Gold 30%+ Optimum Stocks, Bonds Portfolio Investment Allocation

Commodities / Gold and Silver 2013 Dec 10, 2013 - 01:36 PM GMTBy: Axel_Merk

How can an investor get guidance on how to construct a portfolio that will protect them should the stock market have another losing streak that lasts more than a few days? We discuss this question while specifically looking at how much gold an investor may want to hold in a portfolio.

How can an investor get guidance on how to construct a portfolio that will protect them should the stock market have another losing streak that lasts more than a few days? We discuss this question while specifically looking at how much gold an investor may want to hold in a portfolio.

In 1934, the price of gold was $35 an ounce; as of September 30, 2013, it was $1,331, yielding an average return of about 5%? Gold bugs might argue this suggests gold should have a permanent place in investors' portfolios. Conversely, however, those thinking the yellow metal is a barbarous relic, may only see themselves confirmed in their view that gold is overpriced. Keep in mind, the same point can be made about stocks': historical returns are not "proof" of future returns. Without endorsing either view, let's have a look at how an investor could have combined gold and equities to enhance risk-adjusted returns.

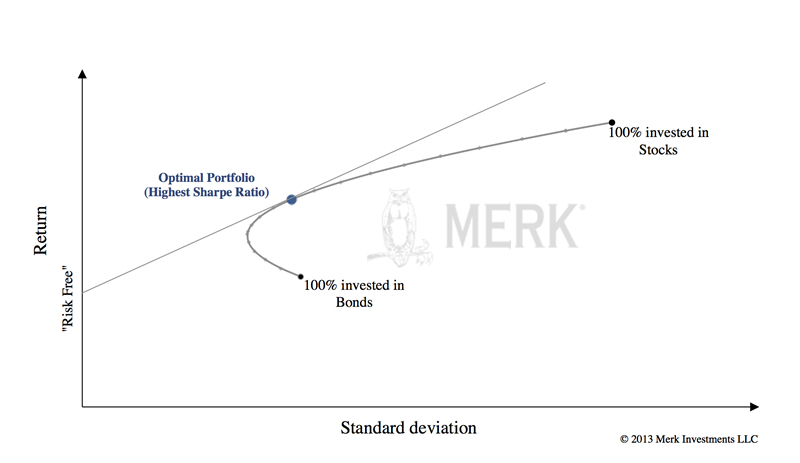

There's an academic theory, the "Modern Portfolio Theory" that presents an "Efficient Frontier," an investment mix that maximizes expected returns for a given amount of expected risk. An "Optimal Portfolio" provides the highest risk-adjusted return; often defined by professional investors as the portfolio with the highest Sharpe ratio, a measure of return per unit of risk as measured by standard deviation of returns.

At first blush, our analysis may lead one to conclude investors may want to hold 30% or more in gold. However, we should really be asking the opposite question: is it sensible for investors to have up to 70%, possibly more, of their portfolio in stocks?

Adding Gold in an Optimal Portfolio

Let's see what an "Optimal Portfolio" containing gold and equities would have looked like over different time horizons:

- Past 5 years (daily data from September 30, 2008 - September 30, 2013)

- Since August 1971 (monthly data from July 31, 1971 - September 30, 2013)

- Since 1934 (monthly data from December 31, 1933 - September 30, 2013)

By going back that far, we had to limit ourselves to a comparison between gold and stocks (using the S&P 500) to reduce data quality issues with bond indices if we wanted to include bonds. We include dividends in equity returns, and consider a "risk free" rate to find the Optimal Portfolio. Also note:

• The S&P 500 Index was only created in 1957, but a composite of the index is available that we believe is a good representation of the preceding years.

• Dividend information is not readily available for all years. As a result, we relied on research of others. Since 1934, the average dividend yield of the S&P 500 has been approximately 3.69%.

While a 5-year horizon appears reasonably long, keep in mind that five years ago, we were right at the peak of the financial crisis. To address this, we also choose August 1971 as a reference point to gauge the long-term performance of gold; it was on August 15, 1971, that President Nixon ended the convertibility of the dollar to gold. While that is truly a long-term horizon, one could argue that the gold price was artificially depressed until then; and, as a result, any return calculated since then might overstate the potential long-term rate of return for gold. To address that criticism, as a third variant, we went all the way back to the beginning of 1934: that year, the Gold Reserve Act changed the nominal price of gold from $20.67 per troy ounce to $35.

Before looking at these charts, keep in mind:

- These are not investment recommendations;

- These models use perfect hindsight, i.e., suggesting what would have been the Optimal Portfolio given the returns and risks prevalent during the period.

- The "Optimal Portfolios" are chosen in the beginning of the period and never rebalanced. In a future analysis, we will discuss the impact of periodic rebalancing.

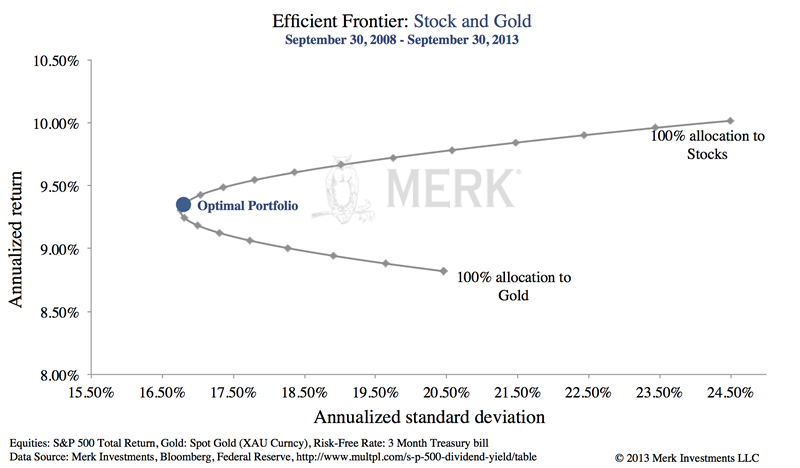

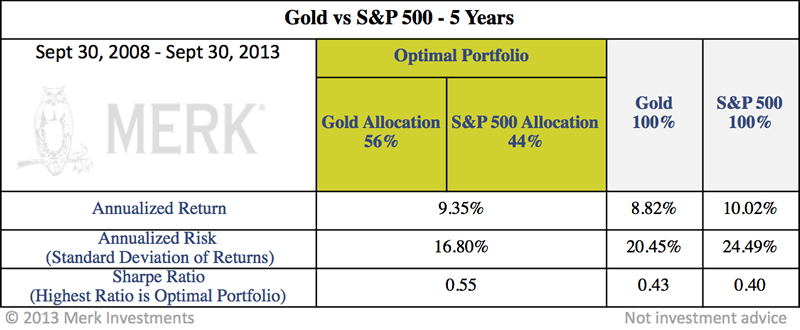

Stocks & Gold: 5-Year Efficient Frontier

The chart above suggests that given a choice between investing in the S&P 500 and gold, an investor would have had the best risk-adjusted returns investing 56% in gold and 44% in the S&P 500. Allocating more to equities might have yielded higher returns, but the volatility of returns would have been substantially higher. Does this mean an investor should have more than half of their investable assets in gold? No, among other reasons, because:

- We don't know what returns gold and the S&P 500 will provide going forward; and

- The investment universe is comprised of more than the S&P 500 and gold.

One possible conclusion is that adding any uncorrelated asset to the S&P 500 may improve an overall portfolio. But the above chart also suggests that if one's outlook for gold or the S&P 500 is different from what it has been in the past five years, the "Optimal Portfolio" may look different. Let's look at a longer-term chart.

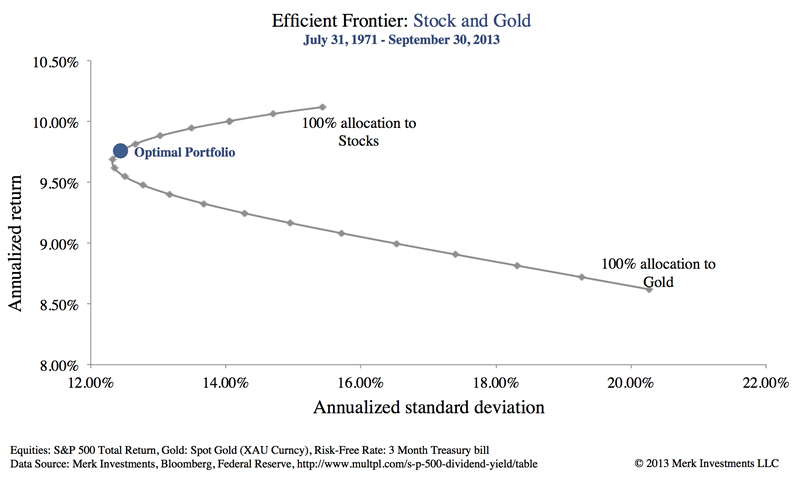

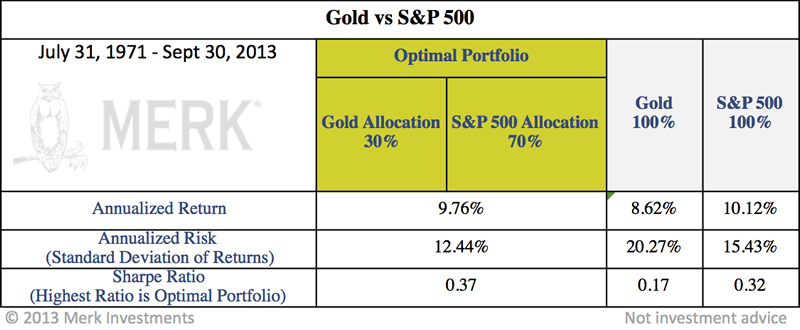

Stocks & Gold: Efficient Frontier Since August 1971

Going back to August 1971, the optimal gold allocation drops from 56% to 30%. Mind you, this includes the run-up in 1980, as well as the subsequent 20-year bear market in gold that followed. It's likely there aren't many investors that piled up on gold and the S&P back in 1971, then never rebalanced their portfolio. Still, the takeaway should be that diversification with uncorrelated assets matters, as it is possible to substantially lower the volatility of a portfolio by adding an uncorrelated asset. That applies despite the fact that gold was more volatile than the S&P 500 since 1971 (different from the risk profile over the most recent 5 year period where gold was less volatile than the S&P 500).

Now, let's go back almost 80 years:

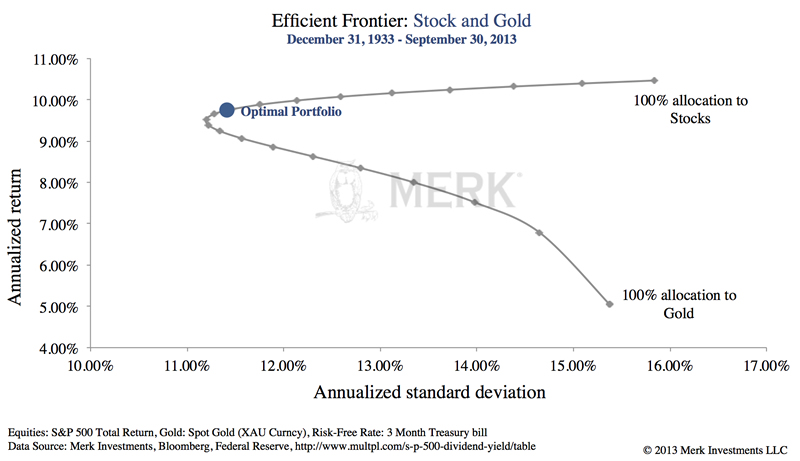

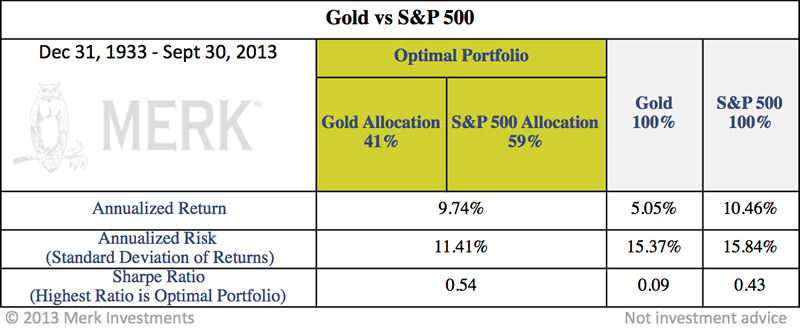

Stocks & Gold: Efficient Frontier Since 1934

Allocating 41% to gold since 1934 would have, according to the theory, provided the "optimal" risk adjusted return: by sacrificing just a little in return, the overall volatility of the portfolio could have been substantially lowered. A couple of caveats:

- There were restrictions on own gold ownership for U.S. persons from 1933 - 1974; the rules were amended over the years; effectively, starting in 1964, U.S. persons were able to at least invest in gold certificates.

- Until 1971, the price of gold was not free floating; the model, as a result, gives the appearance that gold was less risky (i.e., the dollar price less volatile) than it might have been in a free market. We are talking about hidden risks here not well captured when using historical standard deviation of returns, although the risk was ultimately more to the U.S. dollar that plunged relative to gold once the yellow metal was cut loose in 1971.

- The above chart shows that the "Optimal Portfolio" is not at the tip of the curve; to understand why, look back at the first illustration above: to find the best risk-adjusted return, the portfolio with the highest Sharpe ratio, it is in the context of a benchmark risk-free return. Since 1934, the average "risk free" rate over the past 80 years was 3.67%. It's fair to question using the same average risk-free rate for all those years.

- By using December 31, 1933 as the starting point, we are putting gold at a competitive disadvantage, as the market had plunged relative to the heights seen before the 1929 stock market crash. As we write this, the Wall Street Journal references the long-term annual return of the S&P 500 as 5.5% since 1927 in an article, whereas we state almost double the amount of 10.46%. Aside from the 1929 crash (from which there was a partial recovery by the end of 1933), the difference is explained by the fact that the returns stated by the Wall Street Journal exclude the reinvestment of dividends.

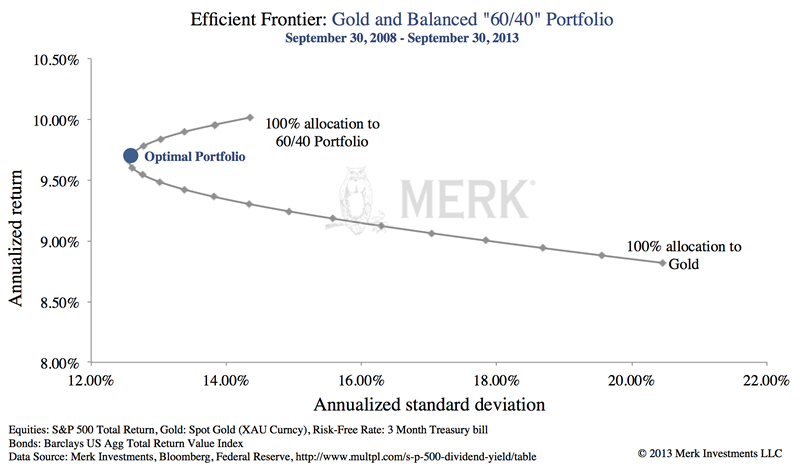

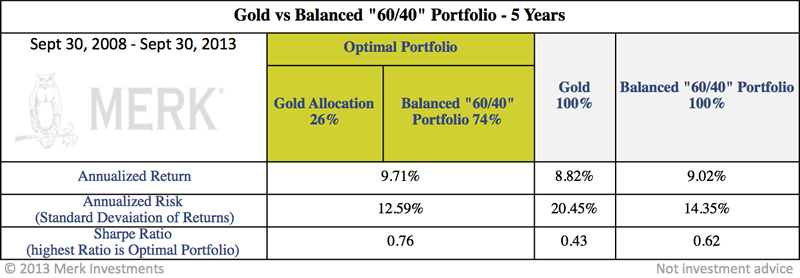

Gold in a Balanced "60/40" Portfolio: 5-Year Efficient Frontier

With this context provided, let's look again at the past 5 years, but this time, adding bonds into the mix. We assume a static 60/40 ratio of stocks to bonds, often referred to as a "Balanced Portfolio," then add the "optimal" amount of gold to the mix - again using hindsight:

Unlike the first example that suggested a 56% allocation to gold, a 36% allocation to gold added to a "Balanced Portfolio" would have yielded the "Optimal Portfolio." Here, gold outperforms the balanced portfolio by a tad, yet one can lower the overall risk profile of a balanced portfolio by adding a gold component.

Clearly, past returns are no proof of future results. Will the seemingly meteoric rise of stocks continue? Haven't we reached a peak in bonds? In fact, over the past 5 years, bonds came out way ahead as the volatility in bonds was abnormally low; this changed as of the "taper talk" earlier this year. And even if one likes the value proposition of gold, it's only prudent to take into account that the recent negative returns may continue. If one extrapolated from the recent negative returns of gold, the "Optimal Portfolio" may well suggest a 0% allocation to gold, assuming other asset classes yield positive returns.

What is the Market? Better Alternatives?

Most investors don't allocate 30%+ of their portfolio to gold; neither can we make such an investment recommendation. But as limited as the analysis here is, we should really be asking the opposite question: is it sensible for investors to have up to 70%, possibly more, of their portfolio in stocks? What this exercise shows that investments that adding investments with low correlation to stocks may improve a portfolio by enhancing its risk-adjusted return.

Aside from including international stocks and bonds, other candidates to consider for inclusion in an investment portfolio are:

- Real estate

- Commodities, including gold

- Currencies (directional), such as a managed basket of currencies

- Currencies (non-directional), such as an absolute return "long/short" strategy

- Managed futures

- Hedge funds

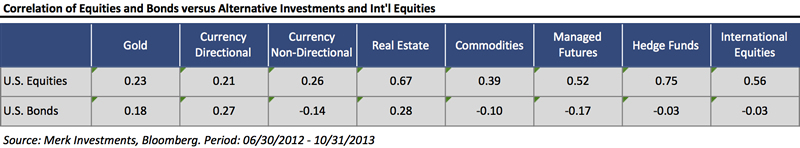

What correlation?

To find an Optimal Portfolio, it's important how the underlying securities in the portfolio interact with one another. But that's not so trivial, as correlations across securities and asset classes are not stable. To illustrate the point, most have heard that the U.S. dollar benefits from a "flight to safety." That may have been the case for a little over two years up to the summer of 2012, but ever since then, the "risk on" / "risk off" trade became more complicated. Or when money fled emerging market local debt where investors thought they could have a free lunch picking up yield with little risk, such money didn't go into the U.S. dollar, but started to chase yields in government bonds of weaker Eurozone countries. Or take gold: there are periods it moves in tandem with the stock market, others where it moves in the opposite direction. Indeed, there are periods when gold has been a hedge against a falling stock market; but it's not always inversely correlated with the stock market. Gold may also thrive in a rising interest rate environment, as it did in the late 1970s.

Here's a selection of other alternative investments and how they correlate to both equities and bonds:(*)

Note that, in recent years, international equities have had a comparatively high correlation to the S&P 500. We have been arguing for some time that investors in international stocks may have primarily been receiving additional return through commensurately higher risk rather than improving the overall return/risk profile of their portfolios. As a result, we encourage investors to consider truer forms of diversification, noting that currency strategies may provide particularly low correlation to U.S. stocks and bonds. Gold is a well-known way to diversify out of the U.S. dollar, however there may be other opportunities worth exploring further.

What return?

The theory works best when we plug in "expected" returns. Wouldn't it be great if we knew tomorrow's return? In practice, many investors use historical returns. As you might imagine, these models heavily favors assets that had a good return during the given look-back period - so don't think the result is unbiased simply because you let a computer generate results. Indeed, one of the biggest challenges in presenting Optimal Portfolios is that they are heavily influenced by the underlying assumptions. Someone can show you that a given investment would have made a fantastic addition to your portfolio, but you may want to look more closely whether the assumptions are realistic going forward.

What risk?

Just as returns play a role, so does risk. In finance, a lot of investors employ standard deviation of returns as a measure of risk. Yet many investors are just fine with "upside risk," but do have a problem with "downside risk" (there's a measure for that, the Sortino ratio). Maybe just as relevant, these models are not very good at capturing high risk, low probability events, also called market crashes. In other words, an optimization analysis that uses historical returns may understate risk if the time period used does not capture a market crash in that given asset. Further, many measures of risk are relative to a benchmark "risk free" rate; but in today's world, one might argue that there's no such thing as a risk free investment in an environment with negative real interest rates given that one's purchasing power is at risk no matter what one does.

Optimal Portfolio: Really?

The takeaway from this exercise may be to look at alternatives in general as a supplement to a traditional equity and bond portfolio. Investors may want to take a pro-active approach to learn how to add value to a portfolio, keeping an open mind about the risks and opportunities out there, especially after the run-up the stock market has had.

To invest profitably, it may be more about developing a robust investment process rather than plugging in make believe numbers into a model. We will publish more analyses on how to diversify in times like these.

Please subscribe to Merk Insights and follow me on Twitter to learn how policy makers impact investors. Also join me for a Webinar on Tuesday, December 17, 2013, discussing how to diversify when bonds are at risk and stocks expensive.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.