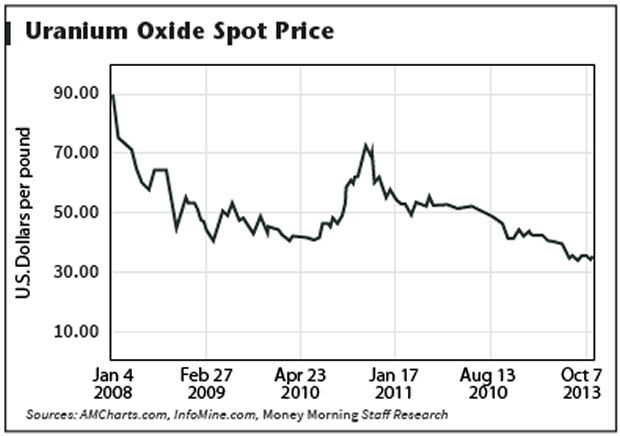

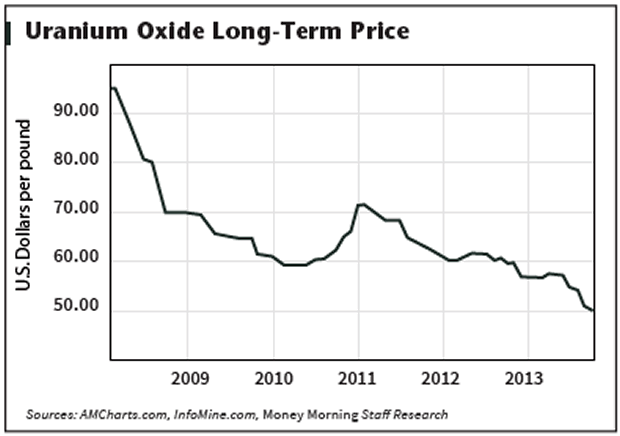

Through all of this, uranium prices - both spot and long-term - have been struggling since early 2011.

Have a look...

But here's what you need to know about the uranium price: although the spot price (currently $36/lb.) is the one most often quoted, as much as 85% of all uranium is sold under long-term, multi-year contracts (currently averaging about $50/lb.).

The other salient point is that, according to some experts, it actually costs $85/lb. to produce.

So the average miner is losing about $50 on every pound of uranium sold at spot and $35 for each pound sold on a long-term basis.

How long do you figure that can last, really?

On Sale, for Now

Nuclear fuel is so concentrated, that just 0.035 ounces of uranium packs the power of three tons of coal.

Besides, it's a lot cleaner and produces far less carbon emissions than many alternatives, a fact growing numbers of environmentalists have come to accept.

Dr. Patrick Moore, founder of Greenpeace, has said, "Nuclear energy is the only non-greenhouse gas-emitting power source that can effectively replace fossil fuels and satisfy global demand."

President Obama himself said he was "Looking forward to working with Congress on implementing policies that ensure that our nation can continue to rely on carbon-free nuclear power."

Next to coal steam, nuclear also provides the lowest cost electricity - just $0.024 per kilowatt hour (KwH).

There's little doubt nuclear will remain a cornerstone of the world's future energy mix.

And uranium producers won't keep losing money indefinitely. The price simply has to rise, and here's how we can benefit.

The Best Uranium Play in the World

Uranium Participation Corp. (TSE: U) is a physically backed uranium ETF. The fund's manager simply buys uranium oxide and uranium hexafluoride, with the purpose of selling those holdings in the future.

According to their most recent statement of investment, Uranium Participation Corp. holds about 5 7.5 million pounds of uranium oxide and about 4.85 million pounds of uranium hexafluoride.

While there's no leverage like that which comes with uranium miners, U.P.C. also carries little more than uranium price risk.

And right now, spot uranium is changing hands at a 60% discount to the cost to produce it - never mind turning a profit.

Current low prices are a disincentive to build new supply, as well as to expand mine output.

The Megatons to Megawatts program was clearly a win-win arrangement, but it's over.

That means about 13% of global supply, 24 million pounds of high-grade uranium, is about to be erased.

This situation cannot last. Uranium prices must rise... which makes Uranium Participation Corp. the best uranium play there is.

Source :http://moneymorning.com/2013/11/26/after-20-years-the-uranium...

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.