Is China Economy Cracking?

Economics / China Economy May 02, 2014 - 10:06 AM GMTBy: Investment_U

Sean Brodrick writes: Signs of a near-term slowdown in the Chinese economy are apparent. And China's economy is so large and intricate that any slowdown there could have a big impact on investors here in the U.S.

Sean Brodrick writes: Signs of a near-term slowdown in the Chinese economy are apparent. And China's economy is so large and intricate that any slowdown there could have a big impact on investors here in the U.S.

In particular, I'm concerned about:

- Agriculture. With a fifth of the world's population but only 8% of its farmland, China is America's largest agricultural export market.

- Coal and industrial metal prices. China is coming down harder on big polluters, and on the production and use of metals. That could fuel volatility in iron, lead, aluminum, copper and coal prices.

- Oil Prices. If China's growth slows enough, that will weigh on global oil prices.

First quarter growth was below annual targets in 30 of 31 Chinese provinces, even though the central government lowered those goals from last year. And there was shocking underperformance in provinces that are resource-dependent and/or manufacturing centers.

For example, Inner Mongolia saw GDP growth dipping to 7.3% in the first quarter from 9.9% a year earlier. Inner Mongolia provides one-third of China's domestic coal. Heilongjiang saw an expansion of 4.1% compared to an 8.5% target. Heilongjiang's industries include coal, petroleum, lumber, machinery and agriculture. The province of Heibi saw its economic growth drop to 4.2% in the first quarter from 8.2% in the fourth quarter of 2013. Heibi is China's top steel producer.

Here's what's going on: China's central government is determined to rein in overcapacity and pollution. The crackdown is affecting the nation's economy more than its central planners anticipated.

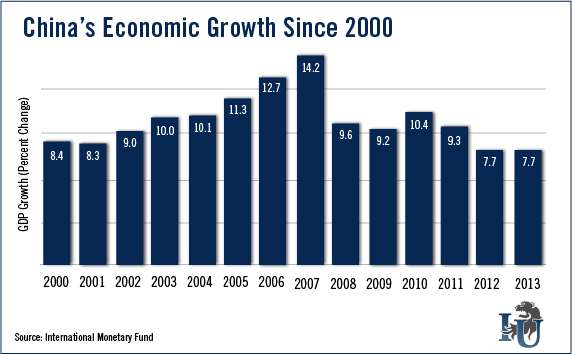

China's economic growth was already expected to slow to 7.3% in the second quarter from 7.4% in the first quarter. Sure, the U.S. would love that kind of economic growth. But we have a more mature economy. For China, this would be the weakest showing in 24 years.

China can work out its problems. And I'm sure, longer term, it will. But we may not have seen the worst of the short-term impact.

For example, China's announcement that it plans to get tougher on loans for iron ore imports caused iron ore futures there to drop 5% on Monday.

I'll also be watching China's imports of grains. The U.S. Department of Agriculture predicts that China will continue to be America's top agricultural export market in 2014, taking an estimated $25 billion of its agricultural products. But earlier this month, a U.S. grain-industry group said U.S. corn exports to China are down 85% from the same period last year.

The Chinese government's crackdown on both production and use of metals also bears watching. It does not bode well for prices of those commodities. As for coal, we'll have to see if more Chinese coal production is cut than coal-burning factories are shut down.

If there's any good news, it's that a slowing Chinese economy will probably lower prices at the U.S. gas pump. That's because U.S. refiners sell more and more product into the global market. Yet that, too, is a troubling sign for energy investors.

If more bad news comes on China, we could see a mass of investors head for the exits.

Good investing,

Sean

Source: http://www.investmentu.com/article/detail/37105/economic-slowdown-is-china-cracking

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.