The Stock Market’s New Normal: A Wall of Worry

Stock-Markets / Stock Markets 2014 Mar 06, 2014 - 05:39 PM GMT

While I realize that fundamentals are important to investment success I also appreciate the relevance of technical analysis in gauging investor sentiment and in timing entry and exit points.

While I realize that fundamentals are important to investment success I also appreciate the relevance of technical analysis in gauging investor sentiment and in timing entry and exit points.

From the technical point of view the market is in a strong bull trend and would appear to be poised to reach new highs. However, when I research into the fundamental reason behind this strength I find little to support it other than the actions of the FED. To explain what I mean I attach 5 charts from two different sources. They outline real underlying weakness. Thus while I am fully invested in equities at the moment I have hard sell stops in place and I am prepared to quickly and solidly go short should my key technical positions break-down on high volume.

Comparison S & P Index with US Macro Economic Activity: 2013-2014.

Comparison S&P Index with US Jobless Claims: 2012-2014.

Comparison S & P Index with FED Balance Sheet 2013/2014.

(Charts Above Courtesy of Zero Hedge Feb 22. 2014).

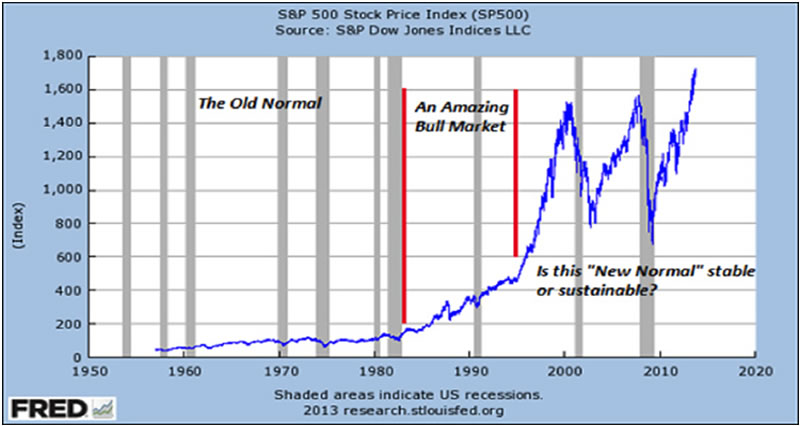

S& P Index 1950 – 2014.

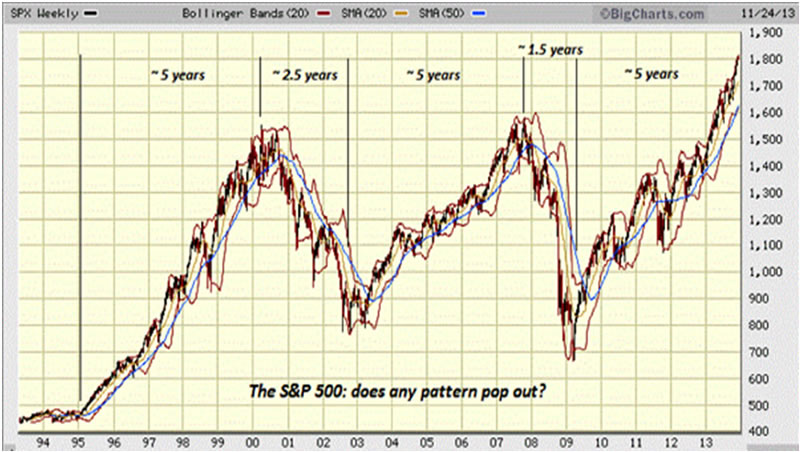

S&P: Bull and Bear Cycles 1994-2014

(Charts Above Courtesy of: “Of Two Minds” Charles Hugh Smith, December 20 2013).

European Youth Unemployment Crisis Continues.

While there is definitely some good news on the European economic front, in that the banking sector appears to be stabilizing, the youth unemployment situation is utterly chronic. Such is the degree of desperation within the populace that the President of Ireland felt compelled to speak out. The following is a report published in the Irish Independent 15th February last:

Irish PRESIDENT Michael D Higgins has warned that society is "sleepwalking into disaster" by failing to tackle youth unemployment and deep-rooted issues including inequality.

He believes the public has been "numbed" by "breaches of trust" arising from the role that institutions and professions played in the economic collapse.

Speaking as he launched a series of seminars to take place across the country this year on ethics, President Higgins told the Irish Independent there was a need to discuss how trust could be restored and what type of institutions were needed for the future.

URGENT NEED FOR ACTION:

"I believe this discourse is not only urgent in Ireland, but essential in Europe if we are not going to abandon the European dream, and allow extremes to be built on top of an exploitation of youth unemployment," he said.

" I think 100 years on from 1914, you could say that Europe sleepwalked into a terrible disaster that was the carnage of World War I. In exactly the same way, if you have a crisis of an economic and social kind, you can't sleepwalk through that, you must act."

"We're in a space where people ask the immediate question of how trust can be restored, and they also ask what kind of institutions can serve us best now.”

"We've seen the return of emigration in Ireland which is deeply distressing for many, even with modern communications where people can Skype each other. All of this means there's a certain sense of deepening catastrophe.”

"It is simply not acceptable that we would drift on and attempt to repair something that has delivered such malignant result, rather we must start anew.”

“I'd like when people go to speak of Ireland abroad, to be able to say that these are the people who are unique insofar as they are all discussing ethics. I believe it would be of enormous value.”

!It's also very consistent with our literary tradition, our peacekeeping tradition, with the best of our Irishness and I think it's well worth it," he added.

President Higgins said he believed it was important to challenge the notion that a "group of experts" should decide the "major decisions" to be taken in people's lives.

He said that experts had "no obligation to explain to you what their assumptions were, what their options are and how they have chosen one policy rather than another.”

Such outspoken honesty has not made President Higgins popular among certain sections of the Irish political elite. One prominent journalist in a national newspaper newspaper actually called for his impeachment.

President Higgins is a hero, his truth must break through into the consciousness of the ruling European Commission. It is obvious to me, and a growing active minority, that unless the current bankrupt European economic policies are modified and modified quickly great social and political instability will explode throughout the entire Euro area. Such a development will make the Ukraine experience the norm rather than the exception. Thus in my view President Higgins is right, we will sleep-walk into a new Pan-European nightmare unless we Europeans wake up to the true reality around us. We must “de-trance” and take action to restore the dream of a new, fair and equitable social covenant that was born out of the devastation of World War II.

By Christopher M. Quigley

B.Sc., M.M.I.I. Grad., M.A.

http://www.wealthbuilder.ie

Mr. Quigley was born in 1958 in Dublin, Ireland. He holds a Bachelor Degree in Accounting and Management from Trinity College Dublin and is a graduate of the Marketing Institute of Ireland. He commenced investing in the stock market in 1989 in Belmont, California where he lived for 6 years. He has developed the Wealthbuilder investment and trading course over the last two decades as a result of research, study and experience. This system marries fundamental analysis with technical analysis and focuses on momentum, value and pension strategies.

Since 2007 Mr. Quigley has written over 80 articles which have been published on popular web sites based in California, New York, London and Dublin.

Mr. Quigley is now lives in Dublin, Ireland and Tampa Bay, Florida.

© 2014 Copyright Christopher M. Quigley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Christopher M. Quigley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.