Is the Canadian Dollar This Currency Losing Its “Safe” Status?

Currencies / Canadian $ Jan 27, 2014 - 12:29 PM GMTBy: DailyGainsLetter

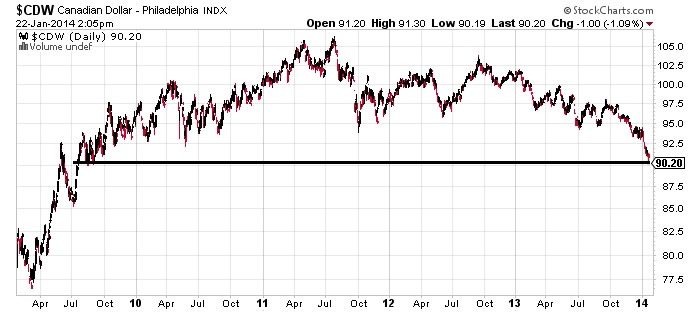

Mohammad Zulfiqar writes: Not too long ago, I wrote about an economic slowdown in the Canadian economy and how it could take the value of the Canadian dollar even lower. (Read “How American Investors Can Profit from the Canadian Economy’s Demise.”) By no surprise, the Canadian dollar (also referred to as the “loonie”) looks to be in a freefall. Take a look at the following chart.

Mohammad Zulfiqar writes: Not too long ago, I wrote about an economic slowdown in the Canadian economy and how it could take the value of the Canadian dollar even lower. (Read “How American Investors Can Profit from the Canadian Economy’s Demise.”) By no surprise, the Canadian dollar (also referred to as the “loonie”) looks to be in a freefall. Take a look at the following chart.

Chart courtesy of www.StockCharts.com

The Canadian dollar is currently trading at its lowest level since September of 2009. Since the beginning of the year, the loonie has declined more than four percent compared to other major global currencies.

Considering all that is currently happening, can the Canadian dollar go down any further?

Simply put, yes, the Canadian dollar may still see some more downside. After the U.S. economy showed a significant amount of stress during the financial crisis, investors flocked to buy the Canadian currency. This may not be the case anymore.

Since the last time I wrote on this topic, some more information on how the Canadian economy is doing has been released. This new information reaffirms my suspicions. It seems the economic slowdown in the Canadian economy is gaining some momentum; even the central bank of Canada looks slightly worried. This could be very bearish for the Canadian dollar.

First of all, wholesale sales in Canada in the month of November remained unchanged from the previous month. Out of the 10 provinces in the country, only four reported an increase in their wholesale sales. (Source: “Wholesale trade, November 2013,” Statistics Canada web site, January 21, 2014.) Wholesale sales can provide an idea about the retail sales and, ultimately, the demand in the economy. If sales remain unchanged or decline, it suggests demand is slowing.

As well, inflation in the Canadian economy is subdued. This has the Bank of Canada worried. In its January monetary statement, the central bank said, “…inflation is expected to remain well below target for some time, and therefore the downside risks to inflation have grown in importance.” (Source: “Monetary Policy Report Summary,” Bank of Canada web site, January 22, 2014.)

To take advantage of this situation—the Canadian dollar falling further—investors may be able to profit by shorting exchange-traded funds (ETFs) like CurrencyShares Canadian Dollar Trust (NYSEArca/FXC).

With all this said, investors have to keep one very important factor in mind: the Canadian dollar tends to move in line with commodity prices, especially crude oil prices. Over the past few days, there has been a surge in crude oil prices, but the Canadian dollar is plunging lower. This phenomenon can have some implications and may cause the Canadian dollar to see a short-term move to the upside. Take a look at the chart below; I have circled this disparity.

Chart courtesy of www.StockCharts.com

Remember: always use proper risk and trade management techniques in order to keep your losses small and your gains large.

This article Is This Currency Losing Its “Safe” Status? was originally published at Daily Gains Letter

© 2014 Copyright Daily Gains Letter - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.