Big Cheap Tech Stocks Hit 13 Year High

Companies / Tech Stocks Dec 01, 2013 - 04:53 PM GMTBy: DailyWealth

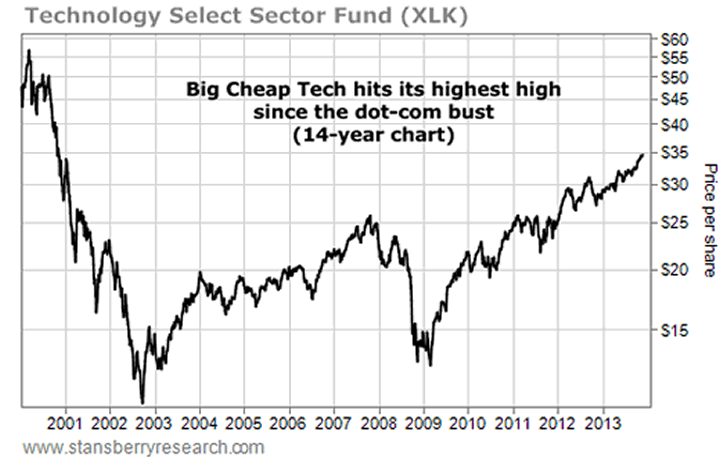

Our "Big Cheap Tech" idea just climbed to its highest level since the dot-com bust...

Regular readers know our "Big Cheap Tech" label covers the biggest and best companies in the technology sector. These businesses have thick profit margins, generate huge amounts of cash, and pay growing dividend streams to shareholders. We're talking about companies like Microsoft, Intel, and Apple.

In late 2010, Steve noted that many of these elite, blue-chip tech companies were trading for extremely low valuations after taking their huge cash hoards into account. We've been following the story closely ever since. And in the meantime, these stocks have soared...

Tech sector fund XLK is a "one click" way to own all of the big names in tech. Apple, Google, and Microsoft are the fund's top holdings... XLK is up 19% this year. Shares now trade at the same price they did in early 2001. It's a major new high for Big Cheap Tech.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.