Will Alibaba Destroy the World?

Stock-Markets / China Credit Crisis Mar 26, 2014 - 12:46 PM GMTBy: PhilStockWorld

"The Word ends not with a bang, but a whimper."

"The Word ends not with a bang, but a whimper."

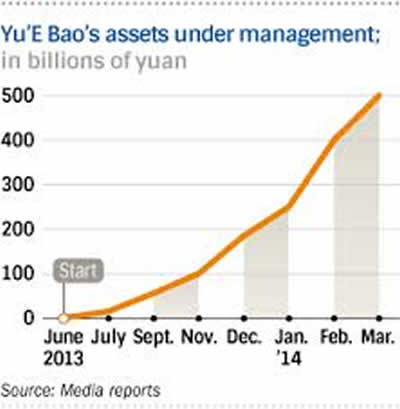

As TS Elliot noted: "Between the idea and the reality, between the motion and the act falls the shadow." Whether or not Elliot was referring to "shadow banking" in 1925, 100 years later his words certainly ring true as "Vampire Internet Funds" like Alibaba's Yu'E Bao are draining liquidity out of China's financial system at an alarming rate.

In less than on year, 81M people have opened Yu'E Bao accounts at an average of $1,000 each, totaling $80Bn of deposits. Compare that with only 67M investors in China's entire stock market – after 23 years of operation! Yu'E Bao gives depositors 6% interest and allows the funds to be used at any time, making payments by smart phone or straight withdrawls anywhere in the World vs 0.35% in a Chinese bank, subject to all sorts of restrictions.

In less than on year, 81M people have opened Yu'E Bao accounts at an average of $1,000 each, totaling $80Bn of deposits. Compare that with only 67M investors in China's entire stock market – after 23 years of operation! Yu'E Bao gives depositors 6% interest and allows the funds to be used at any time, making payments by smart phone or straight withdrawls anywhere in the World vs 0.35% in a Chinese bank, subject to all sorts of restrictions.

People gather in front of a branch of Jiangsu Sheyang Rural Commercial Bank, in Yancheng, Jiangsu province, March 25, 2014. REUTERS/StringerDeposit money draining away from the banks is freaking China out and it won't be long before it starts spreading (because it makes perfect sense for depositors) and suddenly we will end up with either a global liquidity crunch OR banks will have to begin paying fair market rates for deposits, which would also lead to a major crisis as rates rise sharply.

There's already been a run on the Jiangsu Sheyahg Rural Commercial Bank (picture above, yesterday) and you can ignore it if you want to – the way you ignored Northern Trust in 2007 or the Icelandic Banks that same year – who cares, right? It's too far away to affect you, isn't it? Our bankers are far too smart to get caught up in that kind of mess, aren't they?

Legislators, Bankers, Government Officials and, of course, Billionaires were invited to discuss this issue at the National (rich) People's Congress in Beijing (and let he who has a Congressperson not in the top 10% cast the first stone!) where Chinese Banksters, ironically, called for MORE REGULATION:

“Now it’s time to step up regulation for the industry’s own good,” Yang Kaisheng, a former president of Industrial & Commercial Bank of China Ltd. and now an adviser to the China Banking Regulatory Commission, said in an interview this month at the National People’s Congress in Beijing. “The emergence of Internet financing is inevitable in China because it serves the grassroots better, but whoever is engaging in financial services, no matter online or off-line, must comply with regulations. If someone stays out of oversight for too long, the chances of it disrupting financial stability will increase significantly.”

The central bank, in its first regulation of Internet financing, on March 14 blocked plans by Alipay and Tencent to offer virtual credit cards and payments using so-called Quick Response codes, citing security risks. The codes are black-and-white squares containing product or company information similar to bar codes that can be read by smartphones.

They're going to lose control of this eventually. If Ali et al are able to offer credit card terms along with the current payments system, it will be Trillions moving out of banks, not Billions. World War III won't be America and Russia or China, it's going to be a financial war:

Yu’E Bao and other money-market funds could raise banks’ funding costs by three to five basis points and reduce their profit by 1 percent to 2 percent in 2014, according to Barclays’s Yan. In five to 10 years, they could cut banks’ profit by as much as 17 percent, she wrote.

“Why is all the money going into Yu’E Bao? Because banks fail to pay what savers deserve. You can’t fool them,” Ma Weihua, a former president of China Merchants Bank Co., said during a group discussion at the National People’s Congress. “Yu’E Bao is forcing banks to face up to the challenges of interest-rate deregulation.”

The drain from the banks prompted Niu Wenxin, a managing editor and chief commentator at China Central Television, to attack Yu’E Bao in his blog on Feb. 21, drawing 11.5 million views and sparking nationwide debate.

“Yu’E Bao is a vampire sucking blood out of the banks and a typical financial parasite,” Niu wrote. “It didn’t create value. Instead it makes a profit by pushing up the whole society’s borrowing costs. By passing some teeny-weeny benefit to the public, it makes massive profit for itself and lets the entire society foot the bill.”

In other words "Hey, it's our (Bankster's) job to pay 0.25% on deposits and charge 9% for loans!"

F them all!

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2014 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.