What Stagflation Means for Investors

Stock-Markets / Stagflation Jan 24, 2014 - 10:31 AM GMTMichael Lombardi writes: The Bureau of Labor Statistics just reported that inflation in the U.S. economy increased by 0.3% in the month of December and that the Consumer Price Index (CPI) for the entire year of 2013 increased by only 1.5%. (Source: Bureau of Labor Statistics, January 16, 2014.)

Is inflation in the U.S. economy really this low?

It sure doesn’t feel like it. Every time I buy groceries, go out for dinner, get my car fixed, pay utilities bills, or fill up my car’s gas tank, it feels like I am paying a lot more than I did last year or the year before.

Dear reader, inflation is higher than what the CPI figures say because of the way the CPI is calculated; food and energy prices are taken out because they tend to be more “volatile,” according to the government. That means key items consumers buy on a regular basis—food and gas—are excluded from the official inflation numbers!

While the mainstream fears deflation in the U.S. economy, I’m concerned about an unexpected bout of higher inflation hitting us. Why would I think this?

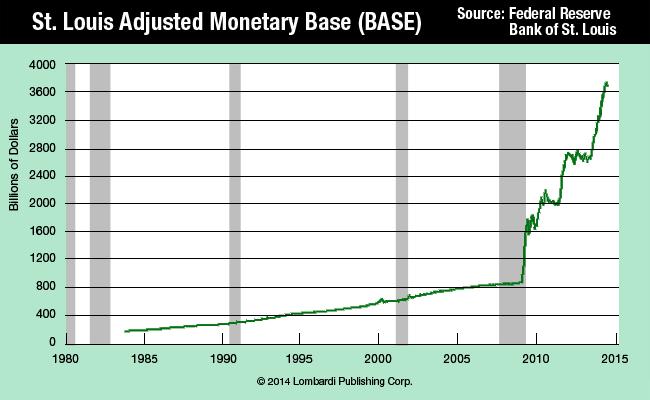

I can sum-up my argument for inflation ahead with just this one chart:

The chart above shows the currency (coins and paper notes) in circulation and deposits of banks at the Federal Reserve.

As you can see, since the financial crisis, the Federal Reserve has injected trillions of dollars into the U.S. economy. This is dangerous, in my opinion, for the simple reason that the more there is of any item in supply, the less the demand, and the lower the price. In this particular case, the more U.S. dollars in circulation, the less they are worth, and the more of them it will take to buy something. This is what creates inflation.

What I say now certainly doesn’t resonate with what you see on the TV, hear from stock advisors, or read on the popular financial websites. With unemployment roaming high, a period of stagflation—that’s when economic growth is anemic and unemployment and inflation are high—could be in the cards for the U.S. economy.

Stagflation is bad for investors because rising prices hurt corporate growth and profits. Companies can’t pass rising costs on to consumers during times of stagflation because economic growth is slow. Thus, during periods of stagflation, stock prices fall. Maybe that’s just where we are headed in 2014.

This article Why We’re Headed for a Period of Stagflation and What It Means for Investors was originally published at Profit confidential.

© 2014 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.