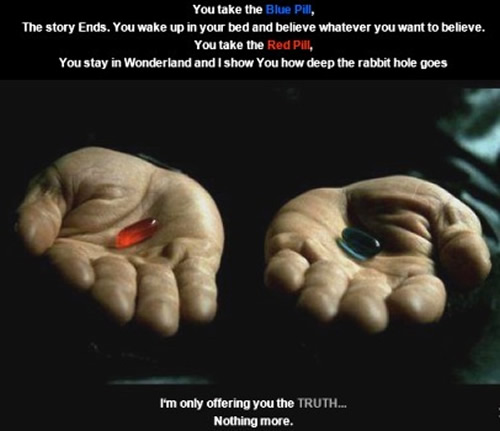

Gold Investors: Take the Red Pill!

Commodities / Gold and Silver 2013 Dec 18, 2013 - 02:43 PM GMTBy: DeviantInvestor

We make choices in our thinking, lifestyle, savings, and investments. We can look reality squarely in the face and swallow the red pill (from the movie - "The Matrix"). Or, we can swallow the blue pill with a healthy slug of whisky, continue riding the roller coaster of mass delusion, and go back to watching "Reality TV" and the evening news. Either way we will experience the consequences of our actions and our thinking.

We make choices in our thinking, lifestyle, savings, and investments. We can look reality squarely in the face and swallow the red pill (from the movie - "The Matrix"). Or, we can swallow the blue pill with a healthy slug of whisky, continue riding the roller coaster of mass delusion, and go back to watching "Reality TV" and the evening news. Either way we will experience the consequences of our actions and our thinking.

The Blue Pill Delusion

US Government Budget: Congress, in their wisdom, will pass a budget that continues spending as usual, borrowing to cover the revenue shortfall, and increasing the official debt a $Trillion or so per year. The debt is still rated AAA because it will be rolled over well into the next century, and all is good. Individual equivalent: spend until credit cards are maxed out and then apply for more credit cards. What could go wrong?

US Government Debt: It can increase forever. Deficits don't matter and debt is just something that happens in our modern times. Unfunded liabilities are somewhere between $100 and $200 Trillion, but - no problem. Individual equivalent: Keep spending on the credit cards! Let's party.

Interest Rate Risk: Interest rates are at multi-generational lows. Hence the borrowing costs for already insolvent governments are exceptionally low. If interest rates do NOT stay this low FOREVER, borrowing costs will greatly increase, deficits will expand even more rapidly, and the spiral of insolvency accelerates. But, it's all good and really, why can't interest rates stay low for another 50 or 100 years? Individual equivalent: I borrow on credit card A to make the minimum payment on credit card B. Now I need to apply for another credit card with a higher limit and lower interest rate.

FASB mark to myth: About five years ago the Financial Accounting Standards Board changed the rules - banks can value certain assets with considerable latitude instead of at market value. Example: Mortgage Backed Securities - some of which are known as toxic waste. This valuation process is also known as "mark to myth" or "mark to model." It perpetuates the illusion of balance sheet solvency - "extend and pretend." Individual equivalent: I have a 1,000 square foot house in the country that is worth less than $85,000. However, the bank and I agreed that it is worth $900,000 and I just took out a loan for $800,000 collateralized by that house. Let's party!

Gold: We don't need the stuff, we have T-Bonds! Let's sell off a major portion of our gold, ship it to Switzerland where it will be melted down and sent to China, India and Russia. Our T-Bonds will be good forever and the gold was earning no interest and taking up space so it is best to dump the gold at today's LOW prices. Individual equivalent: I'll sell the gold Double Eagle my grandfather gave me and buy a 72 inch television made in China. In five years the gold will be gone, the TV will be practically worthless, and I'll be worse off than before.

The Red Pill Reality

Gold: It has held its value for 5,000 years. Gold is respected everywhere in the world and immediately recognizable. By contrast, all paper money systems have eventually failed. Many paper currencies have disappeared in the past 100 years due to excessive creation of those unbacked paper currency units. It will happen again. Remember: if the intrinsic value of the currency is zero, it is not money - it is only a currency unit.

Dollar as the reserve currency: Many countries around the world, such as China, Russia, India, Brazil, and South Africa, have initiated "swap agreements" whereby they trade with each other in currencies other than the U.S. Dollar. Clearly those countries see an advantage in bypassing the dollar in their international transactions. Similarly, countries are increasingly selling oil in Euros, Yuan, and gold, rather than the U.S. Dollar. Using swaps instead of the dollar will cause decreased demand for the dollar, which means it will be valued lower in the future against other currencies, commodities, and gold. The dollar is not likely to be replaced as the global reserve currency within a year, but what about within ten years? It is time to admit that the era of the U.S. Dollar as undisputed global reserve currency is drawing to a close. When the dollar declines, so will the value of assets denominated in dollars. What will unbacked debt-based paper dollars buy a decade from now?

Debt: The U.S. government official debt is over $17 Trillion with many more $Trillions accrued in unfunded liabilities for Social Security, Medicare, and government pensions. The usual consequence of too much debt has been a devaluation of the currency - a dollar crisis whereby the dollar buys less and less of what we need to live. Jim Sinclair refers to this process as "currency induced cost push inflation." The standard of living goes down, people march in the streets, and many ugly consequences materialize. Ask the people of Greece about the quality of their lives after excessive government indebtedness and fiscal irresponsibility destroyed their economy. It can happen here.

QE and Printing Currency: Let's admit that QE was largely created to save the big banks, and that QE is maintained as a wealth transfer system to recapitalize the big banks and fund the deficits of many governments. Does anyone truly believe that printing a $Trillion (just in the U.S.) per year will NOT have negative consequences for the economy, for consumer prices, and for most citizens in the lower financial 90%? What did you pay for food and gasoline five years ago? What about 10 years ago? Has your after-tax income gone up proportionally? What will you pay for food and gasoline in the next 10 years? What will the devaluing dollar buy in 10 years? How much gold and silver do you own as insurance against a devalued dollar?

Cycles: Many well respected individuals have written about cyclic downturns over the next several years. To name a few: Marc Faber, Gerald Celente, Jim Rogers, Mike Maloney, Russel Napier, Jeff Berwick, Michael Pento, Laurence Kotlikoff, Hugo Salinas Price, Robert Prechter, David Stockman, Harry Dent, and others. Will massive money printing delay or eliminate these downward cycles or is another financial collapse imminent? Are you prepared?

Conclusions

Swallow the blue pill and chase it with a half-pint of whisky if you want the easy and well-traveled road of collective delusion. But as Ayn Rand said, "We can ignore reality, but we cannot ignore the consequences of ignoring reality." Or, take the red pill and invest wisely along the less-traveled road.

If you accept the red pill reality of our financial and monetary systems, then we believe you will find that fewer dollar denominated investments, more physical gold and silver, fewer paper assets, and more hard assets make sense.

The consequences of your actions and beliefs are yours to experience. Blue pill or red pill - your choice and your consequences.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2013 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.