Bitcoin Panic - Bloodbath on Mt. Gox

Currencies / Bitcoin Feb 15, 2014 - 03:55 AM GMTBy: Mike_McAra

Very briefly: it is our opinion than not having any short-term positions is the way to go.

Very briefly: it is our opinion than not having any short-term positions is the way to go.

Panic. This one word sticks in the back of everybody’s mind when assessing what’s been going on in the Bitcoin market for the past couple of days. It might be hard to get one’s head around the fact that the currency was at $900 on Feb. 5, only to almost reach $300 today. The sell-off continues, today coinciding with news of another hacker attack.

TechCrunch reported yesterday, that around 4,500 bitcoins, worth upwards of $2,700,000 had been stolen from Silk Road 2, the successor of the black marketplace shut down last year. It is perhaps no wonder that engaging in possibly illegal activities may result in problems, in this case those of the financial nature. Worrying is the fact that the hackers exploited the same bug which had earlier caused severe problems for Mt. Gox, Bitstamp and BTC-e.

This bug, called “transaction malleability”, has been known for some time, but only now did it actually become a burning issue for the Bitcoin community. The accounts of Silk Road 2 were completely wiped out. Around 95% of the coins are supposed to have been stolen by one person or entity.

Knowing that, we might be able to understand why Mt. Gox and Bitstamp put all the Bitcoin withdrawals on hold. Perhaps, thanks to that, there has been no theft of funds on those exchanges. On the other hand, the bug seems to be serious. Serious enough to keep Bitcoin developers working on a resolution almost 24/7.

The news of late, haven’t been particularly good for Bitcoin enthusiasts. Serious bugs have been detected and the price has fallen dramatically. Right now, there’s no telling how low the currency might plunge. It will depend on how soon amendments are made in implementation and how seriously devastating for the Bitcoin community this turn of events turns out to be.

At this time, our best bet is that Bitcoin will recover following favorable news, for instance announcements that transaction malleability has been fixed. The time at which a move up will take place is hard to pinpoint. We have to stay focused and look for any new news from Bitcoin developers and exchanges.

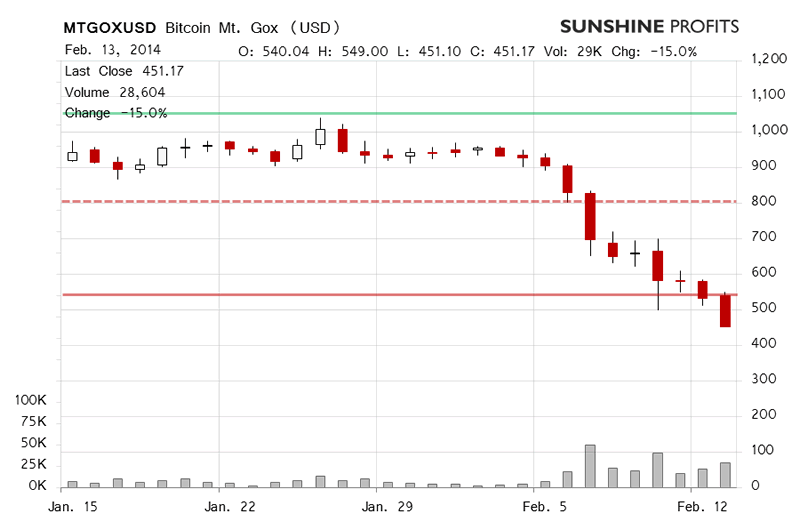

Now, let’s take a look how the situation looks on the chart.

Yesterday, Bitcoin lost 15.0% compared with the previous day’s close. The volume was up and we saw a continuation of the move down. The currency was dancing around the $540 level (solid red line on the chart).

Today, we’re seeing more madness in the market. The currency is already 23.5% down (this is written at around 9:00 a.m. EST) on significantly higher volume than yesterday. Overall, 48,718.9 bitcoins have been traded so far. Right now, Bitcoin is at $345.15, below the Dec. 18 low (the already mentioned solid red line on the chart).

Such depreciation and a move below on significant volume paint a decidedly bearish short-term picture. Yet, Mt. Gox has become increasingly decoupled from other exchanges. Bitcoin trades at above $600 (!) on both Bitstamp and BTC-e, which have had similar problems to Mt. Gox. Bitstamp has given a hint that they will resume withdrawals later in the day, which might partially explain why this is the case, but BTC-e seems to be still having problems as evidenced on their Twitter account by comments suggesting that the exchange is interchangeably up and down.

We’re waiting for news from Mt. Gox, a solution to the transaction malleability problem might contribute to a meaningful reversal, but we don’t bet on it just now. Also betting on further declines seems particularly risky at this time.

Summing up, in our opinion no short-term positions should be kept in the Bitcoin market just now.

Trading position (just our opinion): no positions. We’re waiting for news from Mt. Gox and other exchanges on how the transaction malleability bug will be fixed.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.