Investors' Toolkit - Trailing Stops: Why You Need Them and How to Use Them

InvestorEducation / Learning to Invest Nov 26, 2013 - 12:49 PM GMTBy: Money_Morning

Here at Money Morning, we're big proponents of using trailing stops as an easy and effective way to mitigate risk and boost gains.

Here at Money Morning, we're big proponents of using trailing stops as an easy and effective way to mitigate risk and boost gains.

And yet a surprisingly large group of individual investors don't use them, or have never heard the importance of trailing stops explained.

Perhaps they think using stops is too complicated (it's not). Or maybe putting trailing stops in place is on some nebulous "to-do" list, and it's a task that never gets done.

But consider this to be necessary investment portfolio "maintenance," not unlike the maintenance you must stay on top of for your home or your car. Regular oil changes and gutter cleanings, for example, protect your vehicle and your house respectively from serious and even catastrophic damage.

Likewise, using stops can keep your investment portfolio running smoothly - and protect it from devastating loss.

Stop-loss orders enable you to cut your losses and walk away from a stock before it swallows your savings in its downward spiral.

Trailing stops go a step further - not only do they safeguard against excessive loss, but they also help preserve your profits.

To begin, here is how stop-loss orders work.

Investing Strategies: How to Build a Fortune in the Low-Yield Era

Stop-Loss Orders: Know When to Cut Your Losses

A stop-loss is an order, either formally placed with your broker or a mental reminder, to sell your stock when it declines to a certain price threshold - what you have calculated as the maximum loss you are willing to bear.

Usually, the stop is based on a percentage of your purchase price, but it can also be an absolute dollar amount (a "chandelier stop").

You can easily put stops in place when you buy your stock on your broker's website. If the price of your shares declines to the stop level, it becomes a market order and triggers an automatic sale of your shares.

You can also just set an alert on whatever portfolio-tracking website you use. If the stock reaches that price, you can make an instant decision on whether to cut it loose or keep it (a "mental" stop).

Most investors use stop-losses for one simple reason: If your stock doesn't rise as you had hoped it would, stop-losses limit your potential losses.

Sure, it's true that if you are diligent in using stop-loss orders, you can be "stopped out" of what could end up being a very good stock - if the stock takes a temporary nose-dive. But you can always buy back in.

The actual percentage you set is up to you and depends on your personal risk tolerance. Very conservative investors may want to place their stops at 10% to 15% below their purchase prices. Moderate risk takers might set stop-losses at 15% to 25%. Finally, aggressive investors, who have a longer time frame and don't panic at short-term losses, may set their stops at 25% to 35% of their purchase prices.

In non-volatile markets, a 20% stop is sufficient for most stocks. However, if the company operates in a fairly volatile industry (like biotech or tech), a stop up to 35% may be desired.

Here's how a stop-loss order works:

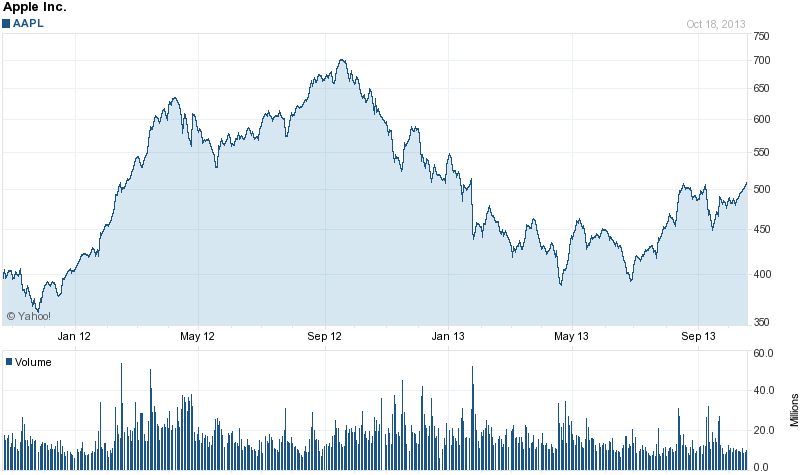

Let's say you bought Apple Inc. (Nasdaq: AAPL) stock in July 2012 at $613 per share, and you set a 10% stop. You would have been "stopped out" when Apple fell to $551.7 in November 2012 (10% or $61.30 less, in this case, than you paid for it), thereby capping your losses and protecting yourself in case the stock goes into a free-fall.

Source: Finance.Yahoo.com

But in a hearty bull market, if you use a regular stop-loss, you will leave money on the table.

And this is where trailing stops come in...

Trailing Stops Explained: Don't Leave Money on the Table

A regular stop-loss is based on the absolute value of your purchase price. A trailing stop, however, automatically adjusts your stop-loss so that it continues to move up as the price of your stock rises.

For example, let's say you again bought Apple stock, but you waited and bought it at $391 a share in April 2013. You set your trailing stop at 10%. When the shares hit $463 in May, your stop moved up to $416.70 (10% of $463 = $46.30, and $463 - $46.30 = $416.70). When the shares climbed to $520 last Friday, your stop went to $468 (10% of $520 = $52, and $520 - $52 = $468).

So your shares have run up to $520. That means you have now locked in gains of $77 - even if the shares fall to $468 and your stop kicks in.

You paid $391, and if the shares fall and you sell at $468, voila! You've locked in $77 in profits, and you didn't have to lose any sleep because your stock took a dive!

Of course, if you sold Apple last Friday, you would have made $129 ($520 - $391, your original price). But where would be the fun in that? You might miss out on a lot more profit, if the shares continue to climb.

When you use a trailing stop, you are taking some of your profits off the table - money that you know is in the bag. Without the stop, Apple could free-fall again, and you could be stuck with losses.

You can set your stops as "good 'til canceled" (GTC), and you can also adjust them whenever you want. If the market gets too volatile for your tastes, just tighten up your stops.

Trailing stops offer investors flexibility and help create investing discipline. They help take the emotion out of the process, in addition to the constant uncertainty of "should I stay or should I go?"

Trailing stops are easy to set, monitor, and use. So use stops, limit your losses, and protect your profits!

Where exactly is the Apple stock price headed? Don't miss Why the Apple (Nasdaq: APPL) Stock Price Will Double from Here

Source :http://moneymorning.com/2013/11/22/trailing-stops-explained-and-why-you-need-them/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.