Why Gold and Silver Hate Easy Money

Commodities / Gold and Silver 2013 Nov 28, 2013 - 10:34 AM GMTBy: Clif_Droke

Ben Bernanke recently provided some clarity to the confusion surrounding the Fed’s QE stimulus program. He indicated that the near-zero Fed Funds rate will likely remain at that level long after ending asset purchases under quantitative easing (QE). This satisfied Wall Street and provided much relief, allowing a mini-rally to transpire in equities but providing additional selling pressure for gold and silver.

Ben Bernanke recently provided some clarity to the confusion surrounding the Fed’s QE stimulus program. He indicated that the near-zero Fed Funds rate will likely remain at that level long after ending asset purchases under quantitative easing (QE). This satisfied Wall Street and provided much relief, allowing a mini-rally to transpire in equities but providing additional selling pressure for gold and silver.

Thus the inverse relationship between gold and the stock market continues to hinge on the assurance of easy money courtesy of the central bank. While many precious metals analysts continue to insist that gold will benefit from QE, the evidence is quite clear that the opposite is the case. Stocks are the clear beneficiaries of loose money and investors have exited the safe havens of recent years, namely gold and Treasuries, in favor of equities this year. Until the massive liquidity provided by the Fed is in any way reduced, gold and silver will likely continue to have a tough go of it.

As Fed watchers have pointed out, both Janet Yellen, the Fed governor nominee, and Fed member Charles Evans have no plans to reduce the stimulus. “Current low inflation numbers and diminished credit demand suggest a moderate recovery,” as one economist pointed out. The economic recovery theme is ironically the biggest obstacle facing the yellow metal at present. Fear and uncertainty are the two catalysts which gold feeds upon, and indeed these two widespread investor emotions kept gold in a strong uptrend until the summer of 2011.

As I noted in a previous commentary, however, an economic slowdown in Asia and/or Europe would have profound consequences for the global economy and would be a definite stimulus for a return to gold among safe haven investors, and a return of economic volatility in 2014 would therefore almost certainly harbinger a revival of interest in gold as a safe haven investment.

According to the CFTC, combined net gold positions by money managers were down by some 37 percent for the week ending Nov. 12, led by a 104 percent increase in short positions. While gold futures fell 24 percent this year, the MSCI developed world equity markets index rose close to 24 percent. Sharps Pixley points out that the worldwide gold-backed ETF holdings tracked by Bloomberg have continued to fall, declining 0.5 million troy ounces in November and 24.6 million troy ounces year-to-date. “So far, various sources support that most of the gold liquidated from the ETFs have been re-melted into gold bars and sent to China,” writes Sharps Pixley.

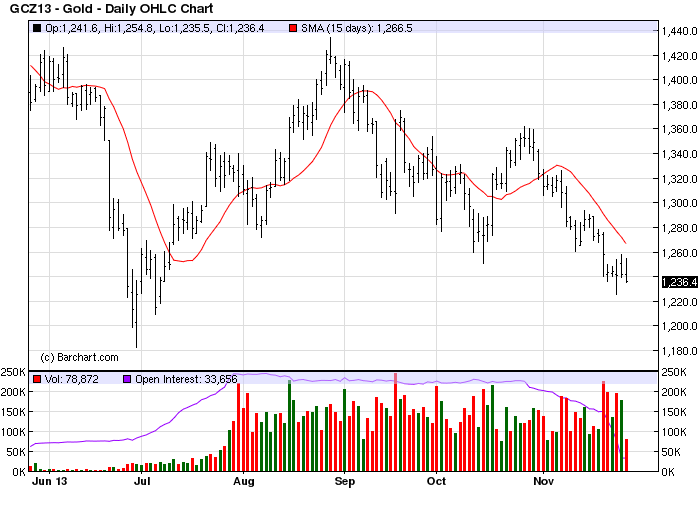

December gold underperformed this week following the “death cross” technical signal that has been widely discussed by analysts. Gold broke below the technical significant $1,268 level on a closing basis and is now in the hands of the sellers in the immediate term. Chart measurements suggest a low between the $1,180-$1,200 levels can’t be ruled out before the latest decline bottoms out in the short term. Keep in mind that gold’s technical path of least resistance is down as long as it remains below the declining 15-day moving average.

Meanwhile silver continued its recent slide by closing at $19.90 on Thursday. Further additional downside is possible to the $18.00-$18.50 area where the lower boundary of a wedge pattern intersects in the weekly chart. Silver’s immediate-term trend is also down below the declining 15-day moving average, a tool which has done an admirable job of capturing most of the immediate-term trend in recent months.

Goldman Sachs released a research report this week revising its 2014 forecast for gold. The investment bank said the yellow metal could drop as much as 15 percent next year due to the increased downward pressure facing commodities because of accelerating U.S. economic growth. Of the major financial institutions, Goldman is one of the few that has the correct understanding of the relationship between gold and the economy/monetary situation, IMO. Let’s also not forget that Goldman Sachs, which often moves the market based on the sheer weight attached to its forecasts by investors.

High Probability Relative Strength Trading

Traders often ask what is the single best strategy to use for selecting stocks in bull and bear markets. Hands down, the best all-around strategy is a relative strength approach. With relative strength you can be assured that you're buying (or selling, depending on the market climate) the stocks that insiders are trading in. The powerful tool of relative strength allows you to see which stocks and ETFs the "smart money" pros are buying and selling before they make their next major move.

Find out how to incorporate a relative strength strategy in your trading system in my latest book, High Probability Relative Strength Analysis. In it you'll discover the best way to identify relative strength and profit from it while avoiding the volatility that comes with other systems of stock picking. Relative strength is probably the single most important, yet widely overlooked, strategies on Wall Street. This book explains to you in easy-to-understand terms all you need to know about it. The book is now available for sale at:

http://www.clifdroke.com/books/hprstrading.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.