Stock Market Crash Five-Year Anniversary Has Investors Worried

Stock-Markets / Financial Crash Mar 11, 2014 - 02:38 PM GMTBy: Money_Morning

Tara Clarke writes: The stock market crash this week that occurred five years ago this Sunday marks a solemn anniversary for U.S. stock markets.

Tara Clarke writes: The stock market crash this week that occurred five years ago this Sunday marks a solemn anniversary for U.S. stock markets.

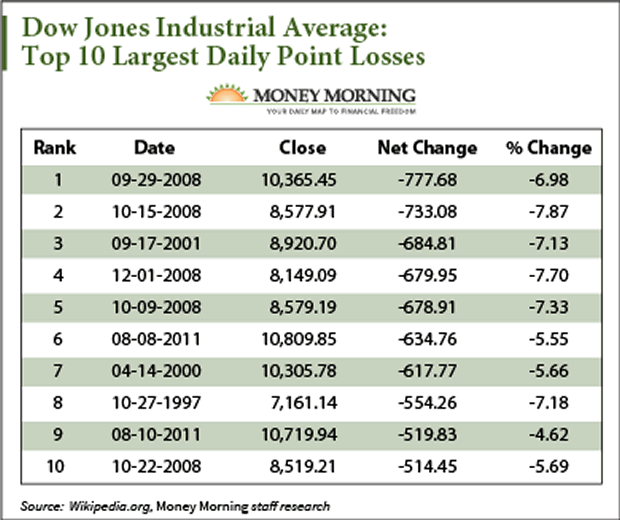

Subprime financial crisis-related events would ultimately become responsible for five out of the top ten biggest single-day Dow Jones Industrial Average stock market crashes, including the top two spots.

After the Dow Jones hit an (at the time) all-time high on Oct. 9, 2007, at 14,164.43, it would fall by more than 50% to 6,594.44 by March 5, 2009 - a little under 18 months later.

U.S. markets hit their lowest point in the crash on March 9, 2009; the 5-year anniversary of that low point is this Sunday.

Since that day, U.S. markets have skyrocketed. The S&P 500 Index is up 174.7% (1,193.85 points), the Dow Jones Industrial Average has posted a 148.35% gain (9,830.98 points), and the Nasdaq is up 235% (3,040.5).

Note: Turn market volatility into profits by learning to trade the market's most powerful index. Here's how...

In fact, as of this week, the bull market - defined as a period in which the S&P 500 gains 20% or more - ranks as the sixth longest since 1928, according to Bespoke Investment Group research.

However, the longer this rally lasts, the greater the anxiety there will be a stock market crash, or at least an official stock market correction - defined as a decline of 10% or more.

"I am very concerned about a correction right now," Money Morning Chief Financial Strategist Keith Fitz-Gerald said on Friday. "The past few weeks have seen higher prices and lower volume. This is like climbing a mountain into thin air - every step higher gets harder. Sooner or later, the markets are going to have to take a breather and turn around."

Here are the three signs that have investors worried we're due for a stock market crash or correction soon...

First, many investors are nervous about the duration of this bull market.

Most last from 50 to 67 months. The bull market that began in 1982 lasted about 60 months before the 1987 stock market crash. The bull market that began in 2002 lasted 60 months to a high in 2007.

And eerily, yesterday (Thursday), our current bull market hit its 60-month anniversary. The past two bull markets were immediately followed by crushing bear markets, and 2009's fallout was the biggest since the Great Depression.

Second, investors are nervous about the lack of market correction.

A market correction hasn't happened since October 2011 - that's a 29-month stretch.

Historically, corrections occur every 18 months, according to S&P Capital IQ.

"The longer we go without resetting the dial, the greater the likelihood of a steeper correction, and the greater likelihood that it becomes a bear market," S&P Capital IQ chief equity strategist Sam Stovall said to USA Today.

The third and final sign making investors wary of a stock market crash is U.S. Federal Reserve action. Since initiating its quantitative easing (QE) program in 2008, the Fed has managed to plump its balance sheet to somewhere over $4 trillion.

In December 2013, the Fed announced its intent to begin unwinding QE by tapering its monthly bond purchases. Since January, the Fed has cut its bond buying by $10 billion a month (to $75 billion).

That tapering is likely to negatively impact equity markets as fewer U.S. Treasurys and mortgage-backed securities are purchased each month.

Even though investors may give pause to the possibility of a stock market crash or correction, they should nonetheless stay invested - just with caution.

"You have to be in it to win it. I am urging people to raise stops and play very conservatively right now. But, do stay ready to buy," Fitz-Gerald said. "Going forward, look to financials, tech, healthcare, and defense stocks."

Join the conversation on Twitter on market #volatility in 2014, and be sure to follow @moneymorning.

Volatility has certainly defined the markets in the early weeks of 2014. But rather than locking in losses on the sidelines, here's how to take advantage of the profits that the boom/bust crowd is leaving behind...

Source : http://moneymorning.com/2014/03/11/dont-trust-broker/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.