Bank of England Mortgage Backed Securities Pricing System

Interest-Rates / Credit Crisis 2008 Apr 27, 2008 - 05:20 PM GMTBy: Mick_Phoenix

Welcome to the Weekly Report. This week we look ahead to the new pricing system for Mortgage Backed Securities and Asset Backed Securities created by the Bank of England, developments in bonds and yields and why the Federal Reserve is central to current yield changes. We ask if the credible policies are leading to increased inflation expectations and look for global reaction. We update the long term trend update for the Dow, FTSE and Gold.

Welcome to the Weekly Report. This week we look ahead to the new pricing system for Mortgage Backed Securities and Asset Backed Securities created by the Bank of England, developments in bonds and yields and why the Federal Reserve is central to current yield changes. We ask if the credible policies are leading to increased inflation expectations and look for global reaction. We update the long term trend update for the Dow, FTSE and Gold.

By now I doubt there is an investor or trader worldwide who isn't aware of the Federal Reserve, Bank of England, Bank of Canada, Royal Bank of Australia and the ECB have been doing in their efforts to infuse liquidity and arrange swaps or borrowings of AAA Government bonds to replace credit paper/notes affected by the loss of confidence in its ability to avoid default events.

This week Mr King at the Bank of England made it clear (how unusual is that!) that the Special Liquidity Scheme it has introduced will last for at least 3 years and if it is required to expand beyond the initial £50Bn then it will happen. The new facility is in addition to this, quoted from the B of E site (it is a large quote but contains some vital information):

Central bank operations

Banks routinely borrow money from central banks in exchange for assets. They do so to manage their day-to-day cash needs as they lend and borrow funds. In response to the stresses in financial markets, central banks worldwide have extended their lending facilities.

Since August, the Bank of England has increased by 42% the amount of central bank money made available to financial institutions. It has increased from 31% to 74% the proportion of its lending to the market that is for a term of at least three months. Since December, the Bank has also widened the range of high-quality assets accepted in its 3-month lending operations to include mortgage-backed securities.

The stock of outstanding lending against that wider range of collateral is £25bn. These changes have aimed to alleviate the problem of financing the large overhang of illiquid assets on banks' balance sheets.

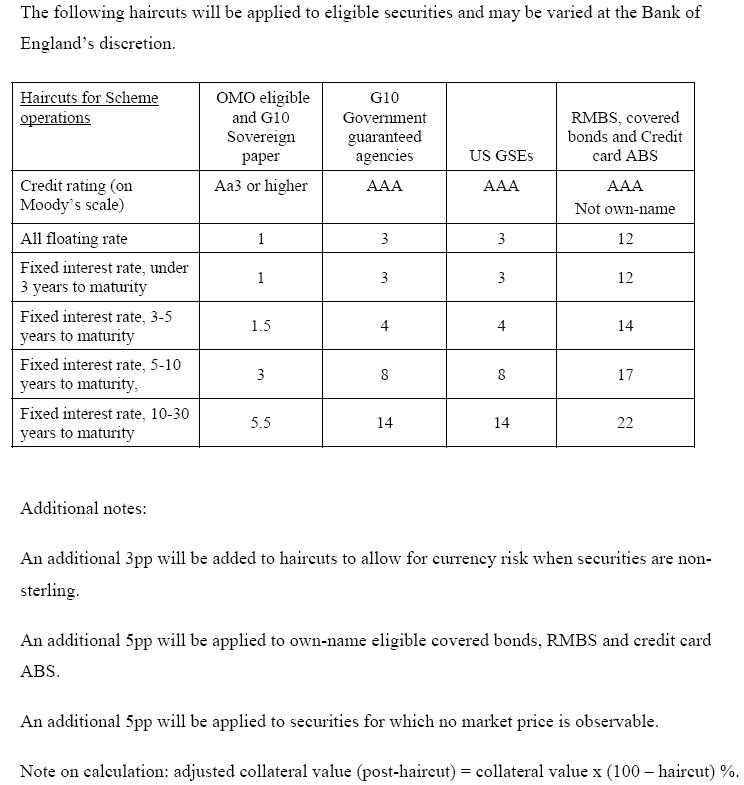

The Bank of England will decide the margin between the value of the Treasury bills borrowed and the value of the assets banks are required to provide as security. For example, if a bank were to provide £100 of AAA-rated UK residential mortgage backed securities, it would, depending on the specific characteristics of the assets, receive somewhere between £70 and £90 of Treasury Bills. A complete list of margins is included in the market notice.

The main category of assets will be securities backed by residential mortgages. Securities backed by credit card debt will also be eligible. These assets will be high quality - rated as AAA. If the assets were to be down-rated, banks would need to replace them with AAA assets. The facility will not accept raw mortgages and none of the underlying assets can be derivative products. The Bank of England routinely accepts assets denominated in currencies other than sterling. It will not accept securities backed by US mortgages.

The Scheme is designed to deal with the overhang of existing assets on banks' balance sheets, not to create artificial incentives to undertake new lending. To that end, only securities formed from loans existing before 31 December 2007 will be eligible for use in the Scheme.

What's so important or vital you may ask? Well, how about the pricing of AAA rated Mortgage and Credit card backed securities, valued at 70-90p on the Pound. Surely that sets a mark to market maximum price for the next 3 years. Borrowing using AAA mortgage and credit debt as collateral just got expensive. Borrowing using anything else as collateral is next to impossible. Borrowing using collateral "invented" after 31 Dec 2007 isn't allowed to be used in the Special Liquidity Scheme. It also means the best route to move losses off the books is to deal with the B of E and it's not free:

Banks will be required to pay a fee to borrow the Treasury Bills. The fee charged will be the spread between the 3-month London Interbank interest rate (Libor) and the 3-month interest rate for borrowing against the security of government bonds, subject to a floor of 20 basis points.

That though is not the most important point raised by the B of E. They have refused to take ANY securities backed by US mortgages. The US just got downgraded by the Old Lady. Now if the B of E won't deal in US mortgage securities, why would any UK bank buy them or accept them as collateral on their lending? Without the "King Put" the risk is just too great.

Can you smell contagion? It gets worse, not only has all US MBS been downgraded to junk but ANY derivative of ANY MBS or ABS is not acceptable as a swap for Gilts.

Here though is the clincher, US Asset Backed Securities backed by credit cards and rated AAA, are acceptable. US credit card debt is more valuable than US mortgage debt. So, who does the B of E rely on for the ratings criteria?

Credit ratings as set out above must have been provided by two or more of Fitch, Moody's, and Standard and Poors.

But the Old Lady has one more swift kick to deliver, it maybe the nastiest of all:

Eligible securities will be valued by the Bank using observed market prices that are independent and routinely publicly available. The Bank reserves the right to use its own calculated prices. If an independent market price is unavailable, the Bank will use its own calculated price and apply a higher haircut. The Bank's valuation is binding.

The haircuts can be considerable as seen by this table:

The US GSE is for conventional debt.

It looks to me that the use of the rating agencies in this matter is very limited. The Bank has decided to make a market on the assets swapped for Gilts, regardless of market conditions and not rely on ratings. Just when you thought it was safe to dump your toxic waste, you realize you could get margin called on it. Of course, if the B of E are marking to market, what's the reasoning for anyone else not to do so? In an attempt to get around a moral hazard that we know is troubling Mr King, the Bank may just have initiated the very scenario they were trying to avoid.

Sometime ago I said that the Facilities set up by the Federal Reserve had an inherent flaw, one that could be taken advantage of by speculators.

To read the rest of the Weekly Report, go to www.caletters.com and sign up to the 14 day free trial.

By Mick Phoenix

www.caletters.com

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.