Bitcoin Price False Turnaround?

Currencies / Bitcoin Mar 26, 2014 - 10:36 AM GMTBy: Mike_McAra

Keeping it short: we don’t support any short-term positions at the moment.

Keeping it short: we don’t support any short-term positions at the moment.

There is a growing market of services around Bitcoin and the world of finance seems to recognize the opportunity this presents. The Wall Street Journal reported a new Bitcoin-related derivative instrument was being developed by Tera Group Inc. The aim of the company is to provide a first Bitcoin swap.

Such an instrument would possibly make it easier for the players in the Bitcoin market to hedge their exposure to the currency (or gain exposure, depending on the type of the player). The first contract will be a 25-day transaction between two U.S. companies from the financial sector. One of the unnamed parties will hope to profit from the appreciation of Bitcoin, the other one will limit its downside.

Apart from coming up with this transaction, Tera has reach out to the Commodity Futures Trading Commission (CFTC) to list Bitcoin derivatives on the regulated market. The structure of the Bitcoin swap is supposedly synonymous to the structure of non-deliverable forwards, which could make it easier for the CFTC to accept the contract. The CFTC hasn’t expressed their opinion on the matter.

It seems that the Bitcoin market is getting the same kind of attention any market would from derivatives operators. Bitcoin swaps or futures could be particularly useful for retailers who could then limit their exposure to Bitcoin price swings. This might be important if Bitcoin doesn’t actually lose any of its wild volatility.

While retailers appreciate the ability to take Bitcoin payments without paying processing fees to credit card companies, they do not necessarily want to bear the exchange rate risk – this is not their area of expertise, and Bitcoin can swing up and down quite significantly. So, retailers might be interested in derivatives with Bitcoin as the underlying asset.

On the other hand, swaps or forwards are individual contracts and, as such, might be relatively expensive to enter. The possibility to launch cheaper regulated instruments, e.g. futures, could be what the retailers are looking for. The extent to which they would be actually interested in both regulated and unregulated Bitcoin derivatives remains to be seen.

At this point, let’s move on to the charts today.

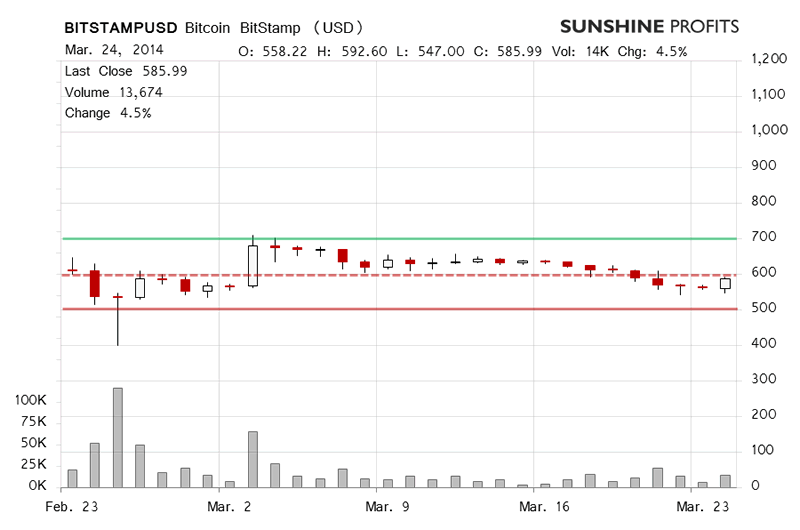

Yesterday saw a reversal on strong volume on BitStamp. The currency went 4.5% up compared with the previous close. The action seemed very bullish but Bitcoin failed to close above $600 (dashed red line on the chart). Based on yesterday alone, we can’t quite proclaim that the move down is over.

This is reinforced by the action today so far (this is written before 11:30 a.m. EDT). Bitcoin has gone 1.5% down. The volume hasn’t been very heavy yet but this may change as the day is far from being over. We’re not seeing a confirmation of a move up, though. It looks more like the move up has run out of steam.

At this point, the short-term outlook remains unchanged, more bearish than not but not bearish enough to go short just yet. If we don’t see any more appreciation today, we will likely consider going short.

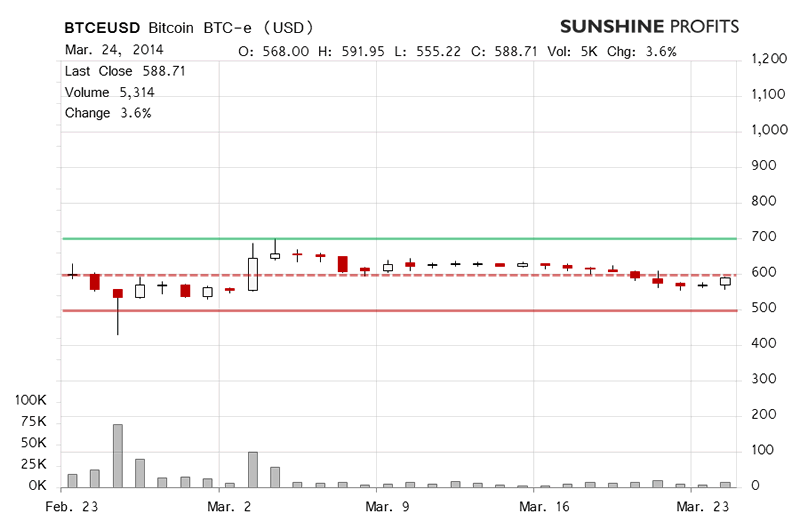

The situation is fairly similar on BTC-e. If anything, Bitcoin gained less yesterday and has lost marginally more today than on BitStamp. The volume was relatively high yesterday and it seems that it might be heavy also today (but not extremely heavy by what we’ve seen until now).

Both yesterday and today, Bitcoin has failed to go above $600 and if it fails to close above this level, we most probably won’t see yesterday’s action as a valid reversal. If Bitcoin fails to appreciate today, the short-term situation will become bearish and we’ll think of going short.

Summing up, in our opinion no short-term positions should be kept in the Bitcoin market now.

Trading position (short-term, our opinion): no positions. If Bitcoin closes the day in the red, we’ll consider shorting.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.