Cold Warning - When Market Bubbles Burst

Stock-Markets / Liquidity Bubble Mar 26, 2014 - 10:28 AM GMTBy: Raul_I_Meijer

You can hurt a few handfuls of Putin’s people for a few days with sanctions like closing their Visa accounts. But if you threaten to buy less Rosneft oil and Gazprom gas, why should they really care? It’s not as if there’s a glut of either available. Any pain will be short lived. Moreover, it’s all but certain that such actions will drive Russia and China closer together, and is that such a dream scenario for America and Europe?

You can hurt a few handfuls of Putin’s people for a few days with sanctions like closing their Visa accounts. But if you threaten to buy less Rosneft oil and Gazprom gas, why should they really care? It’s not as if there’s a glut of either available. Any pain will be short lived. Moreover, it’s all but certain that such actions will drive Russia and China closer together, and is that such a dream scenario for America and Europe?

Of course there’s plenty of folk in the US Senate and in Brussels who relish the prospect of some sort of limited warfare with Russia, but they’re mostly fossilized entities, whether physically and/or mentally. There will be some such voices in Russia too, and there are many in Ukraine, where long festering hatred, by the looks of it, is still one of the main reasons people get out of bed in the morning.

Yulia Tymoshenko, former PM and prime candidate for prime minister again, was caught on tape uttering some real ugly threats against ethnic Russians, like nuking all 8 million of them. And that’s the kind of person the west is preparing to help back in the saddle by unleashing more sanctions and further isolating Putin? Really, we’d rather go there then seek common ground and peaceful solutions?

It would seem that many of the older Senators and EU career bureaucrats are under the impression that all that has changed since the cold war is that Russia was weakened. But if you take one look at what happened to western economies, debt levels and growth rates since then, it would be obvious to what extent the west, too, is considerably weaker.

It’s nice to draw up plans to be less independent on Russia for energy, but there would have to be alternative sources of supply for such plans to work. And they don’t seem to be available, or even if they are, at least 5-10 years away. How much more can bankrupt Europe afford to pay for its oil and gas delivery in the meantime, especially given the fact that it will also have to invest heavily in the infrastructure for the so far almost exclusively theoretical new energy streams?

Is all the chest thumping truly in the best interest of the average European or American? Or is this just the pursuit by a bunch of wrinkled demi-psychopath wannabees, of a faded dream of times gone by, still shot in black and white, that “we” have a god-given right to rule the entire planet and suck up all its resources for our own pleasure, swiping a few scraps off our tables for the rest of humanity? Do the not yet wrinkled rest of us still want to pursue that dream?

At the height of the cold war, if you recall, America still had a middle class, and the majority of the population looked forward and worked hard to achieve a better life for their children. Want to try poll Americans on that now? Want to try ask the Greeks and Italians how they see their children’s futures? The only reason the western elites care enough about reviving growth to risk going to – economic or actual – war over it, is to strengthen their own positions, not those of the increasingly downtrodden they purport to represent.

In China, the government and banking world worry, among an obvious slew of other issues, about the slowing pace of urbanization.

“The pace of migration of rural Chinese to cities, a dynamic hailed by Premier Li Keqiang as key to the nation’s development, is set to slow by a third in coming years …” [..] “In the past 30 years we turned farmers into factory workers, triggering massive gains in productivity and hence growth …”.

One would like to add: yeah, and pollution. What’s wrong with people living in the country side, with less pollution? It hurts economic growth numbers, that’s what’s wrong. But isn’t pollution one of the spear points in Chinese government policy too? Yes, it is, but like the west, China wants to have the growth first, and then clean up the mess afterwards. Whether that’s at all possible is much less of a concern. The leadership prefers a dirty world where it can maximize its hold on power to a cleaner one where it has less. It’s the same story wherever and whenever you look.

The financial world lives in hopeful expectation of more stimulus in China and Europe, stimulus that if it comes will originate only in lousy economic numbers. It’s not a mistake by central banks that lies at the origin of these stimulus measures, they simply serve the interests of the people who actually do benefit from the measures, not the ones who pay for them. That QE et al cannot lift an economy out of the doldrums is as clear to central bankers as it is to any single working neuron. But it is a great way to transfer wealth from the bottom to the top.

In China, the people’s view of economics is much less obfuscated than it is in the west. When real estate prices and trust investments start falling, the Chinese will take to the streets demanding the government give them what they feel they deserve after having moved to smog filled cities to do mind numbing jobs. But while China’s development model is as much of a bubble as ours, after the smoke has cleared, the country will rise up again under different leadership to take on a much bigger role in the world than it’s ever had in modern times.

Are we still going to be chest thumping by then? Or will we have learned to recognize the traits that make the leaders handpicked for us to vote for, unfit to represent out interests? I think that the poorer we get, and that process will forcibly continue, the more likely we are to pick the less competent ones. As long as they use the right words to promise us better days, and they look like they could work in TV, they got the job.

And they can get into another cold war with China and Russia and whoever else challenges our broken black and white dreams by then.

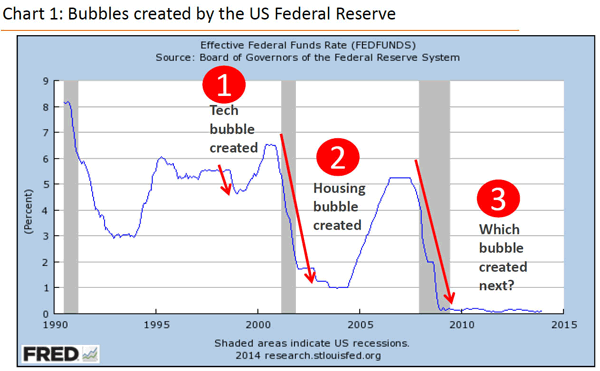

But granted, that’s the future. Here’s a great graph depicting where we are today, courtesy of IceCap:

Guess maybe our bubbles are not big enough yet?

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.