A Property Bubble in the U.S. Housing Market?

Housing-Market / US Housing Dec 18, 2013 - 05:33 AM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: I love it...

Dr. Steve Sjuggerud writes: I love it...

Many so-called "experts" are now worrying about a property bubble here in the U.S.

History says our opportunity in housing is still great. And all this bubble talk is way overblown. Let me explain...

The thought of a property bubble today in the U.S. just makes me laugh...

Think about this... I was just in Hong Kong, where the typical residential property sells for over $1,000 per square foot. (Amount in U.S. dollars, not Hong Kong dollars.) At that price, a tiny 500-square-foot apartment sells for over $500,000!

By comparison, the median house price in the U.S. is less than $100 per square foot.

Which sounds more like a bubble to you?

Over $1,000 per square foot in Hong Kong… or less than $100 per square foot in the U.S.?

The U.S. is cheap!

With such cheap housing here, you might think there's a big reason for it... like an extreme oversupply of new homes. (An oversupply of something usually drives prices down.) But that is completely wrong...

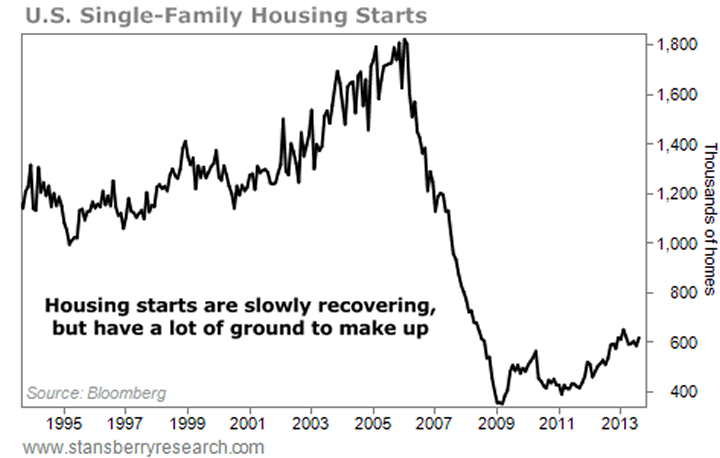

Since the housing bust, homebuilders have NOT been building. Meanwhile, the need for housing in America typically stays relatively unchanged... because Americans are still having babies, and those babies need shelter.

But homebuilders haven't been building that shelter...

As you can see in the chart below, homebuilders have a lot of catching up to do.

Of course, many of the so-called "experts" disagree with me... They say that housing IS in a bubble. The reason they usually cite is that house prices have gone up fast...

The median new home price in the U.S. is up 16% over the last two years. And certain markets are up even more. Las Vegas prices, for example, are up nearly 30% in the last year. San Francisco prices are up over 25%.

We must be in bubble territory after gains like this... right? No...

If we look at individual cities, it's obvious how absurd the bubble talk really is. Las Vegas – the biggest gainer recently – is still 46% below its peak prices from a few years ago. San Francisco is still 18% below its all-time high.

In fact, only two of the 20 major U.S. cities have reached new highs… Hardly a bubble.

In short, property prices in the U.S. are still ridiculously cheap compared with places like Hong Kong. And U.S. houses are still incredibly affordable for Americans (thanks to low interest rates).

So it doesn't look like there is a housing bubble in America now – for a couple solid reasons:

• House prices in America are cheap – selling for below replacement cost in many cases.

• There haven't been enough new houses started to meet demand.

That's a recipe for higher home prices and more home sales – not a housing bust.

I'm heavily investing in Florida real estate myself. I suggest you get to know your own market and put money to work. This opportunity won't last forever.

Good investing,

Steve

P.S. My True Wealth Systems computers recently discovered an incredible way to profit from the housing rebound. The last time TWS gave us this particular signal, readers walked away with 90% gains in less than two years. Other recent signals have generated 141% in one year… and 156% in 11 months. Large hedge funds spend millions of dollars for this kind of intelligence. Click here to learn how regular investors are using it to profit right now.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.