The Upcoming Dawn of the 60-Year Inflation Cycle

Economics / Inflation May 02, 2014 - 11:01 PM GMTBy: Clif_Droke

The latest action by the Federal Reserve is part of a policy shift, the most important one in fact of the last five years. The Fed's plan for unwinding its quantitative easing (QE) stimulus coincides with the bottom of the 60-year cycle of inflation/deflation. It couldn't be happening at a better time and the results will be either very positive or extremely negative, depending on where you stand when the smoke clears.

The latest action by the Federal Reserve is part of a policy shift, the most important one in fact of the last five years. The Fed's plan for unwinding its quantitative easing (QE) stimulus coincides with the bottom of the 60-year cycle of inflation/deflation. It couldn't be happening at a better time and the results will be either very positive or extremely negative, depending on where you stand when the smoke clears.

On Wednesday, the Fed announced a further reduction of monthly asset purchases by $10 billion to $45 billion, further reducing the scope of QE3. The press lauded the reduction as a show of faith by the Fed in the U.S. economy despite a "dismal" reading on first quarter economic growth. The Fed concluded its 2-day policy meeting with the prediction that the economy "will expand at a moderate pace and labor market conditions will continue to improve gradually."

QE was beneficial for banks and large corporations but did nothing to help small businesses and the middle class. Jobs and wage growth were stagnant for most of the last five years while the middle class did its best to muddle through under conditions that could only be described as contractionary. QE was a boon for equity prices but actually hindered the middle class by slowing wage and lending growth.

Although the Fed intended its asset purchase program to stimulate the economy, it actually had the reverse effect. Banks had no incentive to increase lending as the Fed wanted banks to shore up their balance sheets and decrease leverage and risk. The good news, though, is that the end of QE will ultimately be beneficial for small businesses and the middle class.

Since the Fed began scaling back the size of its monthly asset purchases earlier this year, commercial lending has increased. As economist David Malpass recently pointed out, "Growth was weak in 2009-13 but jumped to a 16% annual rate in the first quarter, when the taper started." The Fed plans to gradually diminish its monthly asset purchases until finally ending them in 2015, just as the new long-term inflation cycle will kick off. The end of QE will coincide with the commencement of a new 60-year cycle. Assuming the Fed sticks to its stated intention, there will be little counter-cyclical interference with the new long-term cycle (unlike the one that's ending this year). That means there will be more opportunity for the cycle to play out and extend its benefits throughout the broad economy, not just the financial sector.

With a new inflationary cycle ahead of us, the end of QE should be a positive since banks will no longer have a reason to curtail lending. Although there will be many benefits to this new cycle ahead of us, there will also be some serious challenges as well. One of them we looked at in my previous commentary, viz. the problem of high retail food and fuel prices.

As previously pointed out, in a normal inflation/deflation cycle the transition from deflation to inflation would ordinarily be a gradual progression over a 10-15 year period. In the U.S., however, years of artificially high retail food and fuel prices will short-circuit this process. Since retail food and fuel prices were never allowed to decline in the last five years, the increase in the cost of living could be dramatic in the years immediately following the 2014 cycle bottom. This would obviously serve as a hindrance for the middle class, although it will likely be somewhat mitigated by rising wages and increasing employment opportunities.

To what extent increasing food and fuel prices will create problems in the nascent inflationary cycle is anyone's guess at this point. Combined with an increasing tax and regulatory burden (e.g. Obamacare) for consumers and small businesses, higher retail prices could act as a drag on the anticipated economic growth of the new up-cycle in the years following 2014.

Another potential problem for wind down of QE is the problem of "zombie credits." This is the term bond manager Bonnie Baha has used to describe the bonds issued by corporations with questionable net worth and unsustainable business models. These companies, many of them in the retail sector, have been largely unprofitable in recent years due to the demise of the bricks-and-mortar shopping model. A notorious example would be J.C. Penney. Yet these "walking dead" companies survived in large part thanks to the Fed's unlimited stimulus program of recent years.

Baha believes that these zombie companies are the consequence of the Fed's QE program, which in her words "has essentially allowed the U.S. to defer, if not entirely skip, a normal default cycle in which troubled companies are culled from the marketplace." She suggests, however, that the ending of QE could stop these zombies "dead in their tracks" and cautions yield investors to be alert for zombie credits in their portfolios.

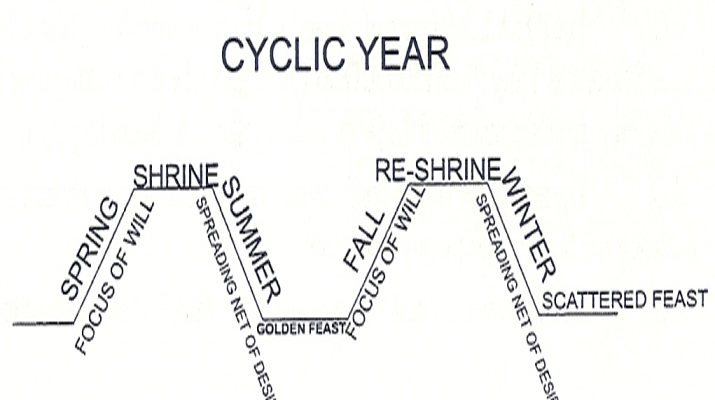

Returning to our main theme, I've included the following graph which was originally printed in the late P.Q. Wall's newsletter. This graphic depicts the various "seasons" of the long-term 60-year cycle as it pertains to the phases of the economy. It also shows the basic divisions and sub-divisions of the inflation/deflation cycle. We're currently approaching the end of "winter" and will soon be entering "spring."

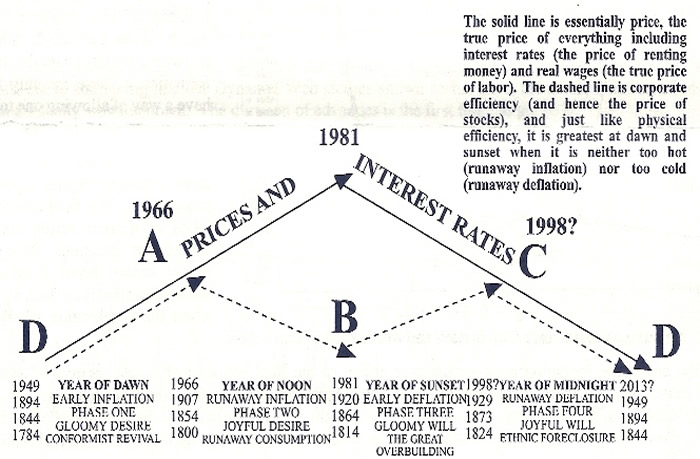

The following graph illustrates in greater detail the phases of the long-term cycle. Again it is from one of P.Q. Wall's old newsletters. This graph is a good representation of the the 60-year cycle and its four 15-year phases. P.Q.'s prediction that interest rates would bottom out in 2013, which he initially made back in the 1990s, was remarkably prescient.

Kress Cycles

Cycle analysis is essential to successful long-term financial planning. While stock selection begins with fundamental analysis and technical analysis is crucial for short-term market timing, cycles provide the context for the market’s intermediate- and longer-term trends.

While cycles are important, having the right set of cycles is absolutely critical to an investor’s success. They can make all the difference between a winning year and a losing one. One of the best cycle methods for capturing stock market turning points is the set of weekly and yearly rhythms known as the Kress cycles. This series of weekly cycles has been used with excellent long-term results for over 20 years after having been perfected by the late Samuel J. Kress.

In my latest book “Kress Cycles,” the third and final installment in the series, I explain the weekly cycles which are paramount to understanding Kress cycle methodology. Never before have the weekly cycles been revealed which Mr. Kress himself used to great effect in trading the SPX and OEX. If you have ever wanted to learn the Kress cycles in their entirety, now is your chance. The book is now available for sale at:

http://www.clifdroke.com/books/kresscycles.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.