Should You Invest in the Marijuana Boom?

Companies / Investing 2014 Mar 03, 2014 - 06:46 PM GMTBy: Casey_Research

By Dan Steinhart, Managing Editor, The Casey Report

By Dan Steinhart, Managing Editor, The Casey Report

I was planning to explore the investment landscape of the burgeoning marijuana industry today, but it looks like the party’s already over.

Appearing before the Maryland Legislature, Annapolis Police Chief Michael Pristoop testified that 37 people died in Colorado on the first day of legalization from overdosing on marijuana.

What a damn shame. With morbid stats like that, the government can’t possibly allow the legalization trend to proceed any further. People’s lives are at stake!

Except they’re not. Chief Pristoop got those stats from a tongue-in-cheek story in The Daily Currant, a satirical newspaper à la The Onion. He believed it to be legitimate, so he cited it during testimony. Despite the fact that exactly zero people in history have died from overdosing on marijuana.

As you surely know, Colorado and Washington recently became the first states to legalize marijuana for recreational use, joining 18 other states that have legalized it for medical use only. Legalization is gaining steam across the US, and that’s unlikely to change—if only because, other than citing fake facts, opponents of legalization have no argument.

Opposition to legalizing marijuana is dwindling for the same reason that opposition to gay marriage is dwindling: there’s no intelligent reason to oppose either one. Unless, in the case of marijuana, you’re concerned with its potential to cause more car accidents. But if those are your standards, we should criminalize beer, cellphones, and makeup, too.

One thing’s for sure: the investment world is enamored with the idea of a brand-new green industry. As an illustration of exactly how hot this infant sector has become, take a look at this screen shot of an email received by a senior Casey Researcher this week. It’s a news release from a mining company, announcing its intent to “diversify” into the legal marijuana business:

An interesting business decision. I’m not sure what synergies exist between mining and marijuana, nor do I have any particular insight into how Next Gen’s management plans to enter the green business. But I applaud its forward thinking.

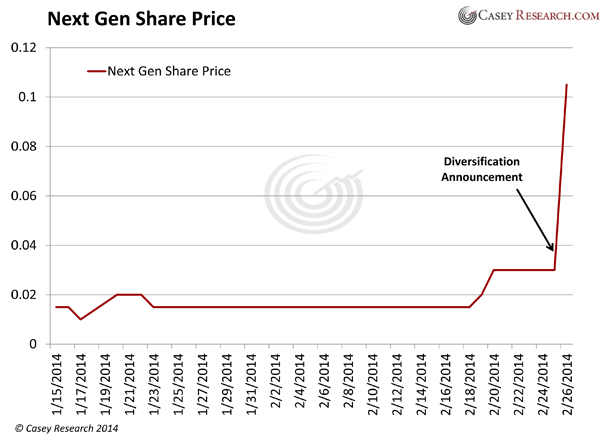

Apparently, so does the market. Here’s how Next Gen’s share price reacted to the announcement:

It soared over 300%, transforming from a penny stock into a dime stock in one day. Again, Next Gen didn’t grow earnings, discover a new gold deposit, or accomplish anything tangible. It tripled its valuation simply by announcing its entry into the marijuana business. That’s what I call a scorching industry.

So, should you put some speculative money into the hottest cannabis stock? Let’s take a quick tour around the burgeoning industry to get a picture of its investment prospects, focusing on five factors…

1) Profits Will Plummet

Had Al Capone been born in any other era, he would not have amassed a $100 million fortune. It was Prohibition that allowed him to earn extraordinary returns in the otherwise standard business of providing alcohol to people.

Likewise, legal purveyors aren’t going to earn anywhere near the spectacular returns that criminals enjoyed when marijuana was illegal. Drug distributors can become filthy rich because dealing drugs requires taking extraordinary risks. One misstep and you go to jail. Or worse, the rival Mexican cartel mows you down. That risk premium is why illegal drugs are so expensive, and why marijuana costs $300-400/oz in the US. But it won’t for long.

How can I be so sure? Because we already have a glimpse into the future. Uruguay legalized marijuana in December, and an ounce of the stuff costs $28 there, less than 10% of what it costs to obtain it the US.

It’s true that the Uruguayan government controls the marijuana industry tightly and set that $28/oz price. But the cost to produce marijuana there averages just $14/oz. So $28/oz is a reasonable guess as to where the price of marijuana would settle if the market were allowed to clear.

Going forward, profit margins won’t be nearly as fat as they were in the past.

2) The Government Will Be Heavily Involved

At least one guy will unquestionably make a killing from marijuana’s legalization. His initials are “U. S.,” and he wears a star-spangled hat.

We’re just two months into legalization, and taxes are already hefty. In Colorado, marijuana is subject to a 2.9% sales tax, plus a 10% tax on retail marijuana sales, plus a 15% excise tax based on the average wholesale price. Washington is no better—it plans to exact a 25% excise tax, plus an 8.75% sales tax.

All told, taxes in these early-adopting states will be in the neighborhood of 30%. And that’s before the feds get their cut (more on that momentarily). Further, taxes are the one exception to the rule, “What goes up must come down.” Someday, tokers might look back longingly at that 30%. After all, the average tax on a pack of cigarettes in the US is 42%.

Last, the marijuana industry isn’t going to be the Wild West. Colorado is working to control pretty much every aspect of the market, as evidenced by its 144-page marijuana Rule Book. You can be sure that other states will follow suit.

3) It’s Still Illegal

Though marijuana is now legal in two states, it’s still illegal under federal law. The Obama administration has said it won’t enforce marijuana prohibition in states that legalize it, as long as those states keep it under control. The federal government maintains the same position on medical marijuana, which, somewhat surprisingly, is also still illegal under federal law.

The feds are moving in the right direction, albeit slowly. Two weeks ago, the Treasury Department issued new rules that open the door for banks to do business with legal and licensed marijuana dispensaries.

Of course, once the feds do get on board, they’ll want a piece of the action. So be ready for even higher taxes.

4) Unsavory First Movers

It’s an unfortunate fact that, because the industry was just decriminalized recently, those best positioned to jump quickly into the marijuana business are those who were already in the marijuana business. In other words: people who were classified as criminals just two months ago.

Not that they were necessarily doing anything wrong by growing and distributing marijuana before it was legal. I’m sure plenty of growers and sellers are good people trying to earn a buck, just like those who grow and sell any other crop.

But as with any emerging industry, the first movers will be those who already possess an intimate knowledge of said industry. And in the case of marijuana, that means people who were running illegal businesses. So if you invest in their companies, you’re entrusting your capital to someone who’s willing to break the law.

As an investor, that should give you pause. Tread carefully, and dial your skepticism up to maximum.

5) Weak Candidates

The investment options in this infant industry are, understandably, limited. We’re a ways off from being able to buy a bushel of hemp on the futures exchange. If you want to invest, you’ll have to go with one of a handful of public companies. And unfortunately, none of them looks compelling.

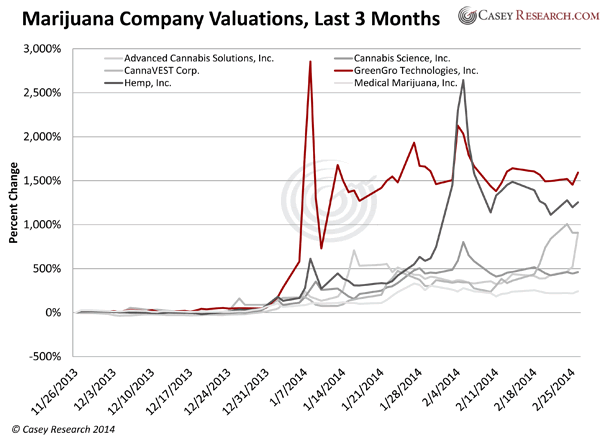

The six companies in the chart below are the purest plays in the marijuana space. Their performance in 2014 is the stuff of legends—the worst performer gained 243% in the last three months:

But dig into their businesses and you’ll soon find that their value comes from their scientific-sounding names, and not from actually making money.

First, the companies are tiny and only trade on the illiquid over-the-counter markets. Before the share price run-up, only one, CannaVEST, had a market cap above $60 million.

What’s worse, most of them don’t have any revenue. And the ones that do generate revenue spend much more than they earn. Not that this is surprising—hardly any business could become profitable in just two months, so we won’t hold that against them. The problem is their valuations: CannaVEST is worth a staggering $1.8 billion today, and most of the others are all in the hundred-million range.

Let’s put it this way: if an entrepreneur walked into the Shark Tank seeking a $1.8 billion valuation for a company that doesn’t make money, Mark Cuban would laugh him out of the room. Speculative money already took these stocks to the moon. By buying one now, your only hope of profiting is for a greater fool to come along and buy it from you at a higher price.

As I see it, because of sky-high valuations, the risks in this blossoming industry far outweigh the potential reward, at least for a retail investor. I’m sure there are some fantastic private deals out there, and if you’re willing to press the flesh and meet some marijuan-trepreneurs yourself, you could make money.

But for non-full-time investors, you’ll want to watch this trend unfold from the sidelines, waiting for either (1) the speculative bubble to pop, so you can pick up some shares for fractions of a penny; or (2) a leader to emerge and demonstrate it can turn a profit.

Here’s a tip, though: If you’re looking for an investment with potentially spectacular gains, I would like to point you to another drug, this one perfectly legal once it’s FDA-approved. What I’m talking about is an impressive biotech startup my colleague Alex Daley, Casey’s chief technology investment strategist, has dug up.

The company is well on its way to launching a breakthrough Alzheimer’s treatment—which, if successful, is sure to be a game-changer for the medical industry. Clinical trial results are due out in early March, and should they be positive, the stock could easily double on the news… so right now is a great time to get in. Find out more about the company and its revolutionary product in this report.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.