Stocks Pop, Gold & Bonds Drop

Stock-Markets / Financial Markets 2014 Jan 30, 2014 - 02:10 PM GMT The SPX Pre-Market calls for a higher open. However overhead resistance in the form of the hourly Cycle Bottom awaits at 1784.98. This bounce may not last.

The SPX Pre-Market calls for a higher open. However overhead resistance in the form of the hourly Cycle Bottom awaits at 1784.98. This bounce may not last.

The Department of Labor reports, “In the week ending January 25, the advance figure for seasonally adjusted initial claims was 348,000, an increase of 19,000 from the previous week's revised figure of 329,000. The 4-week moving average was 333,000, an increase of 750 from the previous week's revised average of 332,250.”

ZeroHedge retorts, “The trend that was so many momentum-chasing bulls friend for so long has ended. The steady downward drift in jobless claims - all noise, debt-ceiling, winter storm, and software glitches aside - has ended. Initial claims rose 19k this week, missed expectations by the most in 6 weeks, and jumped to the same levels seen 6 months ago.”

In addition, Preliminary GDP figures for the 4th Quarter declined. ZeroHedge reminds us, “After the blistering final Q3 GDP print of 4.1% (to be revised far lower eventually), the preliminary Q4 GDP number had only one way to go, down - and sure enough it dropped to the expected 3.2% (well below Joe LaVorgna's 4.0% forecast), capping 2013 GDPat 1.9%, down solidly from the 2.8% growth recorded in 2012. "Assume a recovery..."

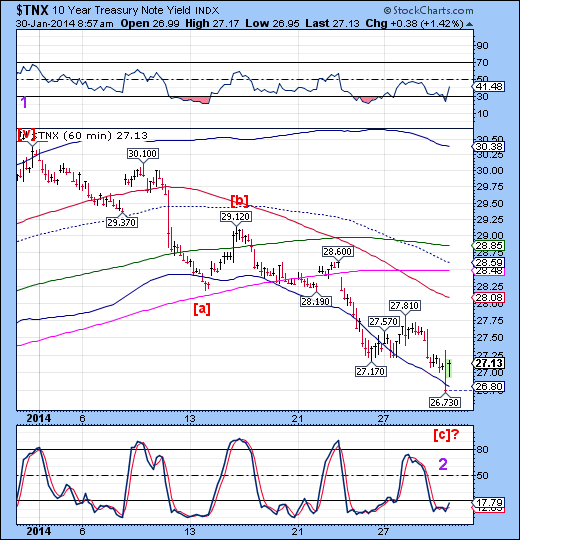

TNX made its expected reversal in the nick of time to make the new Master Cycle left-translated. That is, bullish for yields, bearish for prices.

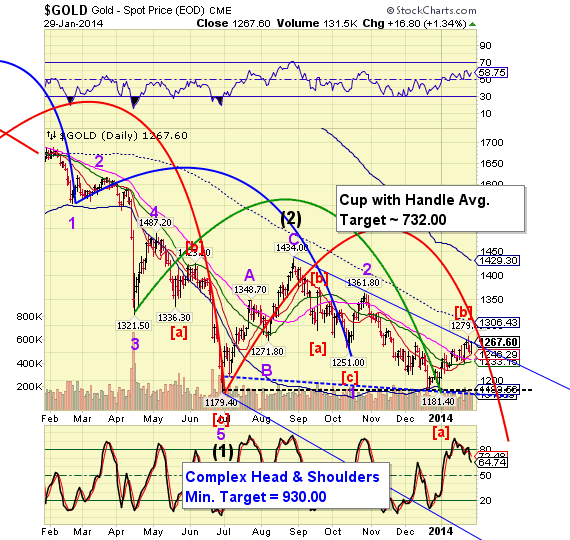

Gold futures came down hard this morning, to 1241.50. Gold id now beneath Short-term support/resistance at 1246.29 and may break the final Model supports in the next day or so.

There will be much wailing and gnashing of teeth among the gold bugs who fail to understand that this is a deflationary event.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.