The Great Unwashed American Energy Independence

Politics / Energy Resources Apr 09, 2014 - 05:15 PM GMTBy: Raul_I_Meijer

The eurocrisis is over, the US Navy makes fuel from seawater, and America will be energy independent by 2037, according to the EIA. Boy, where do we begin? We’re getting flooded with an increasing amount of sheer nonsense wrapped in sheep’s clothing, and it’s hard to keep up. We not only live in a pretend economy, by now most of what we think we see isn’t really there at all. Indeed, there’s not even a there there anymore. Look, if you believe that the Navy can power its fleet with fuel made from seawater, you should probably know there’s a lot of gold in the oceans as well. Which means that you are potentially very wealthy. All you have to do is dig it out.

The eurocrisis is over, the US Navy makes fuel from seawater, and America will be energy independent by 2037, according to the EIA. Boy, where do we begin? We’re getting flooded with an increasing amount of sheer nonsense wrapped in sheep’s clothing, and it’s hard to keep up. We not only live in a pretend economy, by now most of what we think we see isn’t really there at all. Indeed, there’s not even a there there anymore. Look, if you believe that the Navy can power its fleet with fuel made from seawater, you should probably know there’s a lot of gold in the oceans as well. Which means that you are potentially very wealthy. All you have to do is dig it out.

On a slightly – but only so – more serious plane, do you guys realize that the folks at the EIA get paid hefty salaries to produce reports like the new one that predicts the US will be energy independent in a mere 23 years? I kid you not. See, I think the US propaganda machine for Ukraine is insane and unworthy, but then you get this on top of all that.

US To Become Oil Independent By 2037 – EIA (RT)

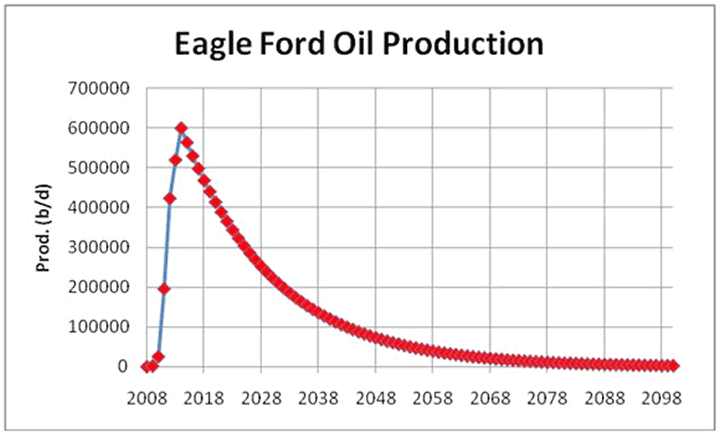

US may stop importing oil by 2037 as abundant domestic crude supplies, including North Dakota’s Bakken field and Texas’s Eagle Ford formation, may push production to the level of consumption, according to the US government. The US Energy Department’s branch that collects and analyzes data – the Energy Information Administration (EIA) says that within 23 years the world’s largest economy may become energy independent …

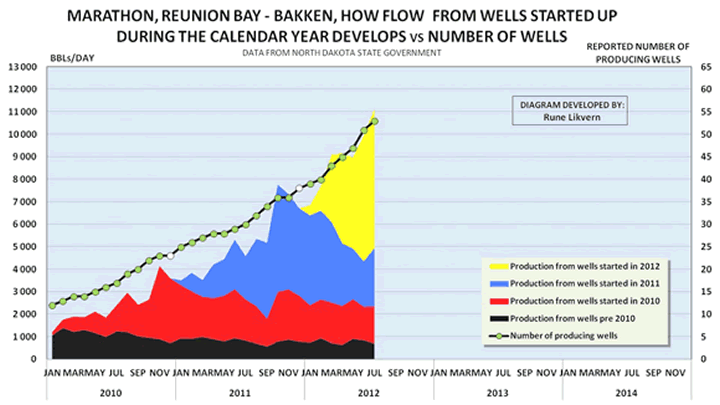

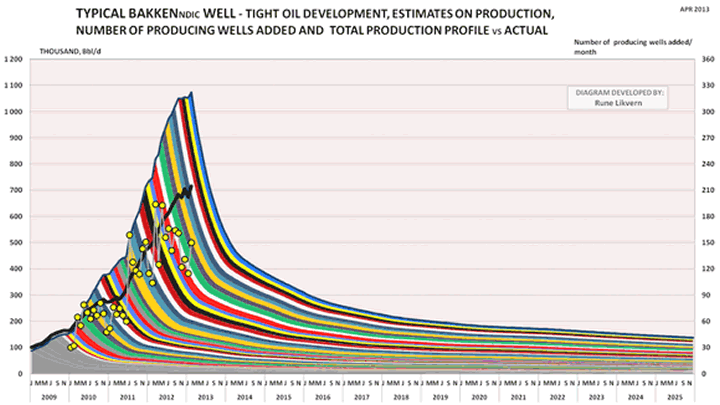

Alright then, once again, there we go. First, Rune Likvern on decline ratio’s in the Bakken Play’s Reunion Bay:

Do note the increase in total well numbers, which sort of mask the decline per well.

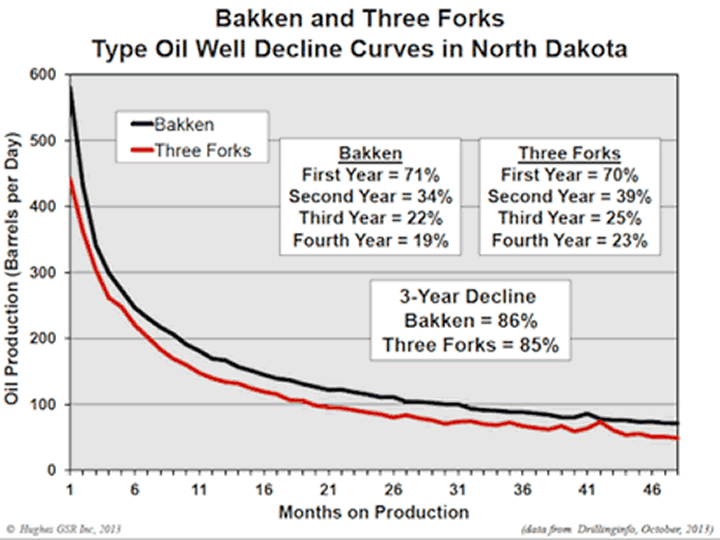

Then, Chris Hughes on the Bakken and Eagle Ford plays:

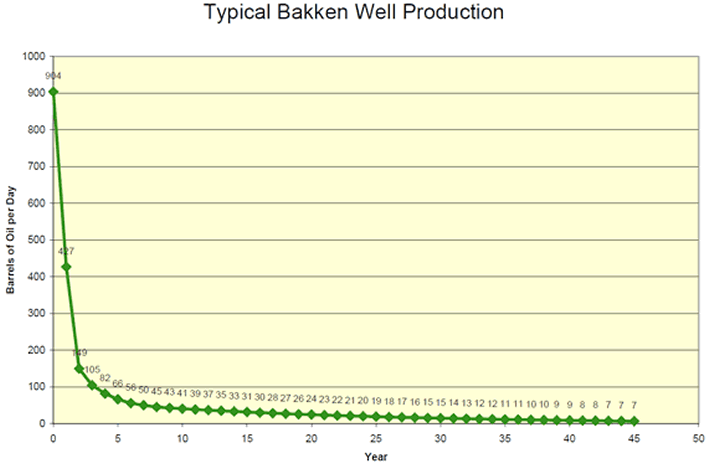

And the North Dakota government on production in a typical Bakken play well:

We have Olivier Blanchard on total Eagle Ford production:

And Likvern again on accumulated typical Bakken well production:

Are there any further questions on for instance how many wells would have to be drilled to overcome the decline rates? In Bakken’s Reunion Bay (1st graph) the number increased five-fold in 2.5 years. If that rate continued, and there’s little to no reason to assume otherwise, there are some 50,000 wells in that play today. At an average price of $8 million per well, that’s $400 billion.

What, you thought Shell and Exxon left shale alone for no reason? If the deplete/invest trend holds up till the EIA dream date of 2037, we’re talking millions of wells, an utterly ravaged landscape and trillions of dollars of “investment”. You think that’s going to happen? Thing is, because of the depletion rate of shale wells, the investment would have to continue for another 20 years, at the present rate, for shale to just play even. And that’s provided those millions of new wells will be drilled. By whom?

The real question is: Why do US government agencies issue reports like this? What are they seeking to achieve? The entire shale industry has been fully exposed by the likes of Rune Likvern and Chris Hughes for quite a while, so it all looks to be purely a propaganda game, where the mass media convey to their audience whatever it is the government would like them to believe. But that just turns the US into Bizarro world more every step of the way. And whatever that may be, or why it may be happening, it’s certainly not going to solve the problems, energy or finance, of the American people. Who happen to pay those cushy salaries the EIA “scientists” are on the payroll for.

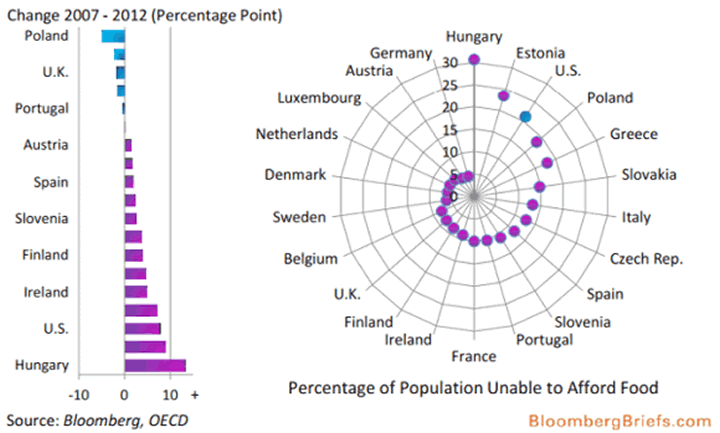

Of course this all plays wonderfully into the whole tale of the US exporting LNG to Europe so it can free from itself from Russian gas dependence. We get it, boys. And that’s at least part of why it’s fed through the media to the Great American Unwashed. More of whom go hungry among OECD nations than in any other country save Hungary and Estonia. Let the eagle soar. So we can shoot it and feed our children.

What is this? Is some foreign desert they have no reason to be in the only place where America’s best and bravest will show what they think they’re made of? Can’t show courage at home anymore? What was that number? I think it was that 8000 US soldiers got killed in action abroad since 9/11, while 100,000 committed suicide. I mean, honestly, people, where do you see this going?

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.