The Global Economy is Running Out of Time

Politics / Energy Resources Dec 15, 2013 - 09:49 PM GMTBy: Brian_Bloom

Energy drives all economic activity. Scientifically based evidence, recently to hand, leads to the conclusion that humanity has approximately 15 years to get its energy house in order. If we fail to achieve this outcome the global economy will not deteriorate, it will collapse. The flip side of this statement is that if we succeed – which is eminently possible from a technical perspective – we can look forward to a long period of global economic stability, if not growth. The obstacles to success are egocentricism and hubris of those in power. In the article below, Brian Bloom summarises key evidence to prove that the current status quo has a bias towards failure in all the world’s industrialised democracies. Urgent action is required.

Energy drives all economic activity. Scientifically based evidence, recently to hand, leads to the conclusion that humanity has approximately 15 years to get its energy house in order. If we fail to achieve this outcome the global economy will not deteriorate, it will collapse. The flip side of this statement is that if we succeed – which is eminently possible from a technical perspective – we can look forward to a long period of global economic stability, if not growth. The obstacles to success are egocentricism and hubris of those in power. In the article below, Brian Bloom summarises key evidence to prove that the current status quo has a bias towards failure in all the world’s industrialised democracies. Urgent action is required.

**********

“Of the three main currents of life, I observed

Energy, from the West;

Wisdom from the East;

Rhythm, from the South.

And all of these shall run together to inform life.

For energy without wisdom is blind;

Nor can they act effectively together,

Out of rhythm with the earth.”

Earth, Frank Townshend, George Allen & Unwin, 1929

In this world of information overload, too many have attention spans that are not predisposed to want to focus on anything but sound bites. The content of this article is too important to have been written in sound bites. For your own sake, and for the sake of your family, friends and associates, I ask that you read it from beginning to end and recommend it to everyone who you believe can help spread the word. Its content is the result of decades of research and thought on my part, as augmented by the inputs of several people who have mentored me along the way.

Most of you will know that in early 2005 I sat down to write Beyond Neanderthal and that in 2009 I commenced writing The Last Finesse.

Both are factional novels targeted at ordinary thinking, non-expert, people who have some understanding that the world is facing several unusual challenges; in particular we have passed “Peak Oil”, and the planet’s climate is behaving in a manner that is inconsistent with its behaviour during living memory. There has been such a plethora of misinformation on both of these subjects – which has been communicated with so much certainty and confidence – that the firm convictions of most interested people are dependent on who they have chosen to listen to. Few, including the so-called experts, are focussing on the likely impact of climate change on energy demand. The bottom line is that regardless of whether the planet is heading for a period of continuing excessive warming, or whether we are facing the beginning of an Ice Age, humanity will need a greater amount of energy per capita to survive intact.

In Chapter 1 of Beyond Neanderthal – published in early 2008 – the coming Global Financial Crisis was anticipated and the likely catalyst thereof was explained. That book provides an overview vision of what life on earth might become if humanity is ever able to evolve beyond the ego/testosterone driven Neanderthal phase of our existence and into a more enlightened phase underpinned by humility and love as envisioned by all the world’s great religions. We have both the technical ability and the management competence to adapt our behaviour appropriately so as to address all our challenges. The biggest obstacles to change are hubris and unethical, egocentric behaviour.

The Last Finesse takes a more near term view and – without specifically articulating the fact – it focuses on a little understood phenomenon which is referred to by specialist scientific researchers as “Energy Return on Energy Invested”. This is a relatively new concept that was first articulated in the 1970s. The media have been trumpeting all the recent energy finds such as shale oil and gas, tar sands, coal seam gas, brown coal deposits and large undersea gas deposits. Unfortunately, what they have not reported accurately (perhaps they have not fully understood) is that it will require disproportionately more energy to extract these new fossil fuel deposits than was historically required to pump plentifully available oil and/or mine high energy density black coal.

Since the mid 1980s, on a global basis, the weighted average Energy Return on Energy Invested of all energy paradigms combined has been declining. The impact of this has been that net global annual output of energy per capita (after deducting the energy required to produce it) has been declining. That was the ultimate reason why the Global Financial Crisis emerged, as you can verify by reference to my article entitled “What Caused The Global Financial Crisis” (http://www.beyondneanderthal.com/what-caused-the-global-financial-crisis/ ). It is also the reason why the central bankers have been effectively chasing their tails by creating tidal waves of money and dropping interest rates to below the rate of inflation. They have been trying to floor the accelerator pedal of a rickety pantechnicon truck that is no longer capable of pulling the trundling economic trailer over hilly terrain. They are wasting their time and your money.

In light of the above, Common Sense dictates that the only way humanity is going to avoid a continuing downward spiral in average standards of living is if weighted average Energy Return on Energy Invested is increased to above that which prevailed when oil was plentifully available. But, as they say in the world of academia, that will be a “necessary but not sufficient condition”.

The hard fact is that, apart from all other negative arguments regarding wind and solar energy, neither energy paradigm (yet) enjoys an Energy Return on Energy Invested that will give rise to an increase in the weighted average of the total. Via the medium of its entertaining storyline, The Last Finesse communicates two primary themes:

- Nuclear Energy is the only known energy paradigm that can facilitate the desired outcome

- There is so much hysteria surrounding Nuclear energy that a clear-headed course needs to be plotted to allow for its embracement, by addressing the hubris issue as a condition precedent; and from the ground up rather than from the top down.

As sub-themes, The Last Finesse also addresses the issue of ignorance that pervades most public discussion on the subjects of nuclear energy and climate change.

Although The Last Finesse was self published in 2011, I have been on a steep learning curve regarding book marketing in a currently dysfunctional book industry. The internet has facilitated a tidal wave of books onto a market that is ill equipped to assess the relevance of individual books. In today’s book market, “market communication” has become excruciatingly important.

It took me some time to understand the relevance of Book Reviews in the marketing mix and it was only recently that I have been able to arrange a series of reviews, the numbers of which will grow over the coming months. If you read the reviews, which can be accessed via the links below, you will come to understand that I am not the only person who believes that my two books are extraordinarily important. I have had almost a “full house” of 5 star reviews. But the daunting challenge is to create a momentum of awareness so that a rolling snowball of readers can become an avalanche.

As part of my efforts, I will be embarking on virtual book tours for both of my novels on December 21st, 2013 which will extend over two months and, I am led to believe, will increase the number of reviews by between 5 and 8 fold.

Just how important are these books? In short, their importance has just shot up exponentially:

Some updated research on Energy Return on Energy Invested with regard to oil has been recently brought to my attention.

Here is a quote from that research:

“the average EROI for US oil production has declined from roughly 20 in the early 1970s to 11 today, while the global average EROI was roughly 30 in 2000 and has declined to roughly 17 today”

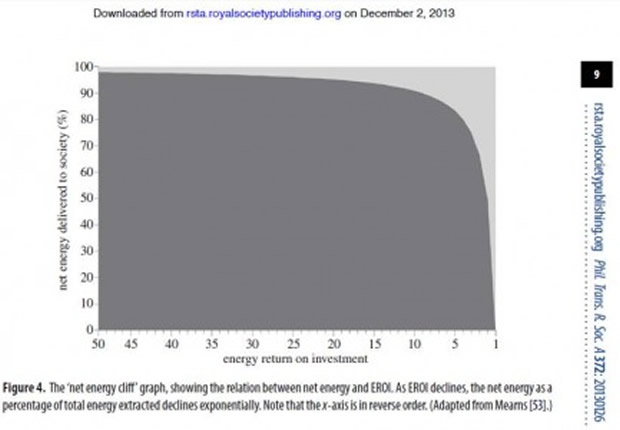

Below, Figure #4 from that research – with specific reference to oil – is reproduced, and below that I provide a simplistic explanation of the graph: (Click to enlarge)

Energy Return on Energy Invested has been plotted on the X Axis, and “net energy delivered to society” is plotted on the y axis.

It can be clearly seen from the model that with an EROEI of anywhere between 50:1 and 15:1 more than 90% of the energy contained in the oil that is extracted, is available as “net” energy.

Below 15:1 net energy begins to fall at an accelerating pace, and below 10:1 EROEI, it falls precipitously.

Now, when you look at this chart in conjunction with the quote in red above, you come to a blood chilling conclusion:

Unless we move now to increase weighted average EROEI, we have around 15 years before the world hits an energy crisis of such dimensions that it will have the potential to seriously damage the global economy, perhaps beyond repair.

Why 15 years?

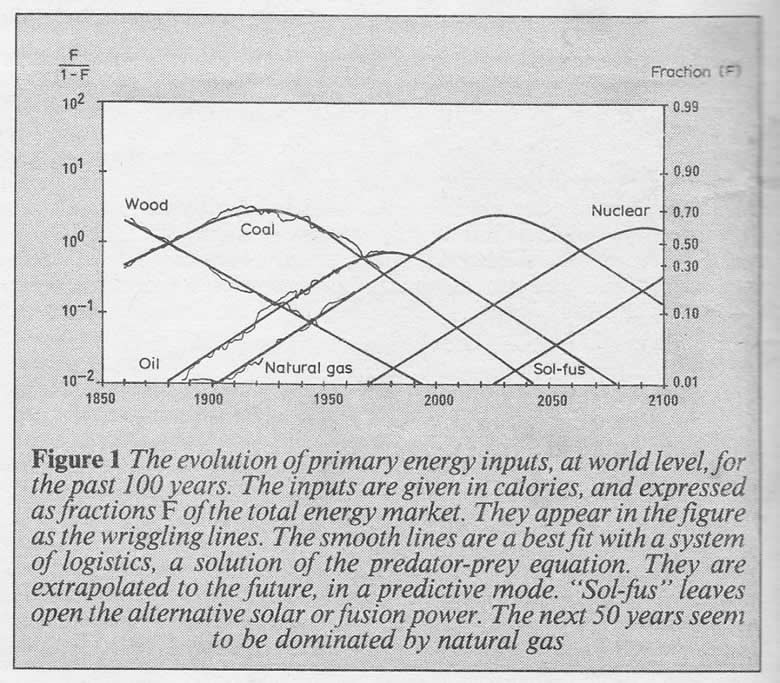

Have a look at the chart below, reproduced from an Article entitled “Swings, Cycles and The Global Economy” that was published in the New Scientist Magazine in 1985:

If you look closely, you will see that natural gas was expected to take over from oil as the primary source of energy in around 1990, and that we can expect to pass “Peak Gas” in around 2030. Because Natural Gas typically has a similar or lower EROEI to oil’s EROEI, today, the global weighted average EROEI of all energy paradigms can be expected to languish and maybe continue to decline slowly. If, by 2060, Nuclear has not taken over from natural gas, we can kiss the global economy goodbye. It will not decline, it will collapse as EROEI of natural gas falls precipitously.

But for nuclear to be able to take over, its market share will have to be growing strongly by the time natural gas’s market share peaks – which is anticipated in around 15 year’s time.

And now we come to the reason I wrote The Last Finesse: The hysteria surrounding nuclear has reached such proportions that it will be political suicide for any democratically elected government to actively promote nuclear in today’s environment. Given that hysteria, the probability of nuclear hitting its straps in the market by 2030 is currently very low. The Last Finesse is specifically intended to allow ordinary thinking people to pierce the veil of hysteria and to get to grips with the realities of nuclear.

Given the commencement of my virtual book tours on December 21st, it will be very helpful if you could add your voice/s to the efforts so as to increase the momentum of market awareness and sales of these two important books.

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2013 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.