Copper limit Down in Full Crash Mode, Commodities in Peril

Commodities / Copper Mar 10, 2014 - 02:27 PM GMT DBA has just completed a 65.6% retracement of its previous decline. This is a typical bear market rally propelled by shorts having to cover. This is why shorting the market can be a zero sum game, if profits aren’t taken early. On the other hand, this presents another opportunity to short agricultural products. The decline may be breathtaking, as DBA goes into a Primary Cycle decline.

DBA has just completed a 65.6% retracement of its previous decline. This is a typical bear market rally propelled by shorts having to cover. This is why shorting the market can be a zero sum game, if profits aren’t taken early. On the other hand, this presents another opportunity to short agricultural products. The decline may be breathtaking, as DBA goes into a Primary Cycle decline.

Investing.com - U.S. corn futures fell from a six-month high on Monday, as investors readjusted positions ahead of the U.S. Department of Agriculture’s closely-watched monthly supply and demand report due later in the day.

On the Chicago Mercantile Exchange, corn futures for May delivery fell to a session low of $4.7888 a bushel. Corn prices last traded at $4.8038 a bushel during U.S. morning hours, down 1.65%.

Copper is yet another example of a commodity going into crash mode. It is difficult to say whether it is going into Wave 3 of (3) yet, or not, but the decline should be powerful, nonetheless.

ZeroHedge comments, “It would appear the fecal matter is starting to come into contact with the rotating object in China. Worrying headlines are beginning to mount on the back of real economic events (an actual default and a collapse in exports):

*COPPER IN SHANGHAI FALLS BY 5% DAILY LIMIT TO 46,670 YUAN A TON

*CHINA YUAN WEAKENS 0.46% TO 6.1564 VS U.S. DOLLAR

*YUAN DROPS MOST SINCE 2008

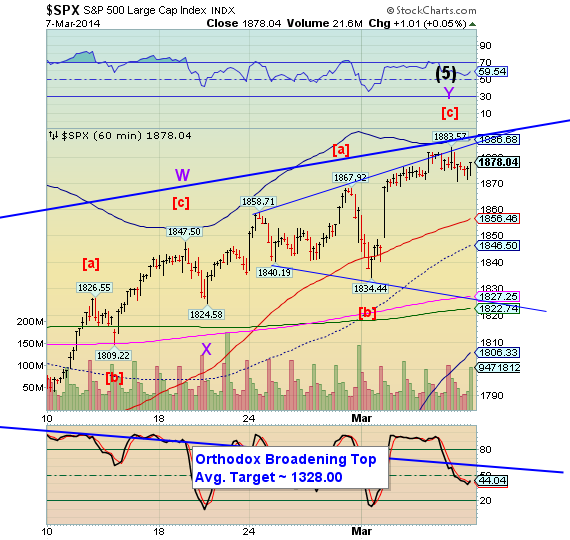

The Pre-market is down, but not convincingly yet. I won’t be available to comment during the day, so use your better judgement. The Orthodox Broadening Top won’t be triggered until it breaks through the lower trendline at 1825.00. The trading bands are narrowing, suggesting a big move ahead, but it may take another day or two to set it up.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.