Business Corporatracy - Twenty Years of NAFTA Sucking Sound

Politics / US Politics Jan 08, 2014 - 12:28 PM GMTBy: BATR

Ah, what a better world the Free Traders built. With the rush to the bottom, the commemoration of the NAFTA 20th anniversary is a most hollow celebration. Those who have a memory of an actual economic prosperity, lament that H. Ross Perot’s warnings were ignored. Business literates urged the public to elect Perot as President. Establishment corporatist interests and corruptacrat officials joined forces to write a blueprint for economic consolidation and political futility. The fruits of this endeavor only satisfy the appetites of the select cabal of manipulation.

Ah, what a better world the Free Traders built. With the rush to the bottom, the commemoration of the NAFTA 20th anniversary is a most hollow celebration. Those who have a memory of an actual economic prosperity, lament that H. Ross Perot’s warnings were ignored. Business literates urged the public to elect Perot as President. Establishment corporatist interests and corruptacrat officials joined forces to write a blueprint for economic consolidation and political futility. The fruits of this endeavor only satisfy the appetites of the select cabal of manipulation.

Heed well the undeniable results.

"NAFTA is really less about trade than it is about investment. Its principal goal is to protect US companies and investors operating in Mexico. The text of the agreement is contained in two volumes covering more than 1,100 pages. The text is mind-numbingly dull. Large portions of it are written in the type of obscure legal terms found on the back of an insurance policy. Buried in the fine print are provisions that will give away American jobs and radically reduce the sovereignty of the US.

[When the Mexican media announced NAFTA, they] did not identify the tiny handful of people in Mexico who would gain the most from this trade pact. They are the 36 businessmen who own Mexico’s 39 largest conglomerates. Collectively, their companies control 54% of Mexico’s Gross National Product. These companies dominate virtually every sector of the Mexican economy of any consequence. When the Mexican government sold off big chunks of Mexico’s state-run companies in the late 1980s and early 1990s, this tiny handful of people quickly acquired control."

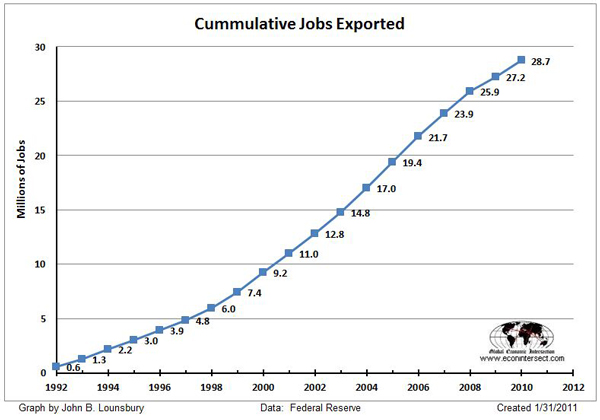

"Both of Perot’s opponents (George H.W. Bush and Bill Clinton) argued that NAFTA would create jobs in the U.S. because of business expansion.

However, the goods balance of trade for the U.S. with Mexico has been negative and steadily growing over the years. In 2010 it amounted to $61.6 billion, which was 9.5% of the total goods trade deficit last year.

So Perot has been vindicated in his opinion; expanded free trade has not been accompanied by an increase in jobs in the U.S. relative to the vast numbers of jobs created in the rest of the world as NAFTA became just a stepping stone on the pathway to global commerce."

"Given NAFTA’s devastating outcomes, few of the corporations or think tanks that sold it as a boon for all of us in the 1990s like to talk about it, but the reality is that their promises failed, the opposite occurred and millions of people were severely harmed."

"NAFTA’s promoters also claimed that NAFTA would be a huge benefit to Mexico, stemming illegal immigration to the U.S., drug trafficking and other corruption, and other ills. (How is that working out?) But even with Mexico’s $1 trillion NAFTA surplus with the U.S., Mexico still suffers a chronic global trade deficit as China and other countries use it as a back door to the U.S. Last year Mexico paid $60 billion for imports of mostly manufactured goods from China while earning only $6 billion from exports of mostly mineral and agricultural commodities to China."

Folks, this globalization model flops for the most simple of all reasons. Allowing the world economy to reward the neo-feudal system produces only societies that control their populations as serfs. Economists and business journalists that ignore the collapse of real income purchasing power by the vast majority, practice their trade for the conglomerate captains of commerce.

The reason that Free Trade agreement swindles, detested by the suffering public, is such a dramatic failure is that twenty years of diminished wealth hits everyone’s pocketbooks. No longer can the dreadful results from the hidden fine print of treaty documents stay secret from the impoverished middle and underclass.

People are now aware that the former "giant sucking sound" has turned into a universal welfare dependency economy of lower expectations. As the global financial system descends into bankruptcy and default, the United States economy will fall even faster than that of poorer nations.

NAFTA is a prime contributor to the dramatic trade deficits that suffocates entrepreneurial ventures that could expand productive growth and achieve a higher standard of living. A Corporatocracy economic system, in union with authoritarian governmental regimes, seeks to rule a world of docile plantation peons.

What is next? CAFTA: Wall Street vs Main Street, proposed back in 2004, and now we have TPP and TTIP on the agenda. The last two decades did not satisfy the greed of the plutocrats. Only total control of transnational business traffic will complete the international trade agreement deals.Absorbing the whole of transaction cash flow into a system of strictly regulated commerce is the economic end game of the globalists. When will people rebel against this bankster’s usury model of business? The darling companies that are approved NAFTA ventures are beholden to the worldwide elites of economic fascism. Perot was right on mark. Oppose future free trade treaties.

James Hall – January 8, 2014

Source : http://www.batr.org/corporatocracy/010814.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2013 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.