Full-Spectrum War, Peak Complexity, and Real Assets

Stock-Markets / Financial Markets 2014 Mar 06, 2014 - 03:49 AM GMTBy: John_Rubino

Not so long ago — say when the Soviet Union was crushing rebellions in Czechoslovakia and Hungary in the 1960s or the US was invading half the Middle East in the 2000s — a big country picking on a small one was mostly a physical activity. Tanks would roll in, buildings and people would be blown up, and that would be that. The aggressor might face the occasional trade sanction from otherwise-impotent “powers,” but this was relatively painless in a world that was not yet financially or technologically integrated.

Not so long ago — say when the Soviet Union was crushing rebellions in Czechoslovakia and Hungary in the 1960s or the US was invading half the Middle East in the 2000s — a big country picking on a small one was mostly a physical activity. Tanks would roll in, buildings and people would be blown up, and that would be that. The aggressor might face the occasional trade sanction from otherwise-impotent “powers,” but this was relatively painless in a world that was not yet financially or technologically integrated.

Contrast those simpler times with today’s Ukraine crisis, where a whole range of new battlefields might soon open up. First is telecommunications, where both sides apparently have the ability to launch a cyber-strike:

Watching for a Crimean Cyberwar Crisis

An info-war is under way as websites are blocked and telecom cables to Crimea are mysteriously cut.Russia’s takeover of the Crimean peninsula has been accompanied by a elements of an information-control campaign: telecom cables connecting that region to the rest of Ukraine have been severed, and the Russian government has moved to block Internet pages devoted to the Ukrainian protest movement.

But so far there is no public evidence of more serious cyberattacks against military or government institutions. Indeed, Russia may need to tread a fine line with such tactics, since they could be seen as acts of war under evolving military doctrine. A report from a NATO group chaired by Madeleine Albright, a former U.S. Secretary of State, has said that if NATO infrastructure were the victim of a cyberattack, it could lead to a physical response such as a bombing.

So far, anyway, “Russia has limited themselves to the things they usually do in the onset of a conflict to try to shape opinion, stifle critics, and advance their own viewpoint,” says James Lewis, director of the Center for Strategic and International Studies, a think tank in Washington, D.C. “They are doing the informational side, which is the opening move in the playbook.” Over the weekend, though, Ukraine’s national telephone company, Ukrtelecom, said that unknown vandals had seized telecommunications nodes and cut cables, severing much of the data and voice links between Crimea and the rest of Ukraine.

Info-war tactics have been seen on the Ukrainian side too. Someone sympathetic to the Ukrainian cause managed to hack the Russian government’s English-language news organ, Russia Today, and substitute the word “Nazi” for “military” in some headlines, with results such as “Russian Senators Vote to Use Stabilizing Nazi Forces on Ukrainian Territory.”

The region has a colorful history of cyberattacks against smaller states and organizations seen as opposing the Kremlin. In Estonia in 2007, the local government antagonized Russia by relocating a bronze statue commemorating Russian soldiers. A flood of attacks against government, media, and telecom websites in Estonia followed, paralyzing them for weeks. (The attacks were “denial-of-service” events, flooding servers with page requests to overload them.) The Russian government denied responsibility, saying “patriotic hackers” were to blame. In 2008, similar events played out when Russia invaded South Ossetia, part of the neighboring republic of Georgia. Again, the attacks—on sites associated with government offices and the embassies of the United States and United Kingdom, among others—could not be provably linked to Russia’s government (see “Georgian Cyberattacks Traced to Russian Civilians”).

Ukraine may be something of a different case. Both Ukraine and Russia are well-known centers of international cybercrime, and both are home to talented computer engineers. But for whatever reason, this sort of mass cyberattack is not happening. “In Georgia you had cyber incidents coördinated with military operations. But the Russians haven’t done that here,” Lewis says. “If violence breaks out in the Crimea, I think they will bump it up a notch.”

The events provide a way for the United States to see what Russia’s cyberwar capabilities are, says Stewart Baker, a former policy chief at the U.S. Department of Homeland Security and now a lawyer in private practice. “From the U.S. point of view, it is an opportunity to watch one country that has integrated cyber [tactics] into their military–Russia–and see what their current doctrines suggest they do,” he said. “But it may be they have decided they don’t need to show what they’ve got, and won’t do it.”

Four years ago, Vladimir Sherstyuk, a member of Russia’s National Security Council and director of the Institute for Information Security Issues at Moscow State University, boasted of significant capacities. “Cyberweapons can affect a huge amount of people, as well as nuclear,” he said in an interview with MIT Technology Review (see “Russia’s Cyber Security Plans”). “But there is one big difference between them. Cyberweapons are very cheap—almost free of charge.”

Even more serious, or at more least wide-ranging, is the fact that Russia owns a lot of dollars and could disrupt the global financial system by dumping them:.

Putin Advisor Threatens With Dumping US Treasurys, Abandoning Dollar If US Proceeds With Sanctions

While the comments by Russian presidential advisor, Sergei Glazyev, came before Putin’s detente press conference early this morning, they did flash a red light of warning as to what Russian response may be should the west indeed proceed with “crippling” sanctions as Kerry is demanding. As RIA reports, his advice is that “authorities should dump US government bonds in the event of Russian companies and individuals being targeted by sanctions over events in Ukraine.” Glazyev said the United States would be the first to suffer in the event of any sanctions regime.“The Americans are threatening Russia with sanctions and pulling the EU into a trade and economic war with Russia,” Glazyev said. “Most of the sanctions against Russia will bring harm to the United States itself, because as far as trade relations with the United States go, we don’t depend on them in any way.”

From RIA: “We hold a decent amount of treasury bonds – more than $200 billion – and if the United States dares to freeze accounts of Russian businesses and citizens, we can no longer view America as a reliable partner,” he said. “We will encourage everybody to dump US Treasury bonds, get rid of dollars as an unreliable currency and leave the US market.” …

To be sure, a high-ranking Kremlin source was quick to distance his office from Glazyev’s remarks, however, insisting to RIA Novosti that they represented only his personal position. Glazyev was just expressing his views as an academic, and not as a presidential adviser, the Kremlin insider said.

That said, putting Russia’s threat in context, the Federation held $138.6 billion in US Treasurys as of December according to the latest TIC data, making it the 11th largest creditor of the US, which appears to conflict with what the Russian said, making one wonder where there is a disconnect in “data.” This would mean the Fed would need just two months of POMO to gobble up whatever bonds Russia has to sell.

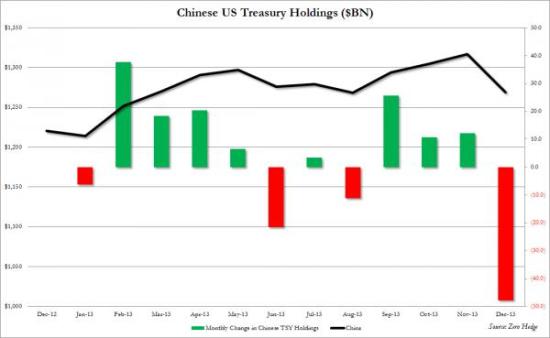

The bigger question is if indeed, as some have suggested, China were to ally with Russia, and proceed to follow Russia in its reciprocal isolation of the US, by expanding trade with Russia on non-USD based terms, and also continue selling bonds as it did in December, when as we reported previously it dumped the second largest amount of US paper in history.

Some thoughts Basically, what this means is that in a world where everyone’s networks are vulnerable and where countries that are emphatically not US allies own a mountain of dollar-denominated paper, small, obscure conflicts can spread in a heartbeat from the physical battlefield to cyber-space and/or Wall Street.

The Ukraine crisis sounds, at the moment, like more of a chance to threaten such attacks than to actually try them. So no cyber or financial Pearl Harbor is likely this week.

But that such things are now on the table and would, should they occur, be sudden, adds yet another layer of complexity to a financial world that already has too many black swans cluttering up its sky. And it raises the appeal of hard assets that 1) don’t reside in accounts that can be hacked and 2) don’t depend on the value of fiat currencies that can simply evaporate. Put another way, the proper response to peak complexity is hyper-simplification via gold, silver, and farmland.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.